Economic Impact of Hospital Mergers on Workers and ConsumersEconomic Impact of Hospital Mergers on Workers and Consumers A study by the National Bureau of Economic Research (NBER) has found that hospital mergers can have significant negative economic consequences for workers and consumers. The study estimates that mergers that result in a 5% or greater increase in hospital prices would lead to: * 203 job losses * $32 million in lost wages * $6.8 million reduction in federal income tax revenues * 1 to 2 additional deaths from suicide and overdose The total economic damage from such a merger is estimated to be approximately $42 million. The study also found that increases in insurance premiums often lead to job losses for workers earning less than $100,000 per year, with middle-income workers being hit the hardest. This is because middle-income workers often do not qualify for Medicaid, but they also cannot afford employer-provided insurance. The data used in the study came from the Health Care Cost Institute and federal government insurance premium statistics. The researchers examined 304 hospital mergers between 2010 and 2015 and found a correlation between mergers and price increases. The authors of the study conclude that “rising health care spending will increase labor costs and reduce business dynamism outside the health care sector, putting pressure on the federal budget and worsening income inequality.” They hope that their research will motivate future analysis of strategies to address price growth in US healthcare and to challenge hospital mergers that reduce competition and lead to higher prices. The full NBER paper is available here: [link to NBER paper]

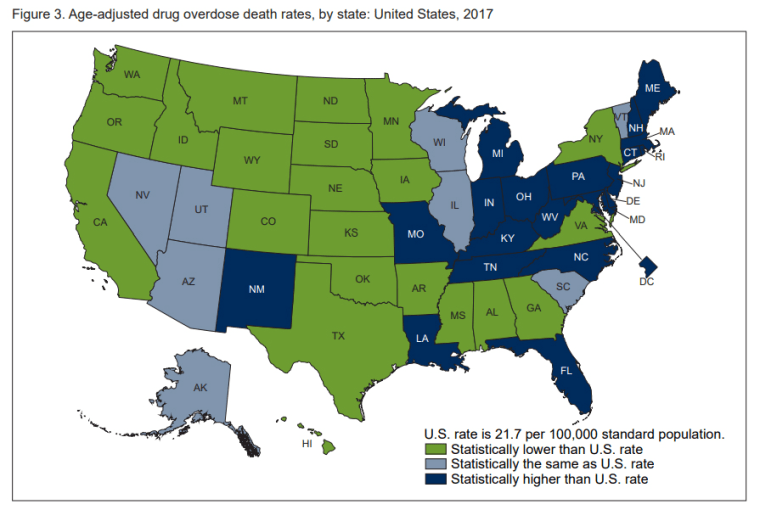

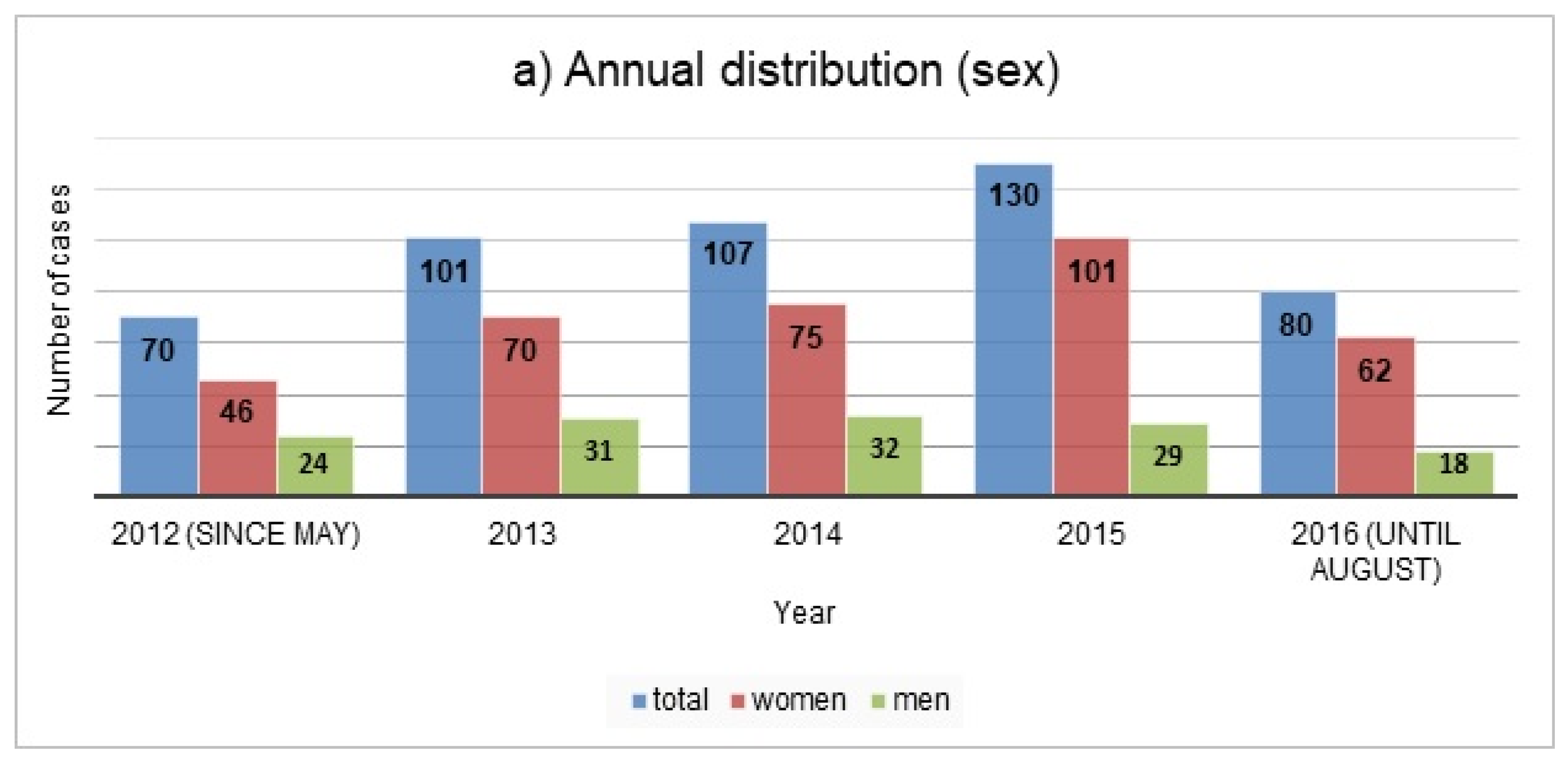

“Similarly, we estimate that the average merger that increased prices by 5% or more would have resulted in 203 job losses, approximately $32 million in lost wages, a $6.8 million reduction in federal income tax revenues, and between 1 and 2 additional deaths from suicide and overdose,” the report said. “This implies that the total economic damage from an individual merger that increases hospital prices by 5% or more is approximately $42 million.”

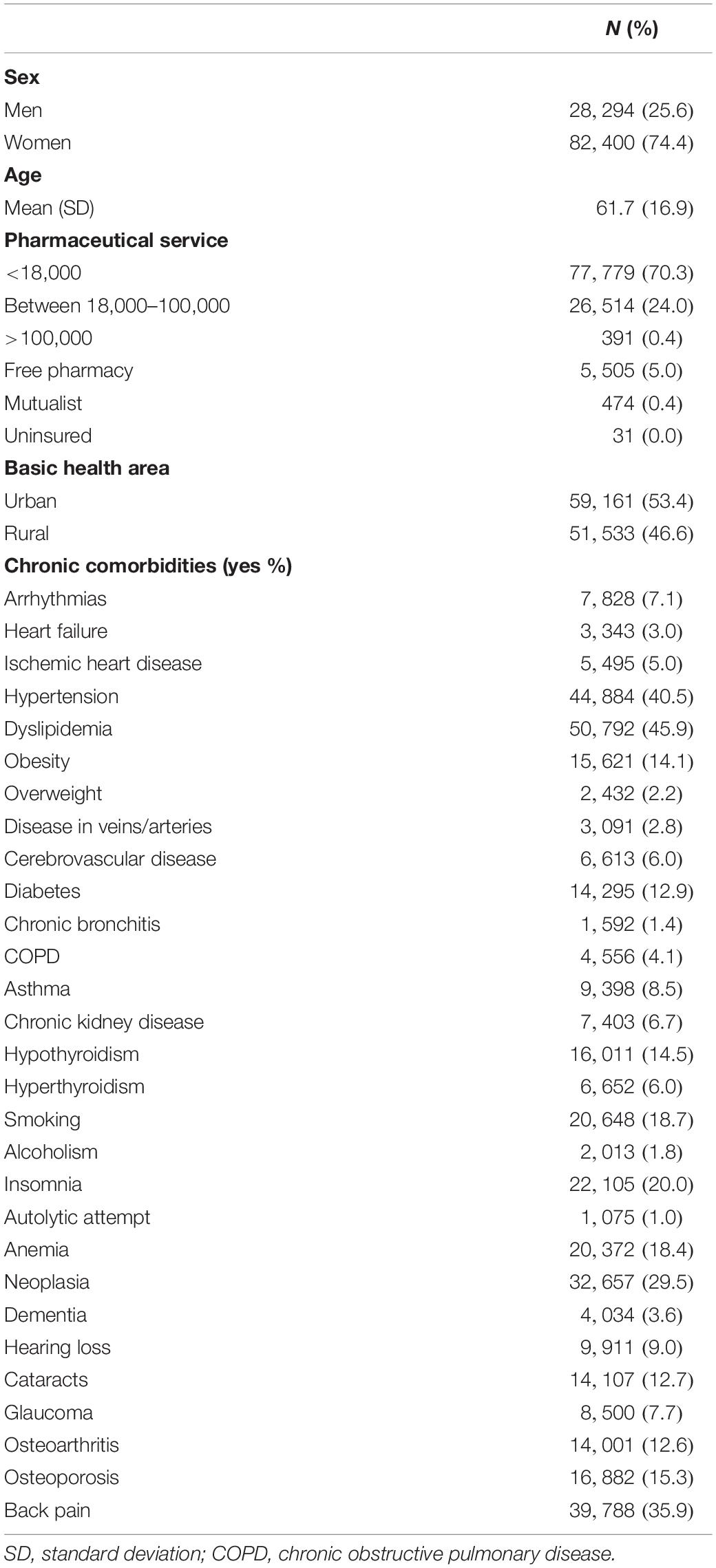

Unsurprisingly, increases in insurance premiums often led to job losses for workers earning less than $100,000 per year. The premium increase hits middle-income workers the hardest, because they often do not qualify for Medicaid. Those who earn $20,000 a year or less rarely have employer-provided insurance.

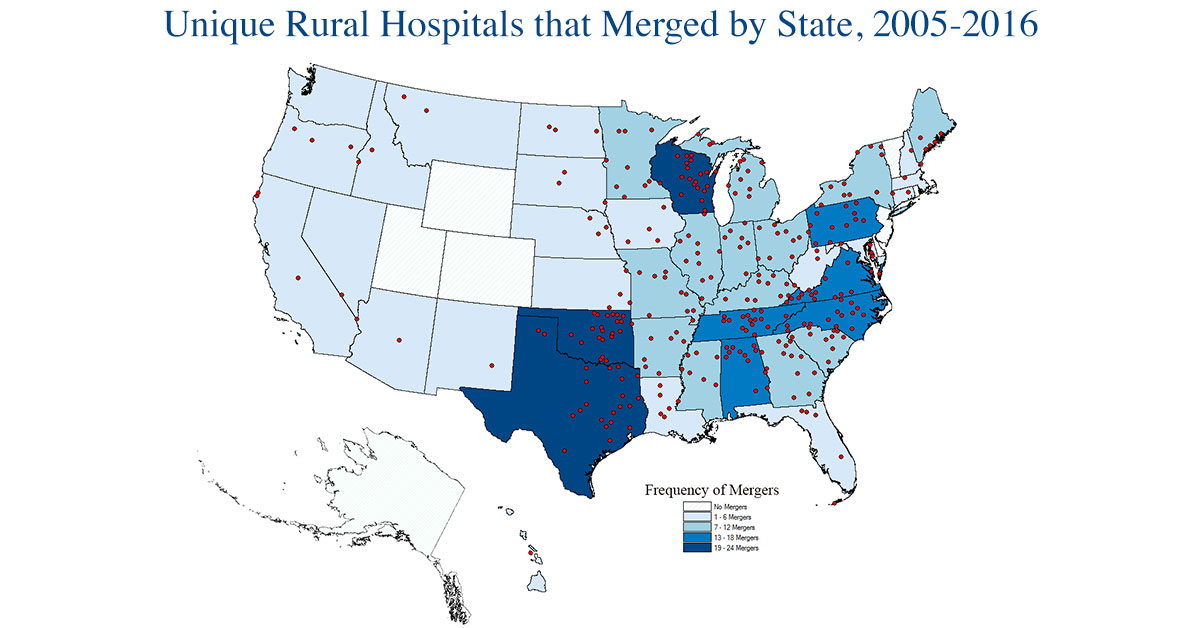

The data used to calculate these estimates comes from the Health Care Cost Institute and federal government insurance premium statistics, the NBER said. The group examined 304 hospital mergers between 2010 and 2015 to determine their correlations.

“In the absence of concrete steps to address health care price growth, rising health care spending will increase labor costs and reduce business dynamism outside the health care sector, putting pressure on the federal budget and worsening income inequality,” the authors wrote in the paper. “We hope this research will motivate future analyzes of strategies to address price growth in US healthcare and ways to screen and challenge hospital mergers that reduce competition and lead to higher prices.”

The full NBER paper can be found here.