Massive undercount of immigrants since 2022 skews employment data in household survey. Census Bureau must adopt Congressional Budget Office population estimates or go home.

By Wolf Richter for WOLF STREET.

Today’s jobs report data is based on two major surveys:

- The research into “institutions” (employers): jobs created outside agriculture (+206,000 in June), various hourly and weekly wage measures and employment by sector.

- The survey among households: total employment, self-employment, part-time and full-time employment, labor force measures, labor force participation rates, unemployment, six unemployment rates, employment rate, etc.

But the data from the household survey is incorrect because the Bureau of Labor Statistics uses population estimates from the Census Bureau, but the Census Bureau has not yet accounted for the huge wave of immigrants in 2022 and 2023, according to the Congressional Budget Office (CBO).

CBO came up with its own population estimates by combining Immigration and Customs Enforcement (ICE) data with Census Bureau data. CBO estimated that net immigration would be 2.67 million immigrants in 2022, and 3.3 million immigrants in 2023, the highest in its data going back to 2000, and about three times the average rate between 2000 and 2021 (1.05 million immigrants per year).

But the Census Bureau has failed to account for the huge influx of immigrants. In terms of population growth:

- CBO: +0.89% for 2022; +1.14% for 2023; highest since 2005.

- Census Bureau: +0.36% for 2022; +0.49% for 2023.

We’ve discussed this extensively here, including a graph of the two differing estimates of population growth.

Because the BLS extrapolates household survey data to the Census Bureau’s underestimations of population size, it understates total employment and the labor force, distorting all other statistics based on them.

We will not cover the household survey data for that reason until the Census corrects its population estimates. But we will cover the establishment survey: payroll jobs, wages, and jobs by sector.

The establishment research: Job growth back to normal, wage growth still higher.

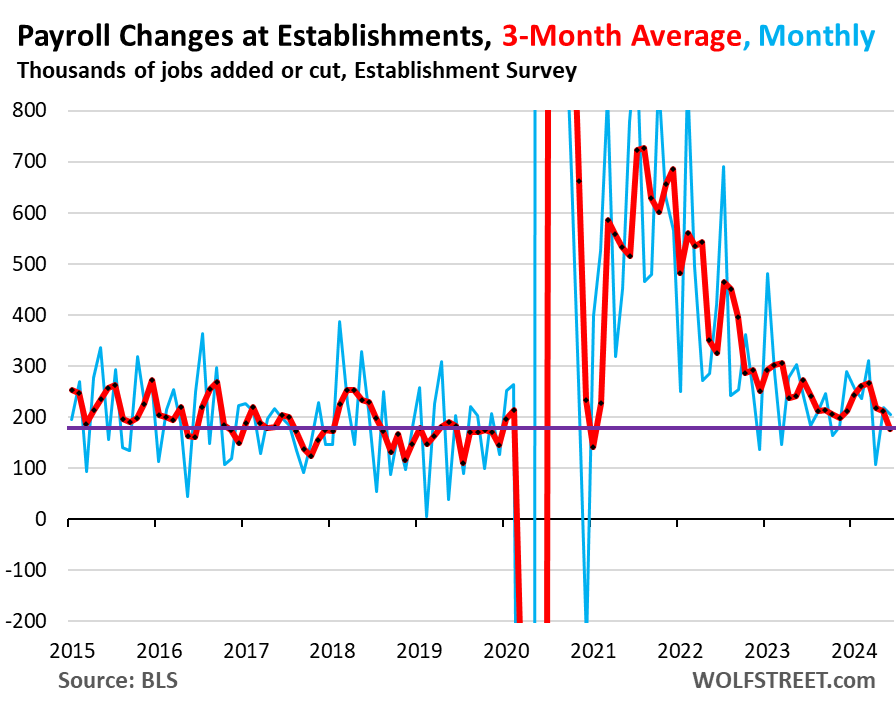

Payrolls at employers rose by 206,000 in June (blue in chart). Over the past three months, including all revisions, employment rose by an average of 177,000 per month (red). This three-month average, which smooths out some of the month-to-month wobble, is right in the middle of the 2017-19 job growth, the Good Times (horizontal purple line).

In other words, job growth has slowed from the frenetic pace following the lockdowns and labor shortages, and is back to the normal pace of the Good Times.

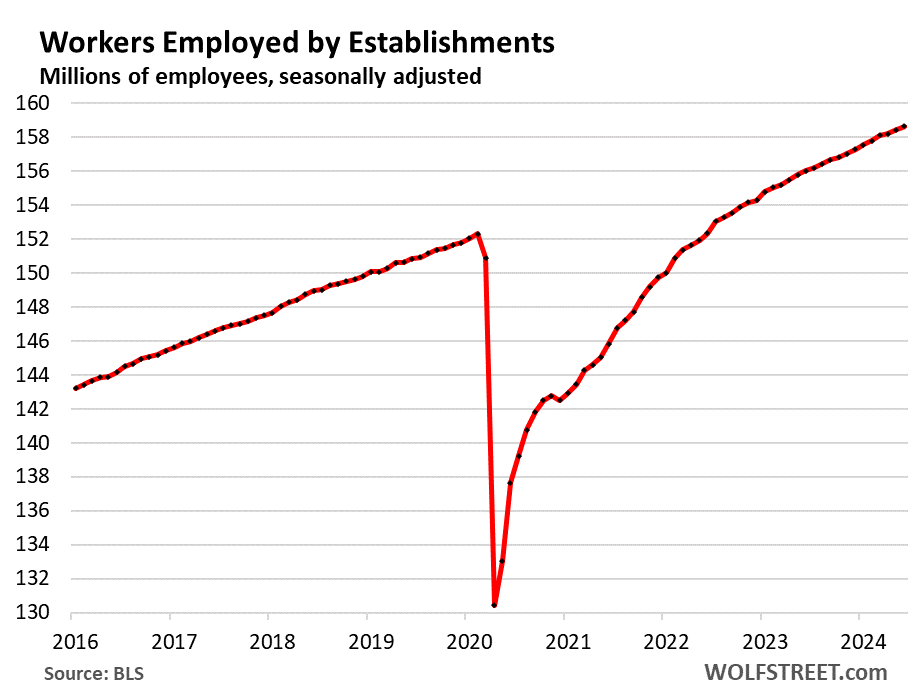

The total number of payroll jobs at employers rose to 158.6 million, an increase of 2.61 million jobs (+1.7%) compared to a year earlier.

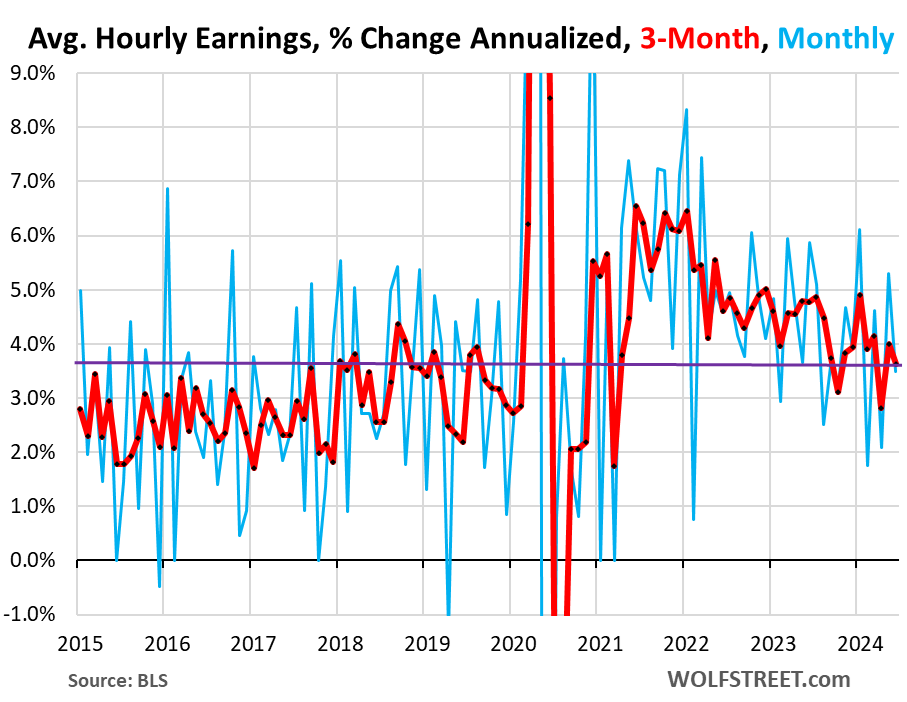

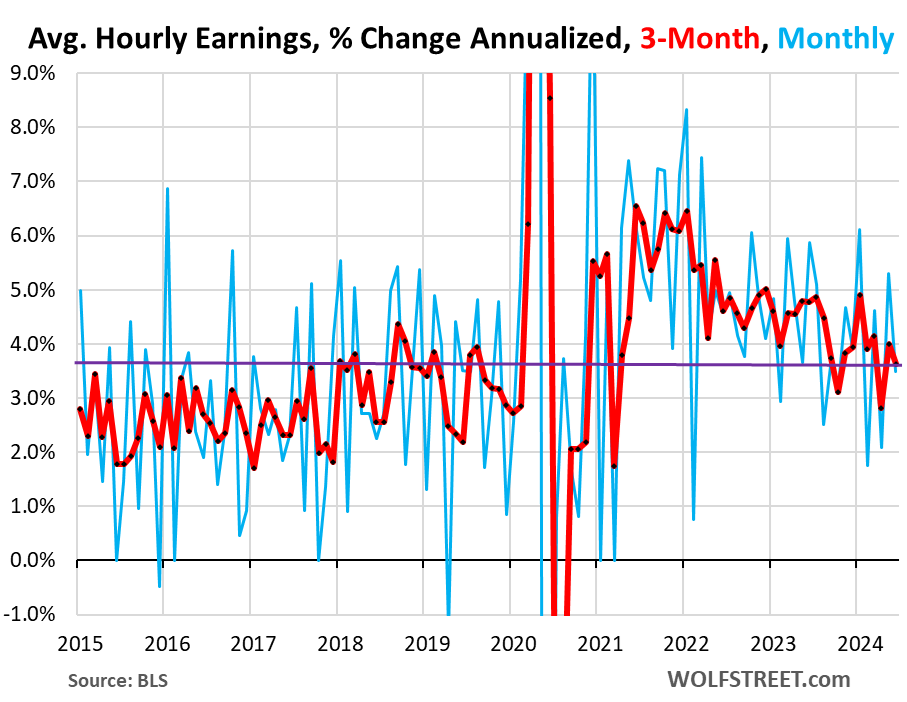

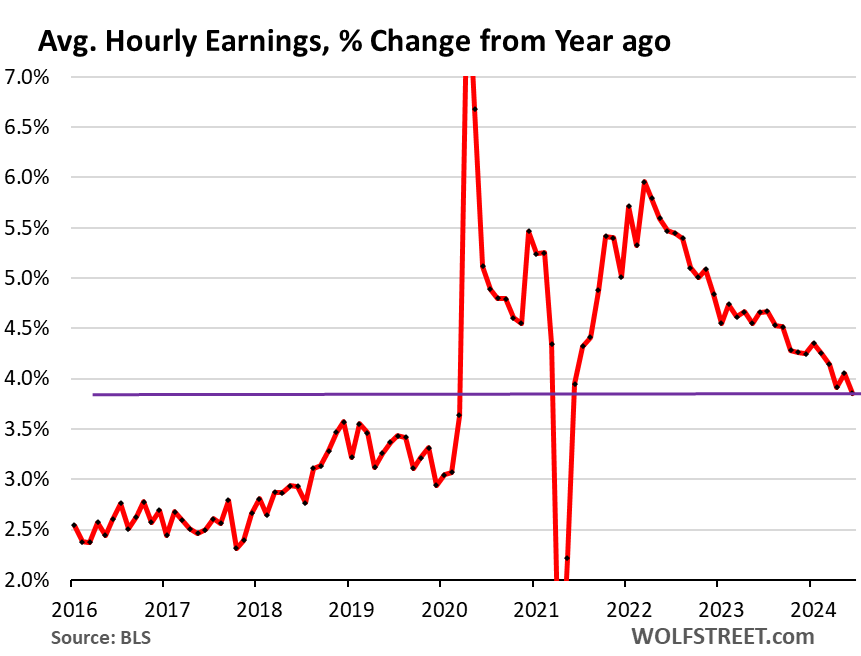

Average hourly wage rose 3.5% y/y (0.3% non-y/y) in June from May. But May was revised upward to a 5.3% y/y increase, the biggest increase since January and the second-biggest since June 2023.

The three-month average, including revisions and some monthly imperfections, rose 3.6% year-on-year.

As we can see from the chart, there has been a clear cooling in wage growth, from the red-hot peak growth in late 2021 to October 2023. Since then, there have been many large month-on-month swings, but no clear further slowing of the trend.

On an annual basis, average hourly earnings rose 3.9%, well above the five-year pre-pandemic range of 2.5% to 3.5%:

Long-term employment trends by sector category

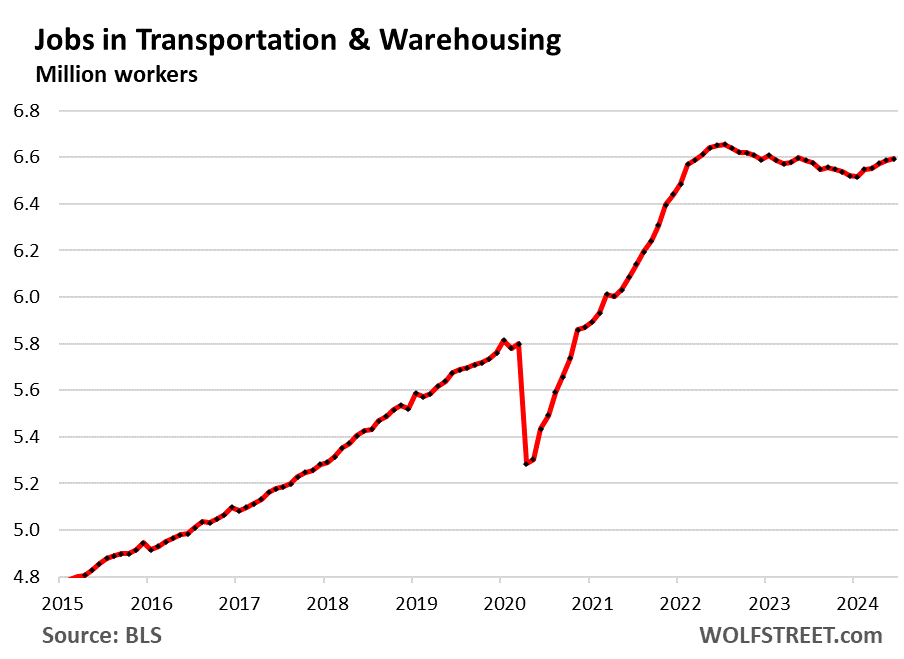

The industry categories are determined by the work location. The surveys are sent to the employer’s facilities. The primary activity at that facility determines the industry category. For example, an employee in an Amazon fulfillment center would fall under “transportation and warehousing.”

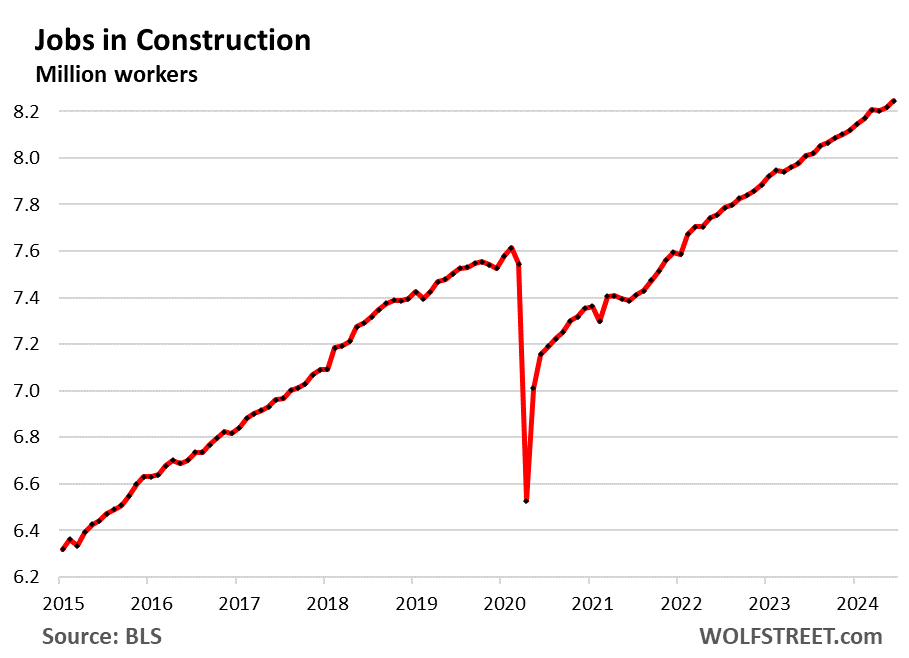

Build Employment (across all types, from single-family homes to highways) rose to a new record, while tight availability of skilled labor remains a problem in some sectors:

- Total employment: 8.25 million, new record

- Monthly growth: +27,000

- Growth over 3 months: +38,000

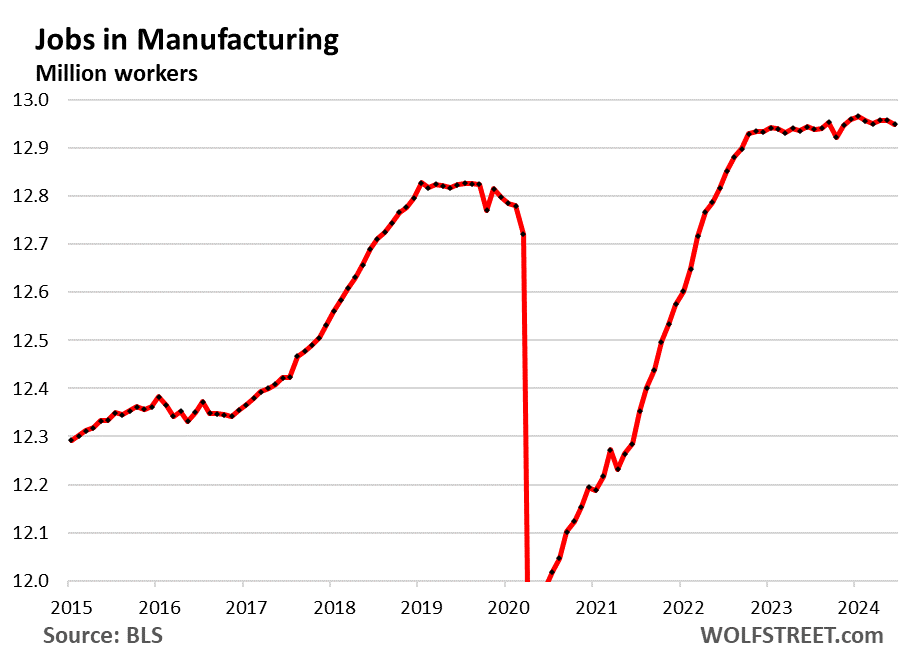

Production: Employment has stagnated at high levels after a pandemic rebound. Automation has ruled for decades, with fewer workers producing more things:

- Total employment: 12.95 million

- Monthly growth: -8,000

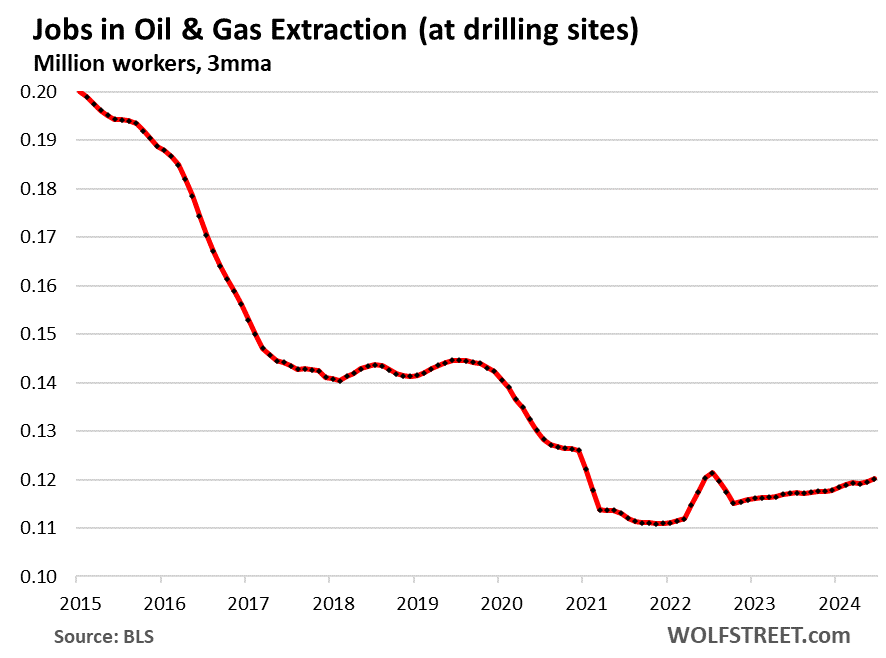

Employment in oil and gas extraction. As a result of the boom in oil and gas production, the U.S. has become the world’s largest crude oil producer and a net exporter of crude oil and petroleum products; and the world’s largest natural gas producer and the largest LNG exporter. But advanced technologies in the oil and gas field have made production increasingly labor-efficient.

Important: This does not include office and laboratory functions in the oil and gas sector: technical staff, engineers, traders, financial staff, managers, etc. These fall under other categories including professional, business and scientific services (see below).

- Total employment: 121,000

- Monthly growth: +1,000

- Growth over 3 months: +2,000

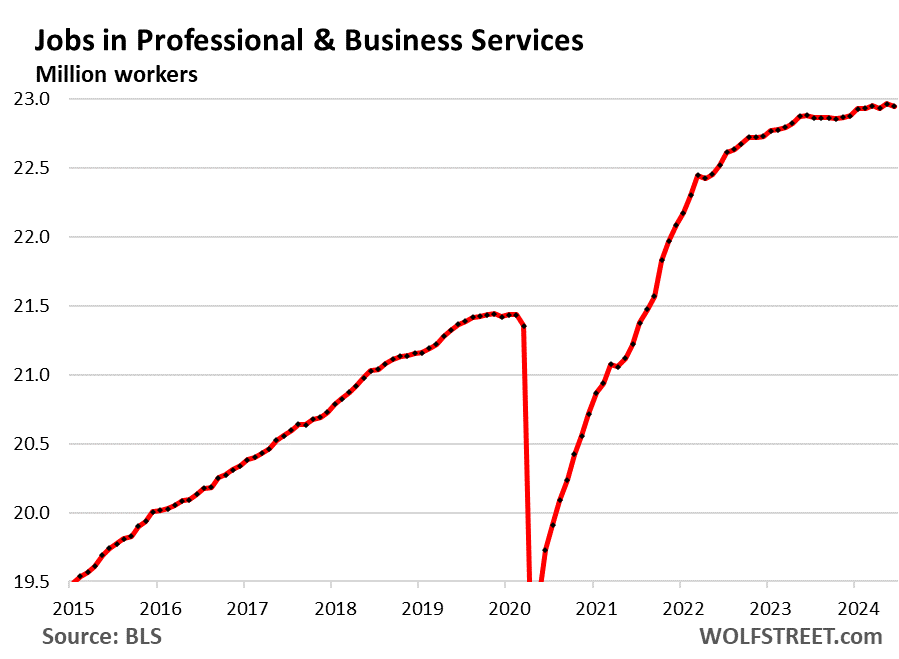

Professional and business services. One of the largest industries in terms of employment, it includes facilities whose employees work in Professional, Scientific and Technical Services; Management of Business and Enterprises; Administrative and Support Services; and Waste Management and Remediation Services. It includes facilities of some technology and social media companies:

- Total employment: 22.95 million

- Month-on-month growth: -17,000 from May record

- 3-month growth: -3,000

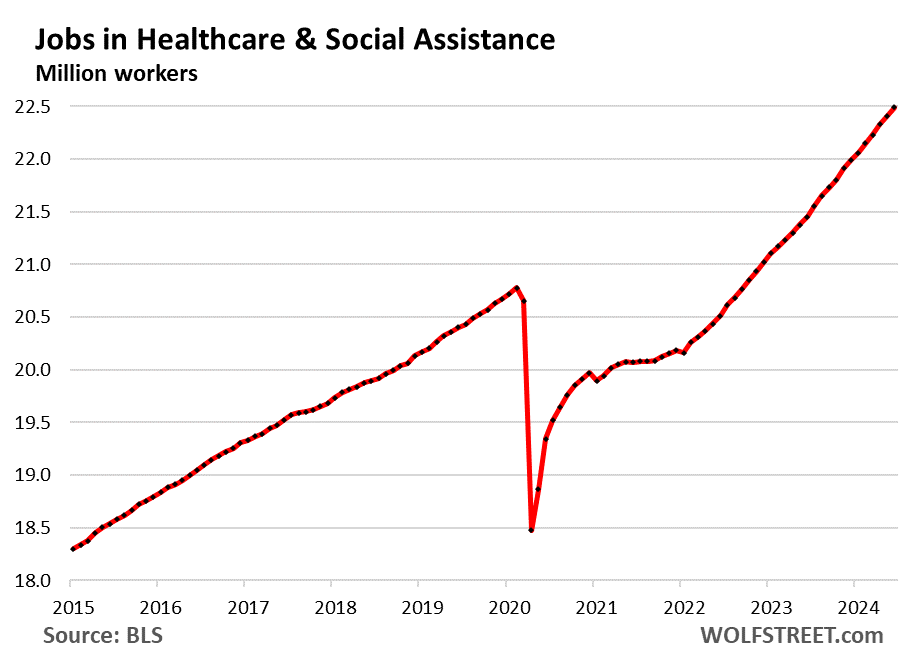

Health care and social assistance:

- Total employment: 22.49 million, new record

- Month-on-month growth: +82,000

- Growth over 3 months: +264,000

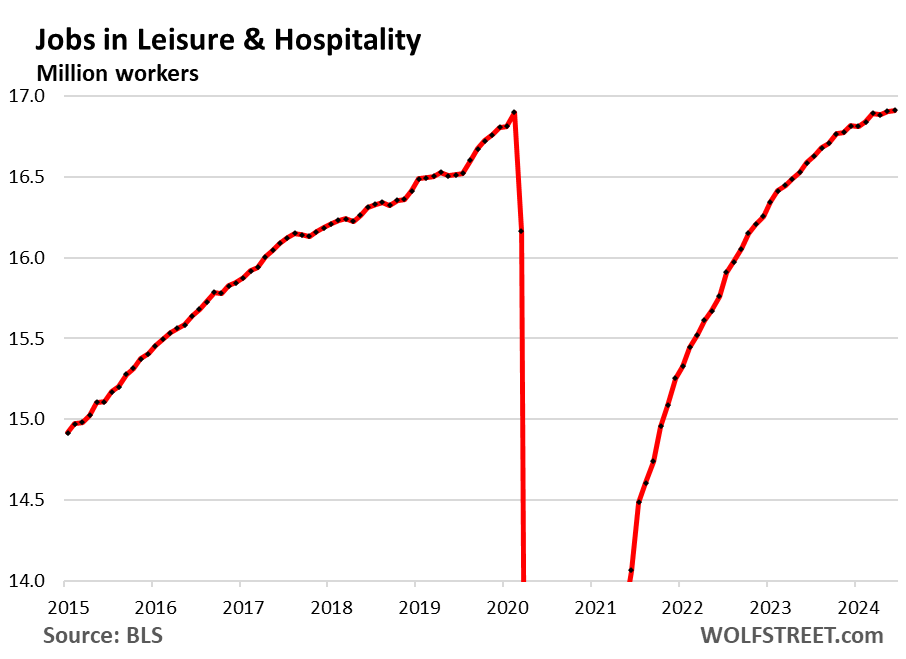

Leisure and hospitality – restaurants, accommodations, resorts, etc.

- Total employment: 16.91 million, finally reaching its pre-pandemic high.

- Monthly growth: +7,000

- Growth over 3 months: +20,000

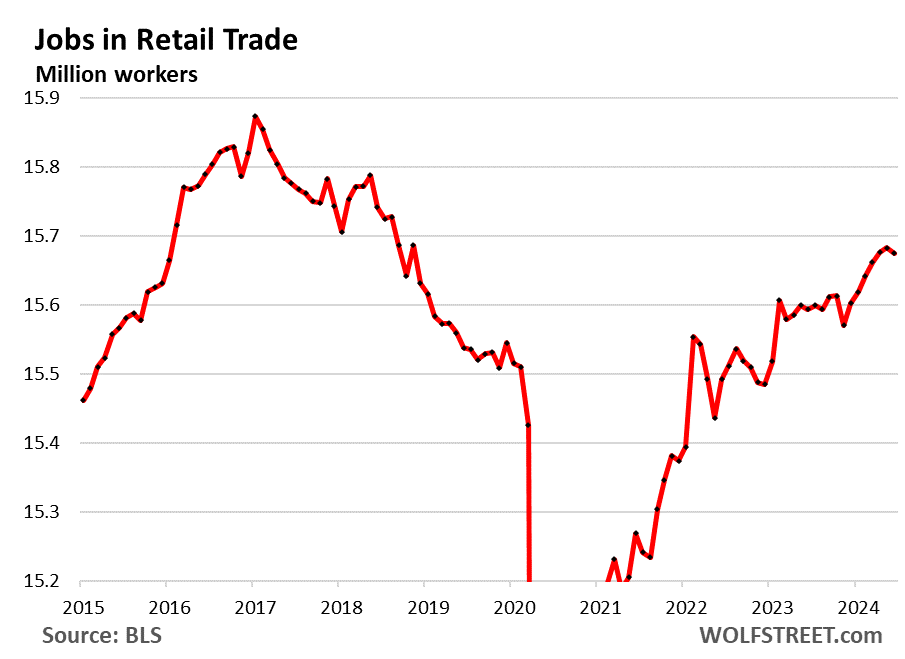

Retail counts employees at physical stores (in shopping malls, car dealerships, grocery stores, gas stations, etc.). It does not include e-commerce-related tech jobs, drivers, distribution center workers, etc.

Much of the physical retail sector has been under severe pressure from e-commerce for years. Dozens of major retailers have been declared bankrupt by the bankruptcy court. We describe this in our series on the collapse of physical retail.

The physical retail sectors that are doing well: those that sell groceries, cars, gasoline, and other things that are hard to buy online. Retailers sell goods. Service providers, such as hair salons, are not considered retailers, but rather service providers, and employment is recorded in other categories.

- Total employment: 15.67 million

- Month-on-month growth: -9,000

- Growth over 3 months: +13,000

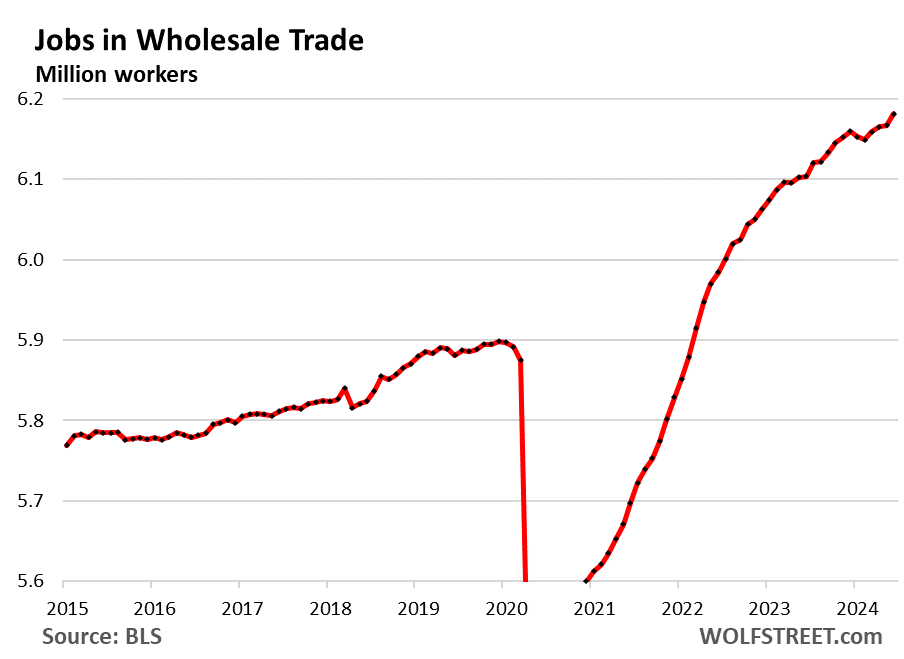

Wholesale:

- Total employment: 6.18 million, new record

- Monthly growth: +14,000

- Growth over 3 months: +22,000

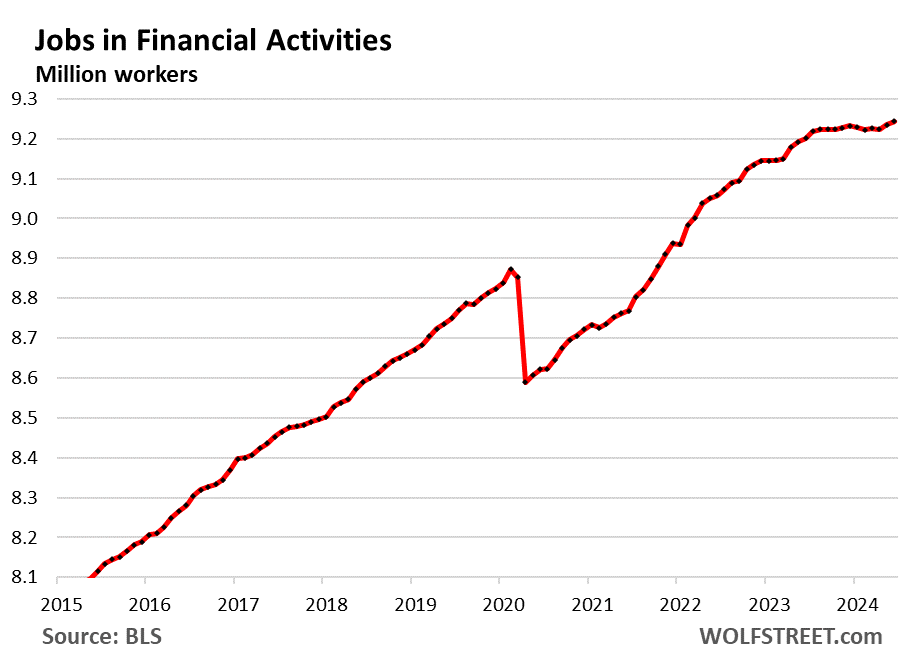

Financial activities (finance and insurance plus rental, leasing, purchase, sale and management of real estate):

- Total employment: 9.24 million, new record

- Monthly growth: +9,000

- Growth over 3 months: +18,000

Transport and storage:

- Total employment: 6.59 million

- Monthly growth: +7,000

- Growth over 3 months: +40,000

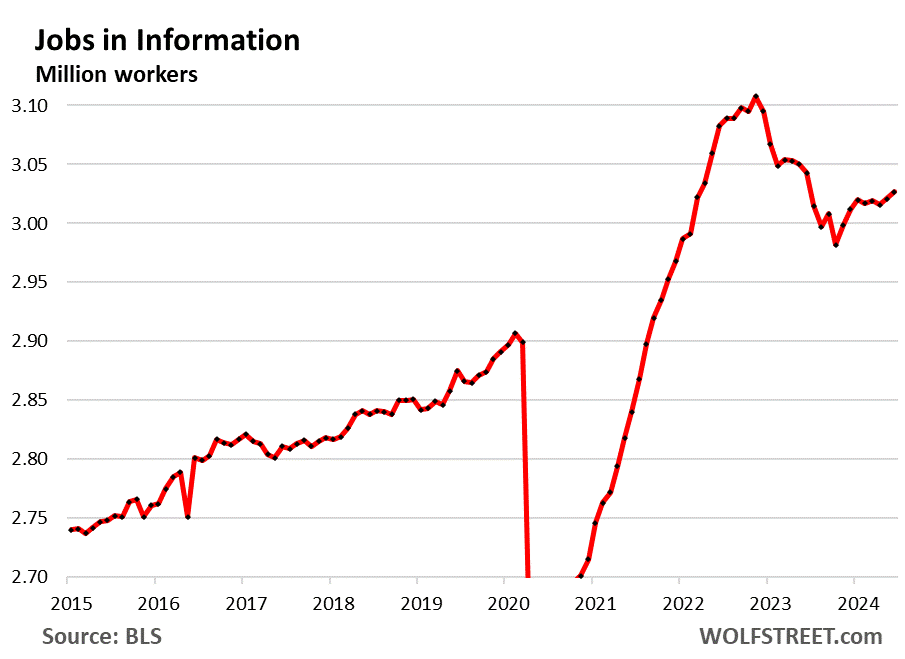

“Information” includes facilities where people work primarily on web search portals, data processing, data transmission, information services, software publishing, film and sound recording, broadcasting (including via the Internet), and telecommunications.

This includes some tech and social media company workplaces. And after the layoffs, they are hiring again:

- Total employment: 3.03 million

- Monthly growth: +6,000

- Growth over 3 months: +8,000

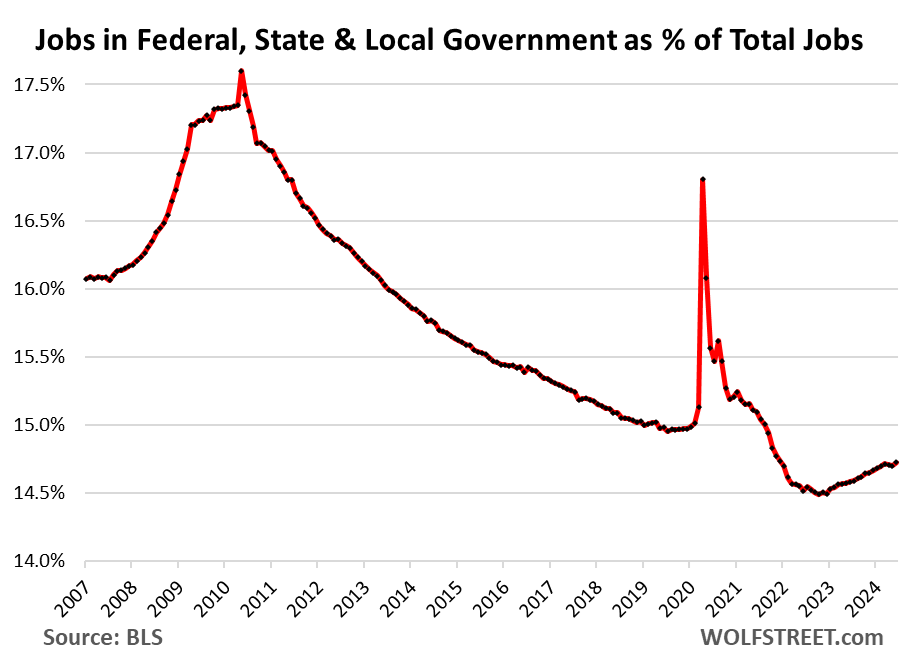

Jobs in federal, state and local governments:

A historically low 14.7% of all employees work for governments at all levels:

- Federal government: 1.9% of all employees

- State governments: 3.4% of all employees (including higher education, e.g. at state universities).

- Local authorities: 9.4% (of which a large proportion are in education, such as teachers and school administrators).

The two peaks occurred during the census (2010 and 2020). The peak in 2020 was also due to the decline in private sector employment during the pandemic.

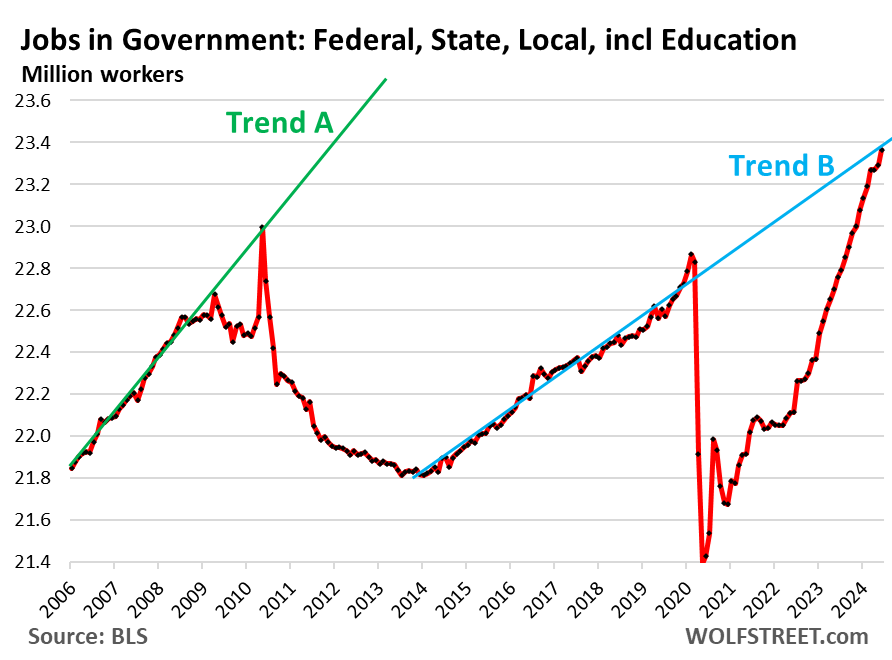

Total employment for citizens at all levels of government – local, provincial and federal – is now back at Trend B levels, not Trend A:

- Total employment: 23.36 million

- Monthly growth: +70,000

- Growth over 3 months: +95,000, consisting of +8,000 federal, +21,000 state, +66,000 local, solution to teacher shortage)

Do you enjoy reading WOLF STREET and want to support it? You can donate. I really appreciate it. Click on the beer and iced tea mug to see how:

Would you like to be notified by email when WOLF STREET publishes a new article? Sign up here.

![]()