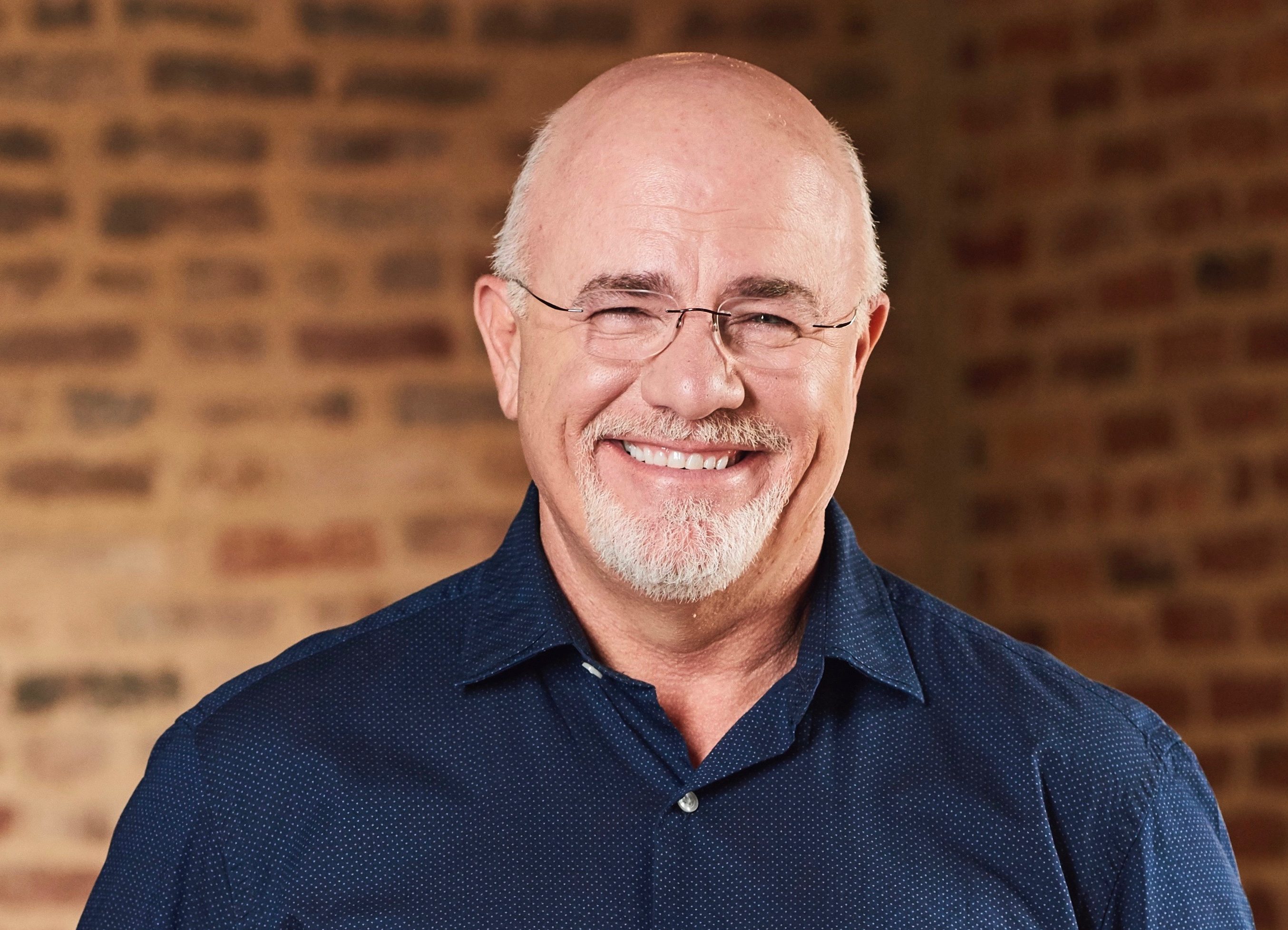

Dave Ramsey’s Unfiltered Views on Real Estate and InvestingDave Ramsey’s Unfiltered Views on Real Estate and Investing In a candid interview with Theo Von, financial guru Dave Ramsey shared his outspoken thoughts on real estate and investing. Real Estate: Not as “Passive” as Claimed Ramsey vehemently dismissed the idea of real estate as passive income. He emphasized the active involvement and hassles associated with it, including property management, unexpected issues, and unruly tenants. T-Bills: A Hassle-Free Alternative Ramsey contrasted real estate with T-bills, which offer a “no-hassle” option with lower returns but less stress. He recommended forgetting about these investments and simply collecting the regular checks. Mutual Funds: Less Stress, Higher Returns Ramsey also highlighted the advantages of mutual funds over real estate. While carrying more risk than T-bills, mutual funds provide higher returns with less stress. Ramsey’s Long-Term Investment Strategy Ramsey focuses on long-term investments and pays no attention to short-term market fluctuations. He advised looking at historical market performance to appreciate the potential gains over time. Warning Against Risky Investments Ramsey shared his experience with a risky options bet on gold that resulted in a loss. He emphasized the importance of avoiding “uber high-risk” investments that resemble gambling. Avoidance of Pyramid Schemes Von discussed his experiences with pyramid schemes, and Ramsey added humorous anecdotes about past scams, including the emu farming craze of the 1980s. Conclusion Dave Ramsey’s interview sheds light on the realities of real estate investing and emphasizes the importance of considering both risks and benefits before making investment decisions. He advocates for a long-term approach, investing in assets that provide consistent returns with minimal stress.

In a recent interview with Theo Von, Dave Ramsey shared some candid thoughts on real estate and investing. Ramsey didn’t hold back, saying, “I hear on social media that real estate is passive income — bullshit. There’s nothing passive about it, man. Your ass is active. You’re either in it or you’re getting screwed. One of the two.”

Do not miss it:

“I got into some real estate,” said Theo Von, who has dealt with his own real estate woes, citing unexpected problems like Airbnb complaints and even someone starting a fire because he wouldn’t turn on the heat in his apartment. He said, “Just crazy people starting fires. That kind of thing.”

Ramsey agreed, noting that real estate comes with a lot of hassle. He compared it to T-bills, which are much less stressful. “You buy it, forget about it, and they send you a check. It’s not a big check, but there’s no hassle,” he explained. Although mutual funds carry more risk, they’re still less stressful than real estate and can provide higher returns.

Also see: This Jeff Bezos-backed startup lets you become a landlord in 10 minutes and it only costs $100.

Von cited the stress of constantly checking stocks, which he found counterproductive: “I check them too much and I don’t like it. It takes about 30 minutes out of my day to check stocks, and in that time I could have just let him do my job.”

Ramsey responded that he buys mutual funds and forgets about them, focusing on long-term gains. “I don’t even know what the market has done this year, and I do this for a living, I don’t follow it,” he said.

For Ramsey, investing is about the long term. “You know, look at what the market has done since 1980, since 1990, since 2012. Look at what I would have made if I had put in $10,000. Since 1992, $1,000 would have turned into $5,000,” Ramsey explained to Von.

Trending: Commercial real estate has historically outperformed the stock market, and This platform offers individuals the opportunity to invest in commercial real estate with as little as $5,000, with a target return of 12% and earn an additional 1% return today!

When Von asked if Ramsey had ever regretted selling a stock too early, Ramsey admitted that he had never bought a stock. “The only stupid thing I did was buy gold once,” he admitted. He lost $5,000 on a risky options bet that didn’t pay off.

The story continues

He called it “uber high-risk” and compared it to gambling: “A buddy of mine made money and he had this gold guy that we could buy gold options on. We didn’t even buy the gold. You just buy the right to buy the gold, and he said he was putting in $5,000 and if it went up, the option went from $5,000 to $50,000 and I was going to increase my money 10x. This guy had won 14 times in a row and he said, ‘Okay, we have to put in $5,000 now.’” Unfortunately, after Ramsey invested his $5,000, the guy didn’t predict how it would go the 15th time. “It’s all or nothing, so I lost the whole $5,000 and there was no sign of $50,000, right? So I’m done,” Ramsey said.

Von then shared his experiences with pyramid schemes, recalling a child scam and a failed glitter mining investment. Ramsey added a humorous anecdote about the emu farming craze of the 1980s, which he managed to avoid, laughing at the absurdity of it.

“I remember in the ’80s, everyone decided emus were the new meat, and a lot of people decided they were going to sell everything and open an emu farm. I managed to avoid that scam. It was one of those fads that didn’t work,” Ramsey described.

Read more:

“SECRET WEAPON FOR ACTIVE INVESTORS” Improve your stock market game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start your 14-day trial now!

Want to receive the latest stock analysis from Benzinga?

This article Dave Ramsey Says He Never Bought Individual Stocks – ‘The Only Stupid Thing I Did Was Buy Gold Once’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.