Buying stocks during a pullback, rather than chasing new highs, is sometimes called a “Buy-the-dip” strategy. Normally this strategy pays off in the long run, but in some cases the payoff can be immediate if the market feels like a bargain is too good to last. This has been the case for the popular e-commerce platform operator Shopify Inc. NYSE: STORE after the stock plummeted nearly 30% following its Q1 2024 earnings report. Once Shopify stock bottomed at $56.31, the stock managed to rise for 12 straight days, indicating that the initial sell-off was an overreaction.

Shopify operates in the computer and technology sector and competes with e-commerce platforms in the digital marketplace, among others Amazon.com Inc. NASDAQ: AMZN, Block Inc. NYSE:SQAnd Etsy, Inc. NASDAQ: ETSY.

To get Shopify warnings:

To register

Shopify is the all-in-one platform for online stores

![]() $64.79

$64.79

-0.24 (-0.37%)

(As of 11:08 AM ET)

Range of 52 weeks $45.50

▼

$91.57

Price target $76.39

Shopify provides an all-in-one ecommerce platform that allows businesses to build and manage a digital store, complete with easy-to-use tools, payment processing, logistics, buy-now-pay-later (BNPL), powered by Affirm Holdings Inc. NASDAQ:AFRMand custom design templates. Having fully integrated features on one platform under subscriptions makes it cost-effective and efficient for merchants to use Shopify. Artificial intelligence (AI) tools allow sellers to automatically write product descriptions and set the tone as “refined.”

Catering for small and medium-sized businesses (SMEs)

While Shopify doesn’t provide statistics on the percentage of small to medium businesses (SMBs) on the platform, it’s widely believed that most merchants do. Monthly plans range from $39 to $2,300 per month, aimed at SMBs and large enterprises. Annual prepaid plans are available at a discount on monthly rates.

In the first quarter of 2024, Shopify added a web performance dashboard, email capture at point-of-service (POS) checkout, and additional embedded AI tools. While most Shopify merchants are on the digital marketplace platform, it also allows merchants to grow offline in-store business with its POS products.

Large companies are also discussed

Enterprise-level brands are also flocking to Shopify. The Shopify Markets Pro is an add-on service that allows businesses to enter global markets to help increase global presence and sales. It automates crucial functions such as calculating and collecting import duties and taxes, automates conversion rates, and provides express shipping, post-purchase customer support, and fraud protection. Major companies like Overstock.com launched in less than 100 days, while Bark Box is expected to launch in 2025.

Earnings were robust in the first quarter of 2024

Based on the reaction, you’d think Shopify would have bombed their Q1 2024 earnings results, but quite the opposite. Shopify reported first-quarter 2024 earnings per share of 20 cents, beating consensus estimates by 3 cents. Revenue grew 23.4% year over year to $1.86 billion, beating analysts’ consensus expectations of $1.84 billion. Gross profit increased by 33% and the free cash flow margin doubled to 12% year-on-year.

Double-digit growth rates throughout the quarter

Merchant Solutions revenue rose 20% year-over-year to $1.4 billion, driven by continued penetration of Shopify Payments payment processing service and growth of GMV. Gross merchandise volume (GMV), which represents the total value of all products sold during the quarter, grew 23% year-over-year to $60.9 billion. The office line GMV increased by 32% year-on-year. Subscription Solutions revenue grew 34% year over year to $511 million, driven by merchant growth and higher subscription pricing. Monthly recurring revenue (MRR) grew 32% year over year to $151 million. Business-to-business (B2B) GMV increased 130% year-over-year, after doubling in 2023.

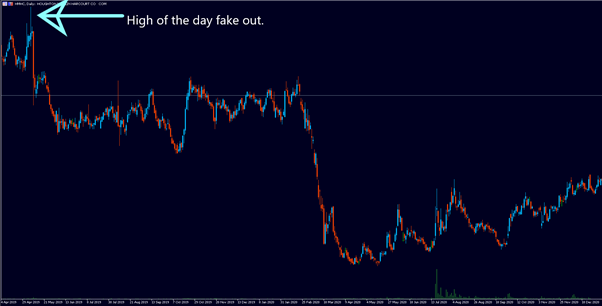

Expectations for the second quarter of 2024 were weak, causing shares to plummet

While earnings for the first quarter were impressive, Shopify provided soft guidance for the second quarter of 2024. Revenue is expected to grow annually in the high 20s, which translates to an annualized growth rate in the low to mid 20s, adjusted for the impact of 300 to 400 basis points from the sale of its logistics activities. Gross margin is expected to decline by 50 basis points sequentially. GAAP operating expenses will increase by a low to mid-single-digit percentage, which translates from 45% to 46% sequentially. Share-based compensation (SBC) is expected to be approximately $120 million, and capex approximately $5 million.

Shopify President Harley Finkelstein was optimistic: “You’re seeing the strongest version of Shopify in our history. Our excellent performance in the first quarter is a clear demonstration of our commitment to the new shape of Shopify, our commitment to operating with a consistent team size, and our focus on building for the long term to deliver both growth and profitability.”

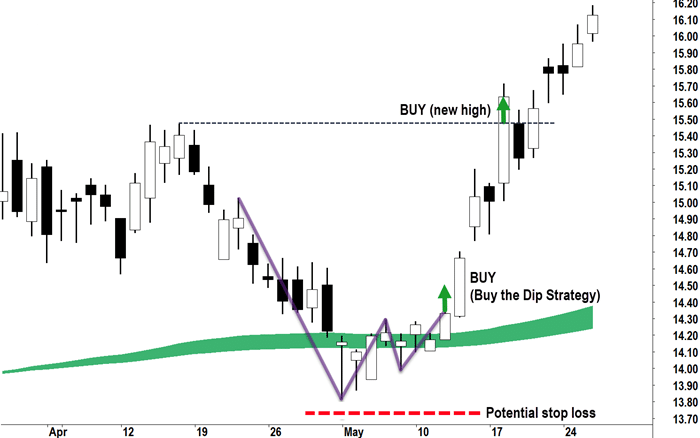

SHOP stock is forming a rounded bottom pattern

The daily candlestick chart for SHOP shows a rounded bottom pattern. SHOP fell from $75.30 to $64.86 after the earnings release. This determines the price levels for filling gaps. SHOP continued to sell until it reached a final low of $56.31 on May 28, 2024. Over the next twelve days, SHOP rose higher, peaking at $68.21 on June 14, 2024, before leveling off. The daily relative strength index swung from the oversold 30 band to a peak near the 65 band before pulling back down towards the 50 band, where it is trying to meander. Pullback support levels are $64.20, $60.03, $56.31 and $53.88.

The analysts are ringing the upgrade bells

Overall Market Rank 4.02 out of 5

4.02 out of 5

Analyst rating Mediocre buy

Upside/downside 18.1% advantage

Short interest Healthy

Dividend strength N/A

Sustainability -1.05

News sentiment 0.87

Insider trading N/A

Expected earnings growth 32.79%

See full details

Analysts everywhere were excited about Shopify’s post-earnings performance. On May 9, 2024, Piper Sandler upgraded its rating to Neutral with a price target of $63. JMP Securities upgraded its rating to Outperform with a price target of $80. On May 22, 2024, Goldman Sachs upgraded its rating to Buy from $64 with a price target of $74. On June 6, 2024, Moffit Nathanson downgraded its rating to Neutral with a $65 price target.

On July 11, 2024, JP Morgan will initiate coverage with an Overweight rating and a $74 price target. On June 14, 2024, Evercore ISI upgraded its rating to Outperform with a price target of $75. This was the final day of the rally, as shares peaked at $68.21 before falling to the gap-fill level of $64, 20 to retest. Shopify analyst ratings and price targets are at MarketBeat. The consensus price target is 17.46% higher at $76.39.

Before you consider Shopify, you’ll want to hear this.

MarketBeat tracks Wall Street’s top-rated and top-performing research analysts and the stocks they recommend to their clients every day. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Shopify wasn’t on the list.

While Shopify currently has a Moderate Buy rating among analysts, top analysts believe these five stocks are better buys.

View the five stocks here

Click the link below and we’ll send you MarketBeat’s list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get this free report

:max_bytes(150000):strip_icc()/chart_dip_recovery_shutterstock_454129360-5bfc300146e0fb0083c14a8c.jpg)