## HDFC Life’s High Claim Settlement Ratio: A Measure of Reliability## HDFC Life’s High Claim Settlement Ratio: A Measure of Reliability HDFC Life maintains a consistently high claim settlement ratio, demonstrating the company’s commitment to its policyholders and ensuring financial security for their loved ones. ### Impressive Track Record In fiscal year 2024, HDFC Life achieved an overall claim settlement ratio of 99.50%, with payouts amounting to ₹1,584 crores across 19,338 policies. This follows a strong history of high settlement ratios, with 98.66% in FY 22 and 99.39% in FY2 3. ### Streamlined Claim Process HDFC Life offers a streamlined claim submission process, allowing claimants to request and submit documents conveniently through various channels without having to visit a branch. The company emphasizes the importance of full disclosure of relevant information to ensure a smooth claims process. ### Same-Day Settlement for Eligible Claims For individual claims that are over three years old from the policy inception date, HDFC Life offers same-day settlement subject to the receipt of all necessary documents and the absence of any further investigation. ### Highest Ever Bonus on Participating Plans HDFC Life announced the highest ever bonus of ₹3,722 crore on participating plans during its April 2024 board meeting. This bonus will benefit eligible policies with immediate maturity benefits or cash bonuses, as well as those that pay out on policy maturity, death, or surrender in the future. ### Reasons for Choosing Companies with High Claim Settlement Ratios: * Long-term commitment and financial stability * Fast and effective claims handling * Demonstration of reliability and trust ### Conclusion By considering claim settlement ratios and other factors like policy terms and costs, customers can make informed decisions when selecting a life insurer. HDFC Life’s consistent high claim settlement ratio underscores its reliability and commitment to providing financial security for policyholders.

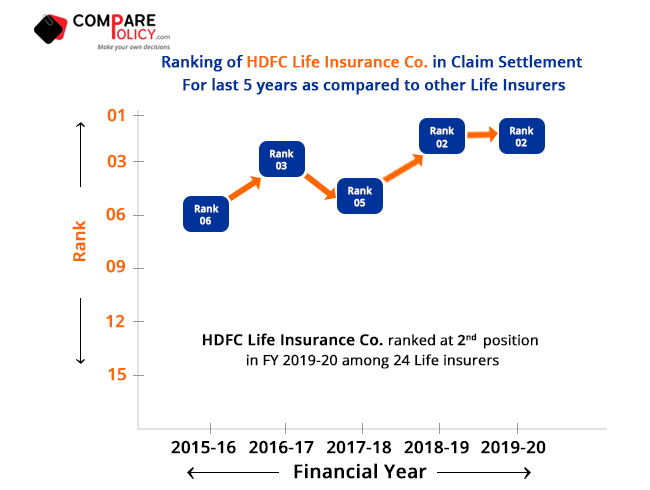

HDFC Life remains committed to its policyholders and maintains a consistently high claim settlement ratio. Life insurance represents a lasting commitment, providing financial security to loved ones after the policyholder is no more. A key measure of the reliability of a life insurer lies in its ability to settle legitimate claims promptly and effectively. While selecting a life insurer, customers often assess the reliability of the company by examining its claim settlement ratio over time.

In fiscal year 2024, HDFC Life maintained an impressive overall claim settlement ratio of 99.50%, with payouts ₹1,584 crores across 19,338 policies. This builds on previous strong performances of 98.66% in FY 22 and 99.39% in FY2 3, specifically in retail claims.

Get money fast within minutes!

Best personal loan at the lowest interest rates

Apply directly

Vibha Padalkar, Managing Director & CEO, spoke about this: HDFC Life said: “Claim settlement is a critical service differentiator for us. Our promise to every policyholder is to settle claims smoothly and efficiently. We are committed to delivering superior service at every stage of the policy lifecycle, which reflects our dedication to making India financially secure.”

HDFC Life offers a streamlined claim submission process, allowing claimants to request and submit documents through various channels without having to visit a branch. The company also emphasises the importance of full disclosure of health and other relevant information that may impact the claims process. For individual claims that are more than three years old from the date of policy inception, HDFC Life offers same-day settlement subject to receipt of all required documents and no further investigation is required.

During the April 2024 board meeting, HDFC Life announced the highest ever bonus of ₹3,722 crore on participating plans. This bonus will be distributed across policies that are eligible for immediate maturity benefits or cash bonuses as well as those that are paid on policy maturity, death or surrender in the future.

Life insurance companies with high claim settlement ratios are generally chosen for the following reasons. These include:

- A long-term commitment:Life insurance is a long-term commitment that provides your beneficiaries with lasting financial protection over an extended period of time.

- Financial stabilityIn the event of the death of the policyholder, the death risk insurance fund ensures that surviving relatives retain financial security.

- Fast and effective claims handling:This ensures smooth and timely payments to your beneficiaries when they need it most, emphasizing the importance of the claim settlement ratio.

- Rate the reliability:A sustained high claims settlement rate over time demonstrates an insurer’s commitment to meeting its obligations to policyholders, building trust and positioning the company as a reliable option.

By considering the claims settlement ratio and other aspects such as policy terms and costs, customers can make an informed choice when selecting a life insurer.

Topics that may interest you