India’s Spectrum Auction Ends with Limited BidsIndia’s Spectrum Auction Ends with Limited Bids India’s spectrum auction, which commenced on June 25th, concluded on its second day after telcos acquired approximately Rs 11,300 crores worth of airwaves. This amount represents only 12% of the government’s estimated minimum value of Rs 96,238 crores for the day’s spectrum offerings. A total of 10 GHz of spectrum was put up for auction, spanning from 800 MHz to 26 GHz. The bidding, which was expected to be limited, resulted in only 140-150 MHz being sold in seven rounds. The auction attracted bids from Reliance Jio, Bharti Airtel, and Vodafone Idea (VIL). However, the breakdown of individual bids is not yet available. On the first day of the auction, the bidding was primarily focused on the 900 and 1800 MHz bands. The operators also expressed interest in the 2100 MHz band spectrum in three circles. In comparison to the record-breaking 2022 auction, where 5G spectrum worth Rs 1.5 lakh crores was sold, the 2024 auction has seen a significant decline in demand. Jio, Airtel, and VIL had spent Rs 88,078 crores, Rs 43,084 crores, and Rs 18,799 crores, respectively, in the previous auction. Telcos’ cautious approach in the current auction is attributed to factors such as expiring spectrum in certain circles and selective interest in expanding coverage. The low EMD submissions by telcos prior to the auction had indicated a limited appetite for airwaves. Jio, with an EMD of Rs 3,000 crores, was the highest contributor, followed by Bharti Airtel (Rs 1,050 crores) and VIL (Rs 300 crores). The Cellular Operators Association of India (COAI), an industry association representing Jio, Airtel, and VIL, expressed optimism that the auction will accelerate the rollout of 5G services, enhancing coverage and connectivity across the country.

NEW DELHI: India’s spectrum auction ended within hours of bidding on Day 2, with telecom companies buying a total of over Rs 11,300 crore worth of airwaves, which is just 12 percent of the minimum value of Rs 96,238 crore that the government had estimated for the spectrum on the second day. offer.

The auction, where a total of 10 GHz of spectrum ranging between 800 MHz and 26 GHz was placed on the block, attracted total bids worth Rs 11,340 crore, sources with knowledge of the matter said. In total, it is estimated that only 140-150 MHz was sold in seven rounds.

Five rounds of bidding took place on the opening day on June 25, but there was not much action on Wednesday, leading officials to declare the end of the auction around 11:30 am.

The 2024 auction – which was held after a hiatus of almost two years – offered radio waves in the 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz, 2500 MHz, 3300 MHz and 26 GHz bands.

As expected, the auction was quiet this time, as market observers had expected a limited number of bids. The telecom companies focused mainly on renewing the spectrum and selectively refurbishing airwaves to increase their coverage.

Reliance Jio, Bharti Airtel and Vodafone Idea (VIL) are competing for the airwaves that support high-speed mobile services in these auctions.

The breakdown of the operator’s bids, or the exact amount telcos have handed out individually, is not immediately clear and will be known once an official announcement is made.

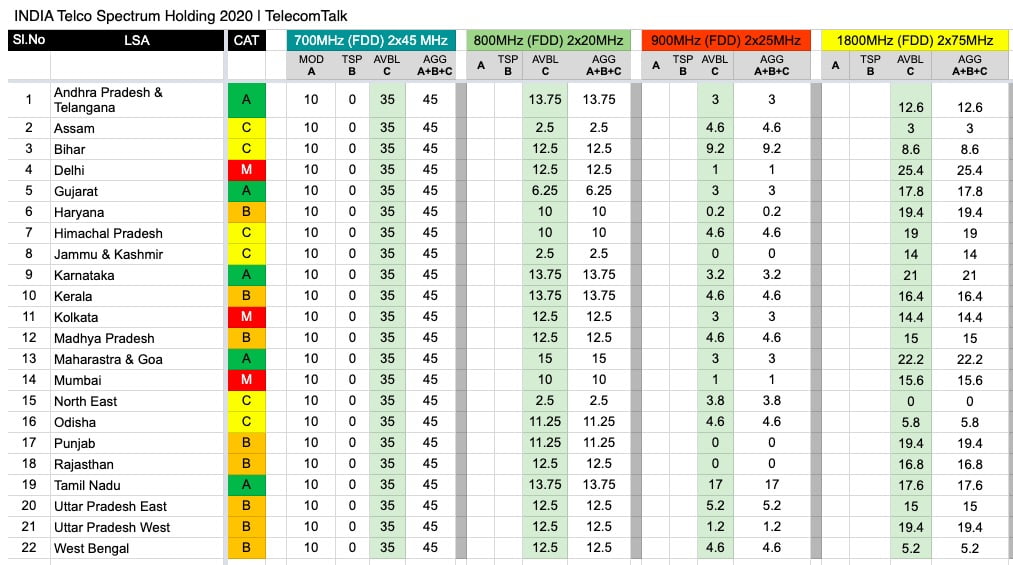

According to the day-one spectrum auction report issued by the Telecom Ministry on Tuesday evening, the bidding took place mainly in the 900 and 1800 MHz bands. The operator also placed bids for the 2100 MHz band spectrum in three circles.

The last auction in 2022 – a blockbuster that turned out to be a seven-day affair – saw a record 5G telecom spectrum worth Rs 1.5 lakh crore sold, with billionaire Mukesh Ambani’s Jio emerging as the highest bidder and almost cut corners in half of the auctions. all airwaves (worth Rs 88,078 crore).

At that time, telecom magnate Sunil Mittal’s Bharti Airtel made a successful bid of Rs 43,084 crore, while Vodafone Idea bought spectrum for Rs 18,799 crore.

Bharti Airtel has a spectrum that goes into six circles and VIL into two circles.

As it is, telcos’ low EMD submissions ahead of the auction reflected a selective appetite for airwaves.

Analysts expect Bharti Airtel to bid for some of its expiring spectrum (it has extensions for 42 MHz of spectrum in the 1800 MHz and 900 MHz bands in six circles), while Jio – which has ample spectrum across 4G – and 5G bands – may be picky and selective, market watchers said. Jio has spent an estimated Rs 1,000 crore for spectrum in 1800 MHz bands in a few circles.

For the 2024 auction, the EMD submitted by telecom companies ranged between Rs 300 and 3,000 crore – the lowest since the 2014 auctions and a whopping 80 per cent less than the previous auction in 2022. Reliance Jio has deposited the highest earnest money of Rs 3,000. For the spectrum auction, Bharti Airtel has submitted an EMD of Rs 1,050 crore and Vodafone Idea (VIL) of Rs 300 crore.

The telecom industry Cellular Operators Association of India – which includes members Reliance Jio, Bharti Airtel and Vodafone Idea – has stated that auctions will catalyze the rapid rollout of 5G services across the country, leading to better coverage and vastly improved connectivity .