3 Promising Renewable Energy Stocks for July 20243 Promising Renewable Energy Stocks for July 2024 As the world transitions towards greener sources of energy, the renewable energy sector holds immense promise. Three companies that are poised for growth in this space are: 1. Fluence Energy (FLNC): – Providing energy storage solutions, software, and support from industry leaders Siemens and AES Corp. – Demonstrating consistent double-digit gross profit margins and positive cash flow generation. – Launching a U.S. battery module manufacturing facility in Utah to strengthen its competitive position and leverage incentives under the Inflation Reduction Act (IRA) of 2022. 2. ReNew Energy Global (RNW): – One of the largest renewable companies globally, with a portfolio of over 15 GW of clean energy. – Offers innovative decarbonization solutions and is involved in wind, solar, hydropower generation, and solar cell manufacturing. – Implementing a capital recycling strategy that contributes to cash flows through the sale of solar assets. 3. Clearway Energy (CWEN): – Possesses one of the largest renewable energy portfolios in the U.S., including wind, solar, battery storage, and natural gas generation facilities. – Committed to rewarding shareholders with a generous dividend yield of 6.36%. – Aiming to deliver annual dividend per share growth of 5% to 8% through 2026. These companies have received positive analyst ratings and have significant stock price upside potential based on current market conditions. For investors seeking to participate in the growing renewable energy sector, these stocks warrant consideration.

These are the 3 best renewable energy stocks to buy in July 2024, according to Wall Street analysts. With the accelerating adoption of renewable energy sources across the globe, there is a bright future for companies involved in developing and/or manufacturing renewable energy solutions. Companies that offer wind, solar, and hydropower energy solutions fall under the scope of renewable energy stocks. We used TipRanks Stock Comparison tool for renewable and green energy stocks to discover three alternative energy companies with a Strong Buy consensus rating and significant stock price upside potential over the next 12 months.

Economies around the world have adopted strict decarbonization targets, fueling the growth of green energy companies. Let’s take a closer look at three companies that are making a big contribution to energy transition goals.

Fluence Energy is enabling the world’s transition to clean energy by providing energy storage solutions. The company also offers cloud-based software solutions for renewables and energy storage++++++++++++++++++++. Importantly, Fluence Energy has the support of two industry leaders, Siemens (EN:SIE) and AES Corp. (NYSE:AES).

In its Q2 FY24 results, FLNC’s diluted loss of $0.07 per share matched analyst estimates, while revenue of $623.14 million topped consensus. The company also reaffirmed its full-year Fiscal 2024 revenue guidance of $2.7 billion to $3.3 billion and annual recurring revenue guidance of approximately $80 million. Fluence has strong cash flow generation capabilities and consistently delivers double-digit gross profit margins.

The company also noted that it is on track to launch its U.S. battery module manufacturing facility in Utah this year. The facility will strengthen the company’s competitive position and help Fluence Energy obtain benefits/incentives under the Inflation Reduction Act (IRA) of 2022.

Is FLNC a good stock to buy?

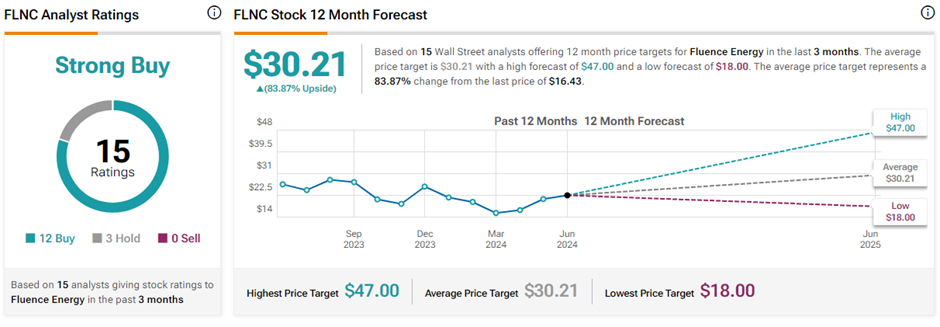

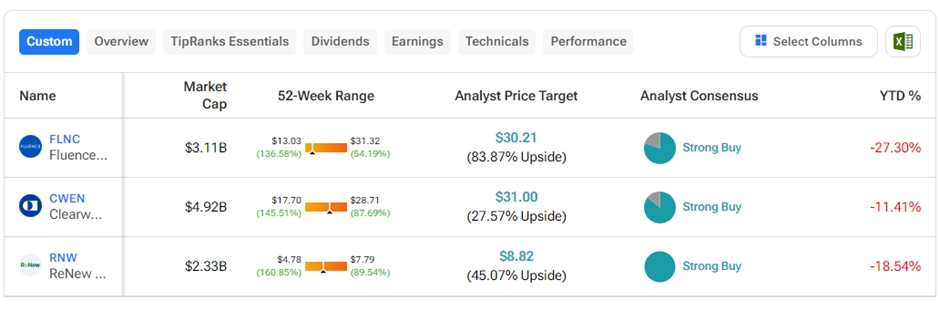

On TipRanks, FLNC stock has a Strong Buy consensus rating based on 12 Buys and three Hold recommendations. Fluence Energy’s average price target of $30.21 implies an impressive 83.9% upside potential from current levels. Meanwhile, FLNC shares are down 31.1% so far through 2024.

#2 ReNew Energy Global (NASDAQ:RNW)

India-based ReNew Energy Global is one of the largest renewable companies in the world, with a clean energy portfolio of about 15.6 GW (gigawatts) on a gross basis as of May 31. The company offers innovative and sustainable decarbonization solutions for businesses. In addition, it is engaged in wind, solar and hydropower generation and manufactures solar cells (photovoltaics).

In Q4 FY24, RNW posted better-than-expected earnings and revenues. Earnings per share (EPS) of $0.02 was higher than the expected loss of $0.04. Also, revenues of $297 million easily beat the consensus of $241 million.

In particular, the company has a capital recycling strategy, where it regularly sells assets (solar capacity). This contributes to cash flows in the form of a net gain on asset sales.

Is ReNew Energy Global a bargain?

With six unanimous Buy ratings, RNW stock has a Strong Buy consensus rating on TipRanks. ReNew Energy Global’s average price target of $8.82 implies 45.1% upside potential from current levels. Year-to-date, RNW shares have lost 19.5%.

#3 Clearway Energy, Inc. (NYSE:CWEN)

Clearway Energy claims to have one of the largest renewable energy portfolios in the U.S. The company has approximately 6,200 net megawatts (MW) of installed wind, solar and battery energy storage systems. It also owns another 2,500 net MW of environmentally friendly, highly efficient natural gas generation facilities. The company believes in rewarding shareholders with generous dividend payments.

In Q1 FY24 results, CNEW’s diluted loss of $0.02 per share was much better than the consensus estimate of a loss of $0.25 per share. However, operating income of $263 million missed consensus estimates by more than 8%.

Clearway Energy currently has a dividend yield of 6.36%, which is above the industry average. The company raised its quarterly dividends by 1.7% to $0.41 per share. Clearway continued to maintain that it is on track to deliver annual dividend per share growth of 5% to 8% through 2026.

Is CWEN a good stock to buy?

With six Buys and one Hold rating, CWEN stock has a Strong Buy consensus rating on TipRanks. The average Clearway Energy Class C price target of $31 implies 27.6% upside potential from current levels. CWEN stock is down 8.4% year to date through 2024.

Closing thoughts

The renewable energy sector is expected to witness tremendous growth in the coming years, supported by increased reliance on clean and green energy sources. Moreover, governments around the world are adopting favorable regulations, which are expected to bring huge benefits to renewable energy companies. The above three renewable energy companies have won the optimistic views of analysts and have solid potential for price appreciation. Investors may consider them after thorough research.

Revelation