Mile-High Costs: The Denver Health Tax

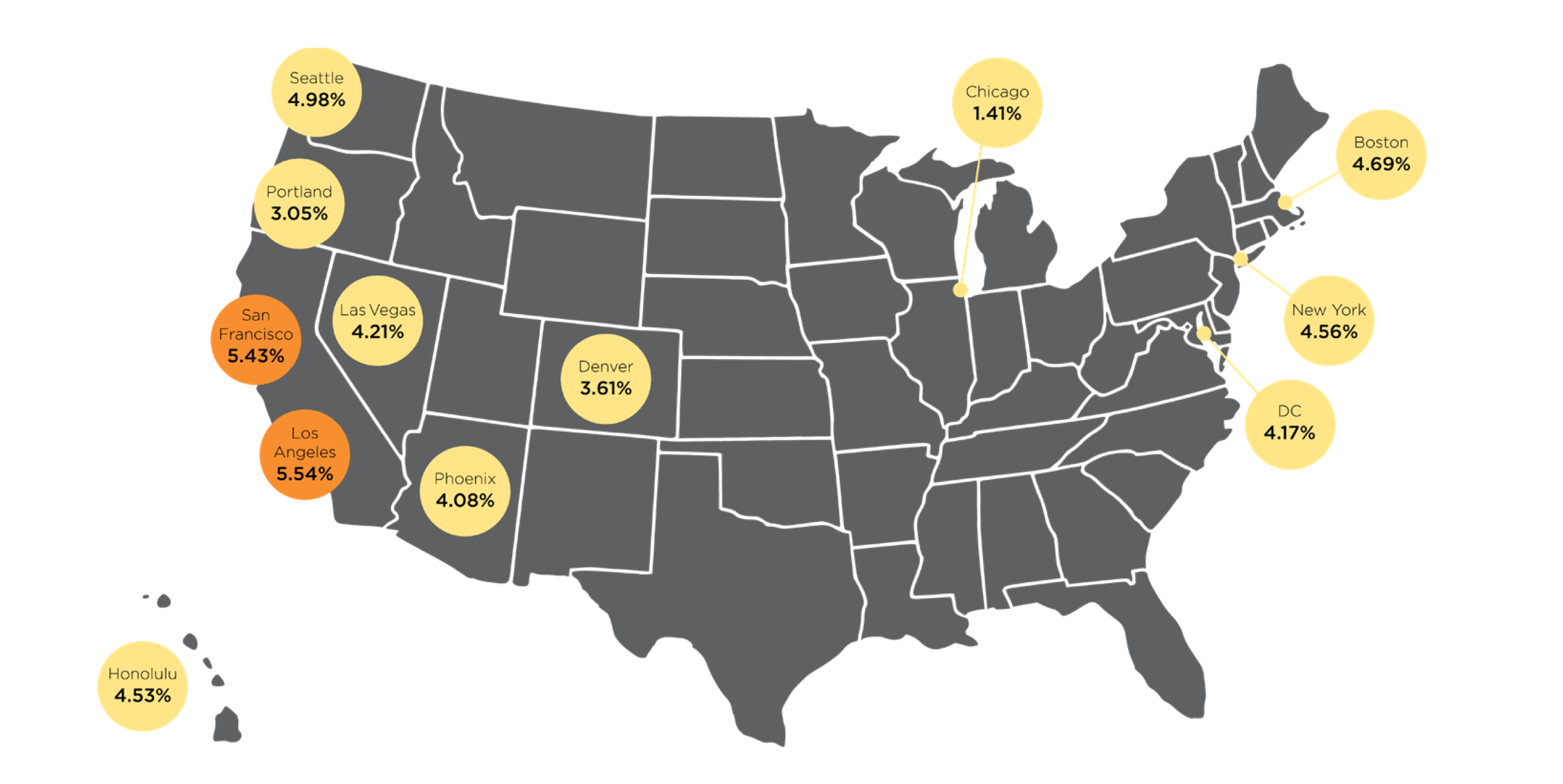

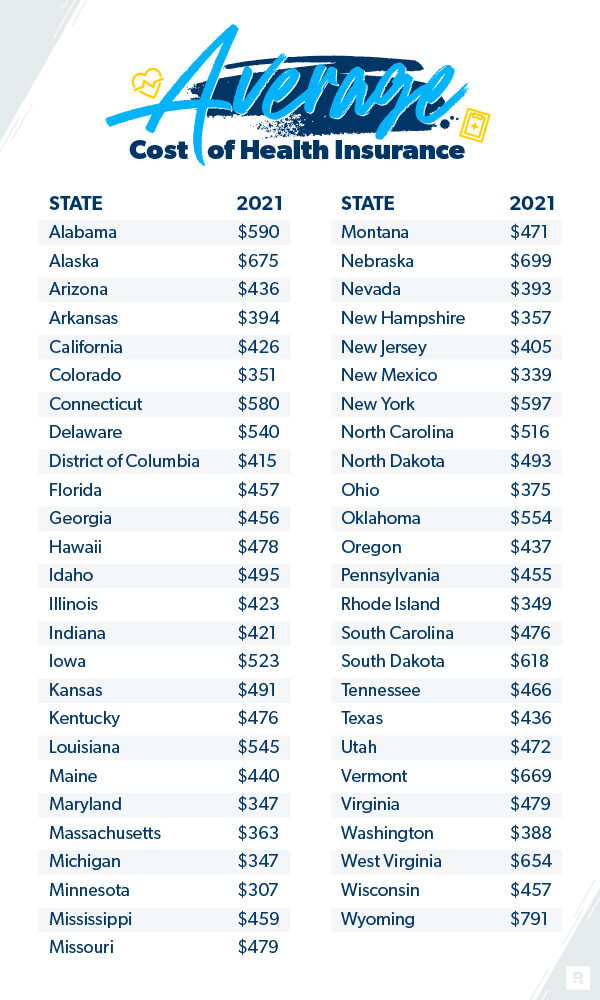

Denver, Colorado, is a thriving metropolis known for its stunning mountain views, vibrant arts scene, and growing economy. However, the city also faces a significant and ongoing challenge: the high cost of healthcare. In an effort to address this issue, Denver voters passed a landmark ballot measure in 2018 known as the Denver Health Tax. The tax, which went into effect in 2019, imposed a 4.5% sales and use tax on medical devices and services within the city limits.

Goals of the Denver Health Tax

The Denver Health Tax was designed to achieve several key goals: *

Expand access to affordable healthcare:

Revenues from the tax were intended to fund a variety of programs aimed at making healthcare more affordable for low-income residents, including health insurance subsidies and reduced-cost clinic visits. *

Improve healthcare quality:

The tax was also intended to support investments in healthcare infrastructure, new medical technologies, and workforce development to enhance the quality of care provided in Denver. *

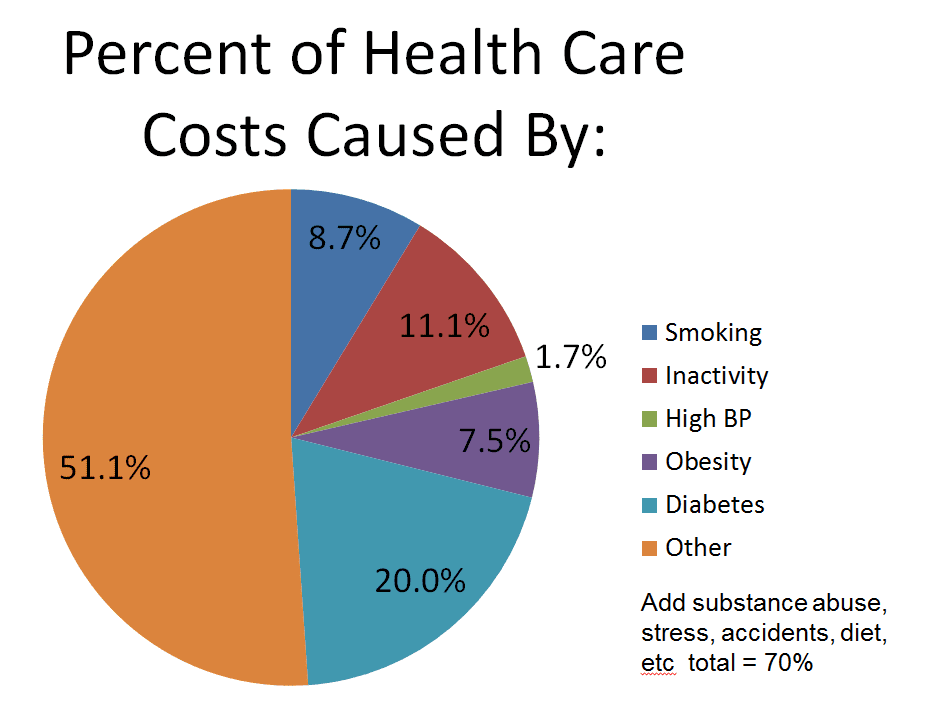

Reduce healthcare costs over time:

By making healthcare more affordable and efficient, the tax aimed to reduce overall healthcare spending in the city, saving money for individuals, businesses, and the government.

Impact of the Denver Health Tax

Since its implementation, the Denver Health Tax has had a noticeable impact on healthcare in the city: *

Increased access to healthcare:

The tax has helped expand health insurance coverage to thousands of low-income residents, making it easier for them to access basic and preventive care. *

Improved healthcare quality:

Investments in healthcare infrastructure and workforce development have led to improved patient outcomes and increased access to specialized medical services. *

Reduced healthcare costs:

While it is difficult to quantify the precise impact, some studies suggest that the Denver Health Tax has contributed to a modest reduction in healthcare spending in the city.

Controversies and Challenges

Like any major tax initiative, the Denver Health Tax has not been without its share of controversy and challenges: *

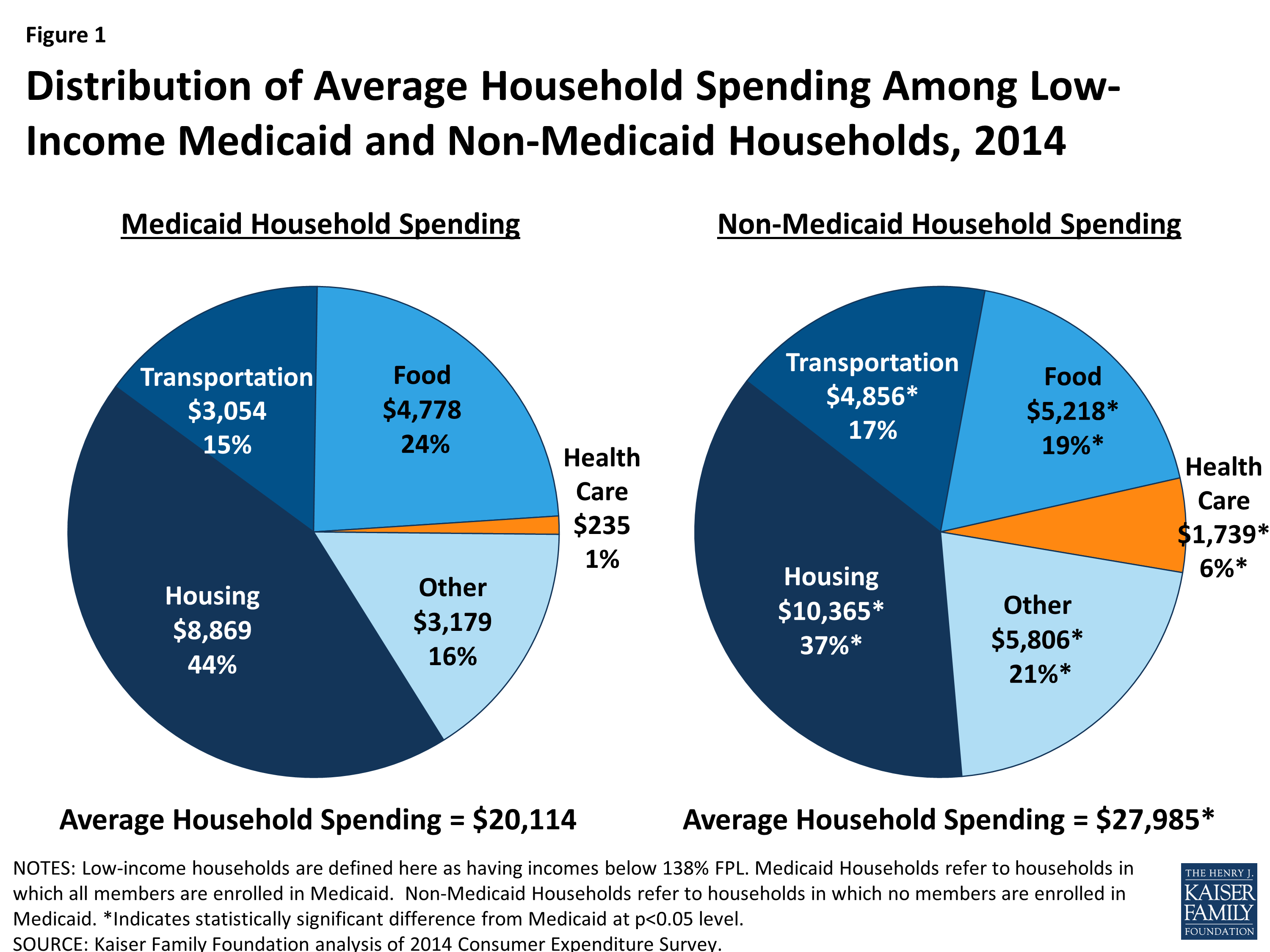

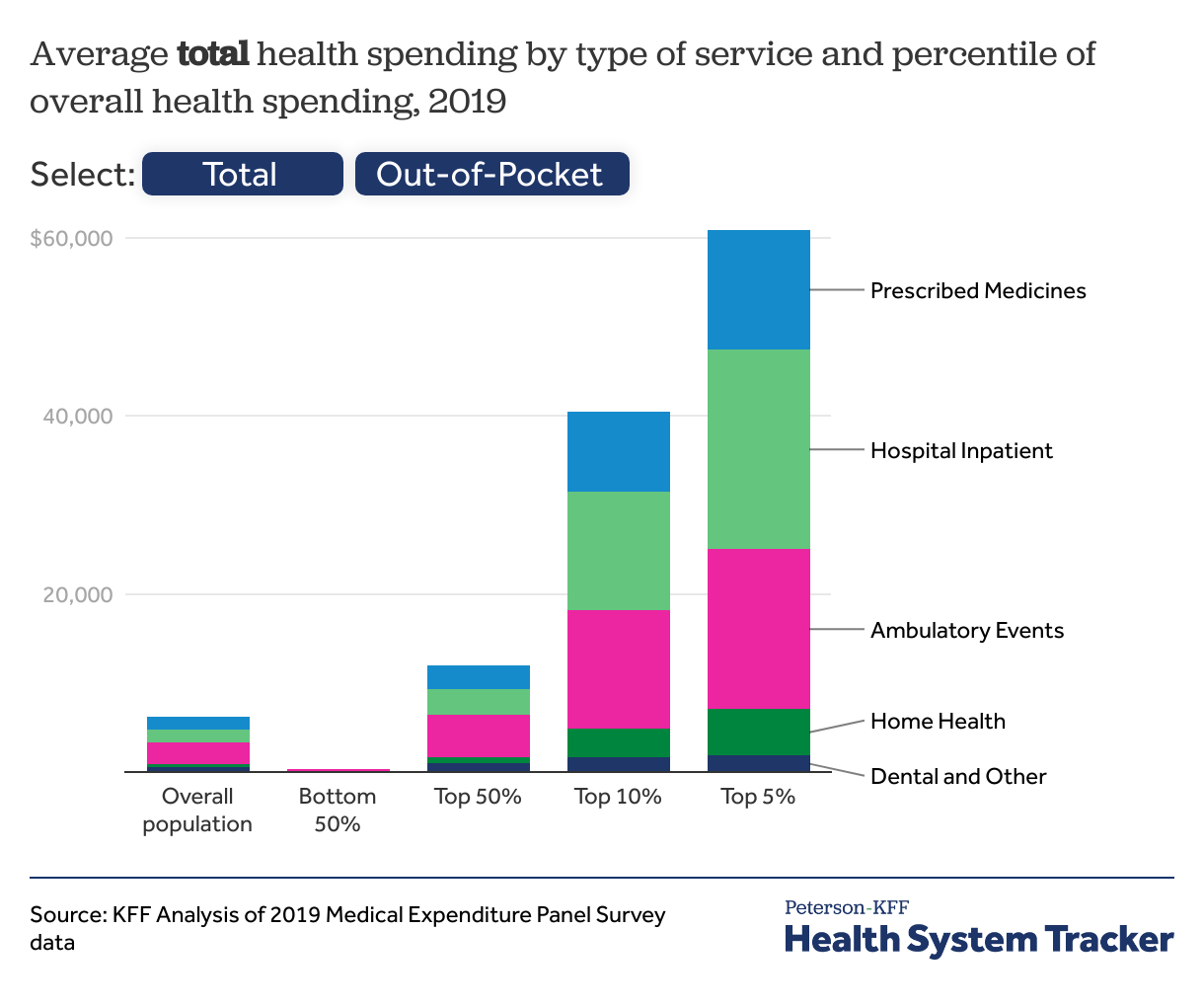

Regressive nature:

Some critics argue that the tax is regressive, meaning it disproportionately affects low-income residents who spend a larger portion of their income on medical care. *

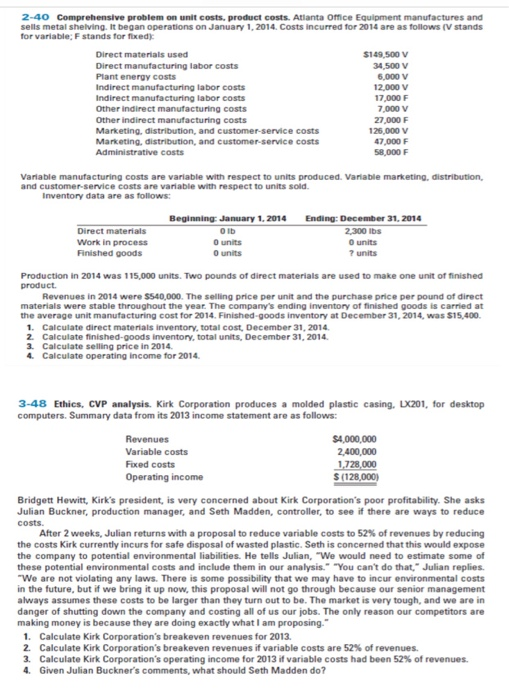

Revenue shortfalls:

The tax has consistently fallen short of its projected revenue goals, which has limited the scope of the programs it can fund. *

Administrative costs:

Implementing and administering the tax has been more expensive than anticipated, further reducing the net revenue available for healthcare programs.

Future Outlook

The Denver Health Tax is still a relatively new initiative, and its long-term effects will take time to fully evaluate. However, the initial results suggest that it has the potential to make a significant contribution to improving healthcare access, quality, and affordability in Denver. As the city grapples with the ongoing challenges of healthcare costs, the Denver Health Tax will likely remain a focal point of debate and policy discussions. It serves as a reminder that addressing healthcare disparities and ensuring accessible, affordable care for all is a complex and ongoing endeavor that requires innovative solutions and a commitment to equity.## Can a Sales Tax Solve Denver Health’s Financial Crisis?## Can a Sales Tax Solve Denver Health’s Financial Crisis? Denver Health, a nonprofit hospital, is facing a financial crisis and has turned to the City Council for help. The hospital is proposing a 0.34% sales tax increase to help pay for uncompensated care. If approved, the tax would be added to the ballot in November. Denver Health has been struggling with uncompensated care costs, which occur when patients are unable to pay for their medical care. In 2020, the hospital lost $60 million in uncompensated care costs, a number that doubled to $120 million in 2022. Last year, uncompensated care costs rose to $136 million, with $35 million coming from out-of-town patients. More than half (65%) of Denver Health patients are covered by Medicaid or are uninsured.

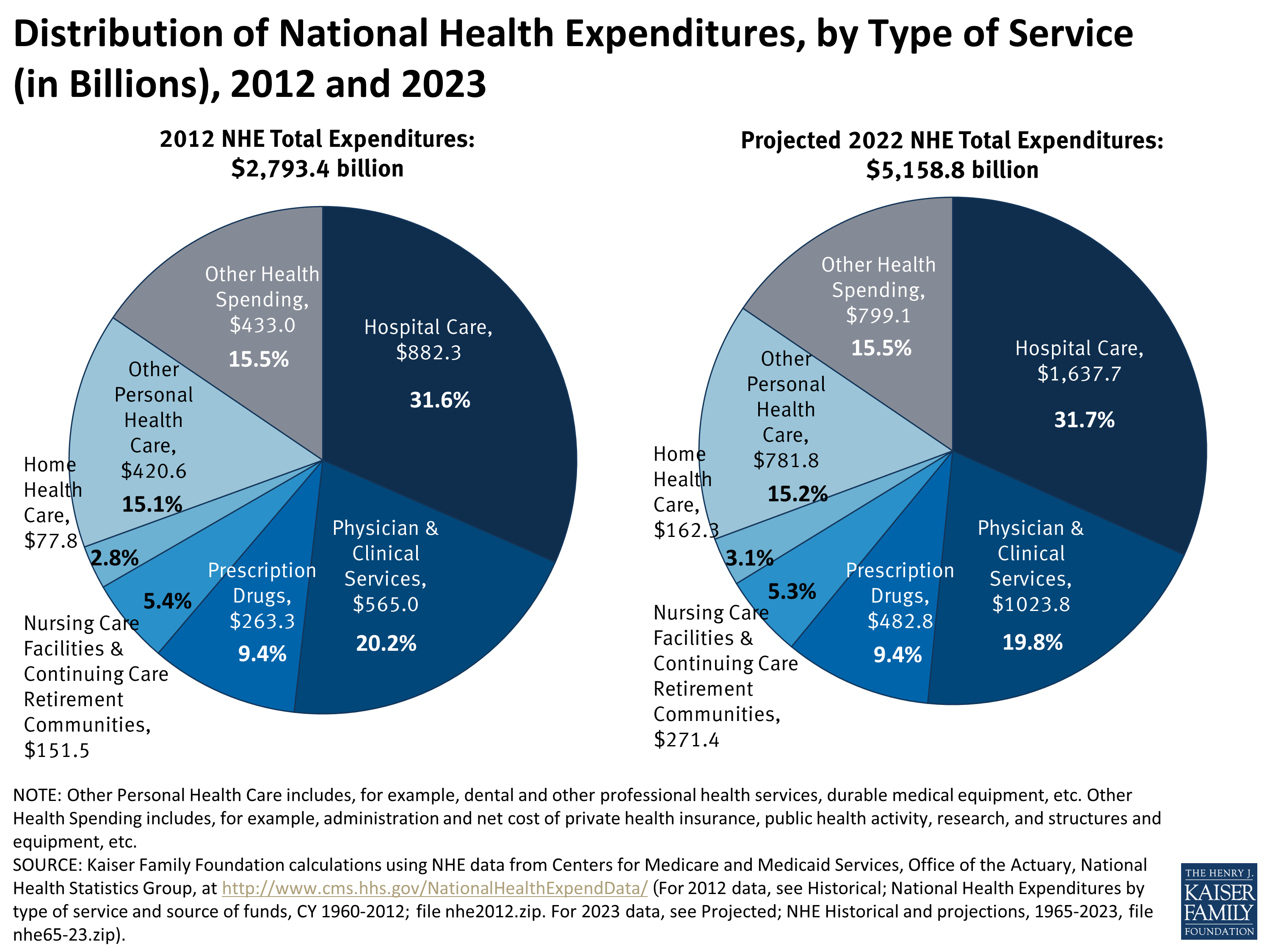

Rising Medical Costs Impacting Nonprofits

Denver Health is not alone in its financial struggles. Many nonprofit health care systems across the country are feeling the impact of rising costs. While some nonprofits have been able to increase their operating margins, others are still dealing with rising labor costs. Cost caps are also becoming a factor, which can be particularly damaging to nonprofits.

The Denver Dilemma

The proposed tax would increase Denver’s sales tax to more than 9%, with tax collections capped at $70 million. The tax would make Denver the most heavily taxed major city in the broader metro area. Some council members worry that voters will reject a tax increase. According to Denver Health CEO Donna Lynne, the sales tax would ensure that out-of-town patients contribute to the hospital’s costs. She also stated that cuts may need to be made if the hospital is unable to secure additional funding from various sources. The Denver City Council is still considering the proposal, and a vote is expected soon. If approved, the tax would be added to the ballot in November.

Mile+High Costs: The Denver Health Tax

The Denver Health tax, a 0.75% sales tax approved by voters in 2005, has been the subject of heated debate for years. Supporters argue that it provides crucial funding for essential health services in the city, while opponents maintain that it disproportionately burdens low-income residents and stifles economic growth. The tax generates approximately $200 million annually, which is used to fund programs at Denver Health, the city’s public hospital system. These programs include primary and specialty care, mental health services, and a variety of public health initiatives. Advocates for the tax point to its positive impact on the city’s health outcomes. Denver Health has seen an increase in patients seeking preventive care and a decrease in the number of uninsured residents since the tax was implemented. They also argue that the tax is a necessary investment in the community’s overall well-being. However, critics argue that the tax is unfair to low-income residents, who spend a larger proportion of their income on necessities like groceries and healthcare. They also contend that the tax discourages spending in Denver, driving shoppers to neighboring cities with lower sales tax rates. A study commissioned by the Denver City Council in 2021 found that the tax has a regressive impact, meaning that it takes a larger proportion of income from lower-income households. The study also estimated that the tax has reduced economic activity in Denver by $1.3 billion per year. The debate over the Denver Health tax is likely to continue. The tax is set to expire in 2027, and voters will ultimately decide whether to renew it. City officials are currently exploring alternative funding models, but no concrete plans have been announced. In the meantime, Denver Health faces ongoing financial challenges. The hospital system has been hit hard by the COVID-19 pandemic, and it is unclear how it will be able to maintain its current level of services without additional funding.