Buying stocks when you are worried about a stock market sell-off sounds counterintuitive. After all, why would you invest your hard-earned money in something if it loses value?

Historically, investing during corrections (drawdowns of at least 10%) and bear markets (drawdowns of at least 20%) has been a winning decision. Companies that pay dividends provide an additional incentive to weather periods of increased volatility.

This is why Coca Cola (NYSE: KO), Lockheed Martin (NYSE: LMT), Waste management (NYSE: WM), Union Pacific (NYSE:UNP)And United Parcel Service (NYSE: UPS) are five companies that are built to last and can reward investors with passive income no matter what the stock market does.

Image source: Getty Images.

1. Coca Cola

Coca-Cola is almost a flawless dividend stock. It has paid and increased its dividend for 62 years in a row, making it a Dividend King. It also has a hefty yield of 3%, significantly higher than the S&P 500‘s yield of 1.3%, or 1.7% for the Dow Jones Industrial Average.

Most importantly, it has a recession-proof business model. Its portfolio includes soft drinks, coffee, tea, juice, sparkling water and energy drinks — all relatively inexpensive staples. Consumer behavior varies, but generally these are the types of products that have steady demand, regardless of what the economy is doing.

Coca-Cola has been a stock that has underperformed the market for years, but there is reason to believe that it is moving in the right direction and that earnings growth could accelerate. That turnaround could take time, although an attractive dividend is a valuable incentive to be patient and let an investment thesis play out.

It’s one of the reasons why Warren Buffett, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) has owned the shares for over 30 years, which is why Coca-Cola is still a good buy.

2. Lockheed Martin

Lockheed Martin operates in a very different sector than Coca-Cola, but the defense contractor has a similar investment proposition.

It does almost all of its business with the U.S. government and, to a lesser extent, with approved U.S. allies. A reliable customer base and a huge backlog make Lockheed’s cash flows predictable, which helps it budget for expenses and dividend payments.

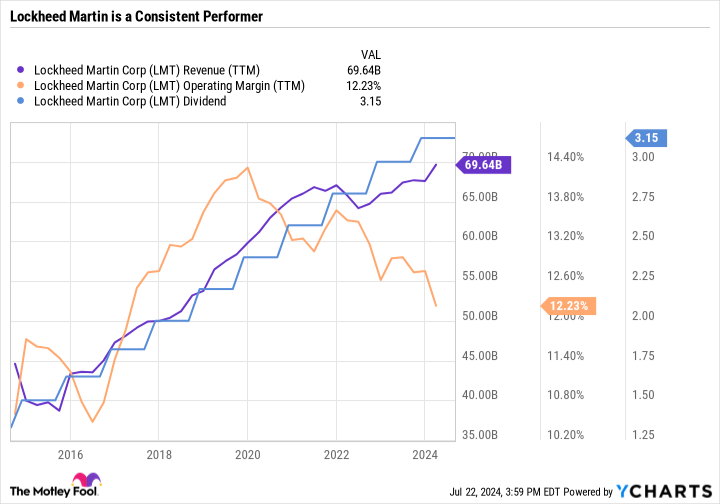

The following chart sums up the business nicely: stable revenue growth, a range-bound operating margin in the low to mid-double percent range, and annual dividend increases. It has raised its payout for 21 years in a row and currently yields 2.5%.

LMT turnover (TTM) chart

The tough nature of the defense industry typically results in discounted valuations, even for the top players. Indeed, Lockheed’s price-to-earnings (P/E) ratio is just 17.4, which is close to the 10-year median P/E of 17.8.

The story continues

All things considered, Lockheed is an extremely reliable dividend-paying value stock that can do well regardless of market trends.

3. Waste management

Unlike many other dividend funds that lagged the growth-stock-fueled rally, WM (as Waste Management calls itself) has performed strongly and is hovering near a record high.

The company’s business model is beautifully simple. WM collects, transports, and processes waste and recycling materials for residential, commercial, and industrial customers. It also invests in low-carbon efforts, such as converting landfill gas, which results from the decomposition of organic matter in landfills, into pipeline-quality natural gas.

WM tends to do better in periods of expansion, as industrial and commercial consumers produce more goods and therefore have more waste. But it should still be considered a recession-proof business, as its cash flows are largely based on long-term contracts and its services are needed regardless of the economy.

For example, WM has switched most of its recycling operations to a fee-for-service system, which provides protection against fluctuations in commodity prices.

The biggest downside is the stock’s valuation. It has more than doubled in the last four years, while the dividend has grown by less than 40%. Every time the price of a stock exceeds the dividend growth, the yield drops, which is why WM now yields just 1.4%.

Even based on estimated earnings, WM is a pricey stock, with a forward P/E of 30.5. However, it will likely do just fine in the event of an economic slowdown and a stock market sell-off. It’s a company you can count on to weather volatility, but only if you’re okay with the premium valuation.

4. Union Pacific

Union Pacific is one of the largest railroads in North America. The high-margin cash cow, which focuses on the western two-thirds of the U.S., is instrumental in moving freight at low cost.

Although railroad stocks are considered cyclical, the sector is essentially an oligopoly, given the high barriers to entry and capital-intensive nature. But it is not an oligopoly in the same way that FedEx and UPS, or Coca-Cola and PepsiCobecause there is no direct competition between all the railways. For example, CSX And Norfolk South focuses primarily on the eastern third of the US

Union Pacific’s biggest competitor is Berkshire Hathaway’s BNSF, but even those railroads operate different networks and don’t serve exactly the same regions.

Another advantage of railways is that they own their infrastructure, which means that costs go primarily to labour and maintenance, rather than building entirely new routes.

Union Pacific may experience a slowdown during an economic downturn, but you can rest easy knowing its business model is built for the long term. It carries a reasonable 23.3 P/E and raised its quarterly dividend to $1.34 per share earlier this month, which represents a forward yield of 2.2%.

5. UPS

UPS hit a new 52-week low after reporting disappointing results. Package delivery volumes fell and costs rose, a blow to the company’s growth trajectory and wiped out the momentum it enjoyed early in the pandemic.

UPS revised its guidance during its 2024 Investor and Analyst Day, laying out a path to achievable goals over the next three years. The stock has gone virtually nowhere since that March presentation, and it wouldn’t be surprising to see it continue to struggle in the short term. But over the long term, the company is simply too good to ignore.

Management is investing heavily in improvements and innovations, including artificial intelligence, to drive margin growth. It is strengthening its healthcare services to target a specific customer base with time- and temperature-sensitive shipments.

With a price-to-earnings ratio of just 21 and an impressive yield of 5.1%, UPS is an interesting buy-and-hold candidate for investors looking to boost their passive income streams even during a stock market sell-off.

Strong Stocks to Buy Now

When considering a stock market sell-off, investors should only turn to ultra-safe picks like Coca-Cola, Lockheed Martin or WM. All three companies are certainly worth investing in, but cyclical companies with cheap valuations and growing dividends — like Union Pacific and UPS — can also be good buys.

The most important quality to look for when investing is a company’s ability to meet shareholder expectations well into the future. For dividend-paying companies, that means growing earnings to support higher dividend growth, maintaining a competitive edge, and cultivating a strong balance sheet. In short, all five of these companies are industry leaders that are well-positioned to weather a downturn or even gain market share and emerge stronger.

Should You Invest $1,000 in Coca-Cola Now?

Before you buy Coca-Cola stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $692,784!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 22, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, FedEx and Union Pacific. The Motley Fool recommends Lockheed Martin, United Parcel Service and Waste Management. The Motley Fool has a disclosure policy.

5 Dividend Stocks to Buy Even If You’re Worried About a Stock Market Sell-Off was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is provided by our partners and/or the news agencies. Copyright and Credits go to the news agencies, email [email protected] Follow us WhatsApp verified channel

The post 5 Dividend Stocks You Can Buy Even If You’re Worried About the Stock Market first appeared on Frugals ca.