FedEx Exceeds Expectations with Profit Forecast for 2025FedEx Exceeds Expectations with Profit Forecast for 2025 FedEx has released a positive outlook for its future earnings, predicting that its 2025 profit will surpass analysts’ expectations. The company anticipates that cost-cutting measures implemented this year will lead to improved margins, despite ongoing challenges in the parcel shipping industry. Following the announcement, FedEx shares soared over 16% in after-hours trading, while rival United Parcel Service also saw a modest gain of almost 2%. As part of its efforts to enhance efficiency, FedEx is consolidating its delivery operations. The company has already cut $1.8 billion in structural costs in the fiscal year ending May 2024 and plans further permanent savings of $2.2 billion by the end of fiscal year 2025. Despite these cost-cutting initiatives, revenue remains a concern for FedEx. Industrial production and demand for parcel shipping have slowed due to inflation and rising interest rates. FedEx’s Express overnight delivery unit is particularly affected by the USPS’s shift from higher-margin air services to more cost-effective ground services. However, FedEx’s fiscal 2025 earnings per share forecast of $20.00 to $22.00 surpasses analyst estimates of $20.92. This positive outlook reflects the company’s belief in the long-term sustainability of its cost-cutting efforts. FedEx reported combined revenue of $22.1 billion for the recent quarter, slightly higher than the previous year and marginally above analyst estimates. The company’s efforts to reduce costs and improve efficiency will be crucial in navigating the ongoing challenges in the transportation sector and achieving its ambitious profit targets in the years to come.

(Reuters) -FedEx forecast on Tuesday that its 2025 profit will exceed analysts’ expectations. It is expected that the cost cuts planned for this year would deliver margin gains, even as revenues remain under pressure from subdued parcel shipping demand.

The company’s shares rose more than 16% in after-hours trading, while those of rival United Parcel Service rose almost 2%.

FedEx is merging its separate delivery operations in an effort to improve efficiency at a time when the stubbornly weak global transportation market is seeing its profits fall.

FedEx said it reduced nearly $1.8 billion in structural costs in the fiscal year ending May 2024 and plans an additional $2.2 billion in permanent cost savings by the end of fiscal year 2025.

The unprofitable U.S. Postal Service contract, which generated about $1.75 billion in revenue for FedEx in the fiscal year ending May 2023, expires in September.

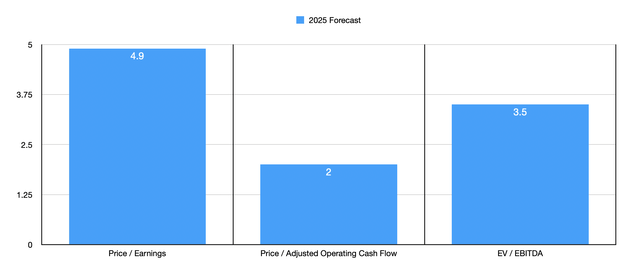

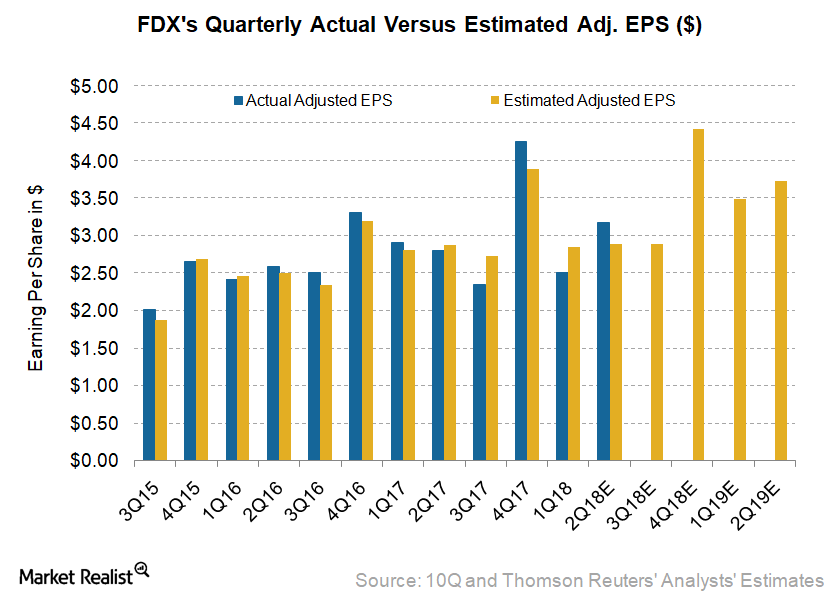

The package delivery company expects fiscal 2025 earnings per share to be between $20.00 and $22.00, with the midpoint slightly above analyst estimates of $20.92 per share.

But the revenue side of the business remains a challenge. Industrial production and demand for parcel shipping – the two main drivers of the economy’s success – are subdued as inflation and higher interest rates take their toll.

The company’s Express overnight delivery unit, its largest, is struggling with declining volumes as the USPS shifts packages from higher-margin air services to more economical ground services.

FedEx reported combined revenue of $22.1 billion, slightly higher than last year’s $21.9 billion and slightly above analyst estimates of $22.06 billion.

(Reporting by Ananta Agarwal in Bengaluru and Lisa Baertlein in Los Angeles; Editing by Pooja Desai)