ABSTRACT

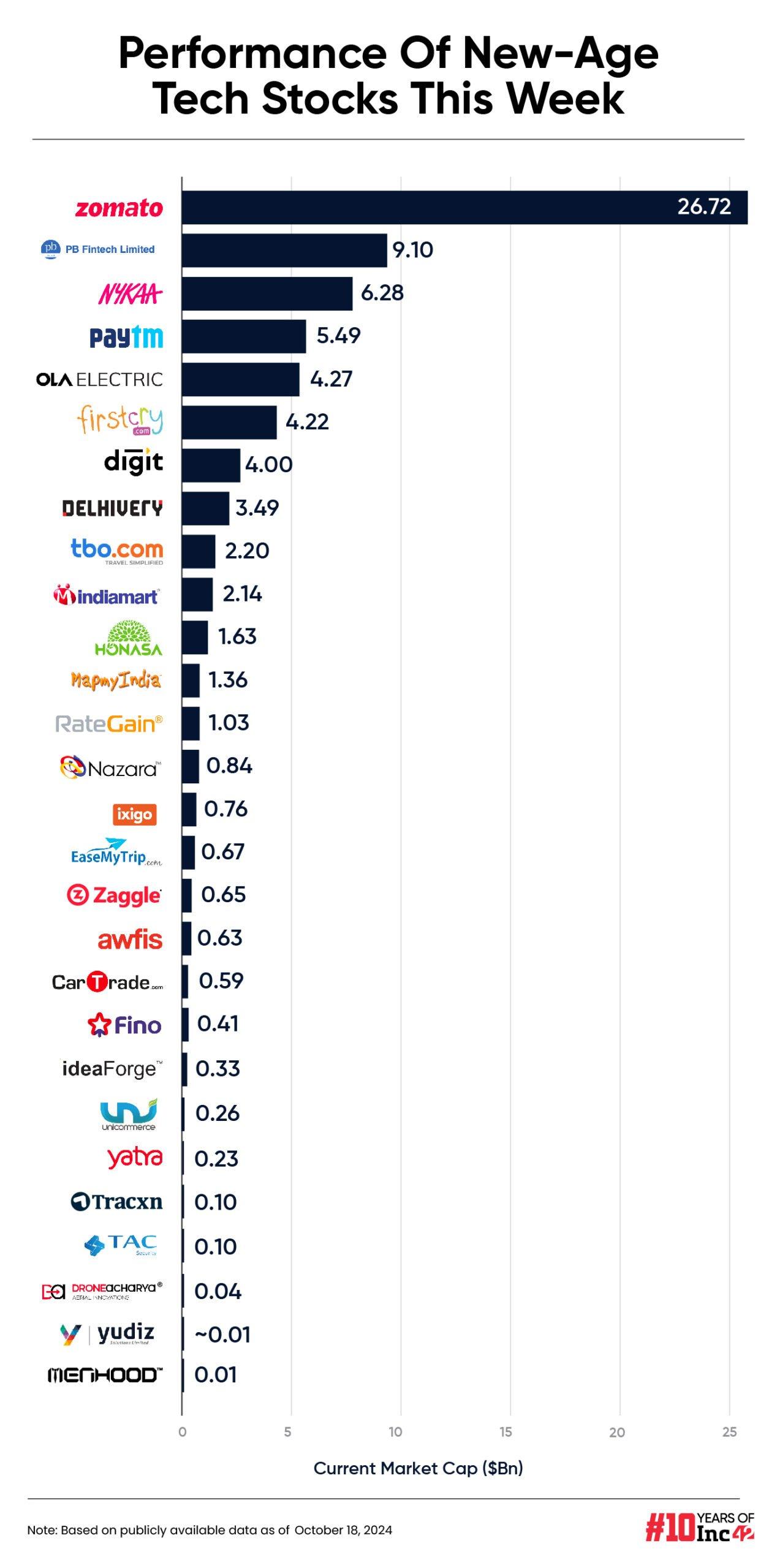

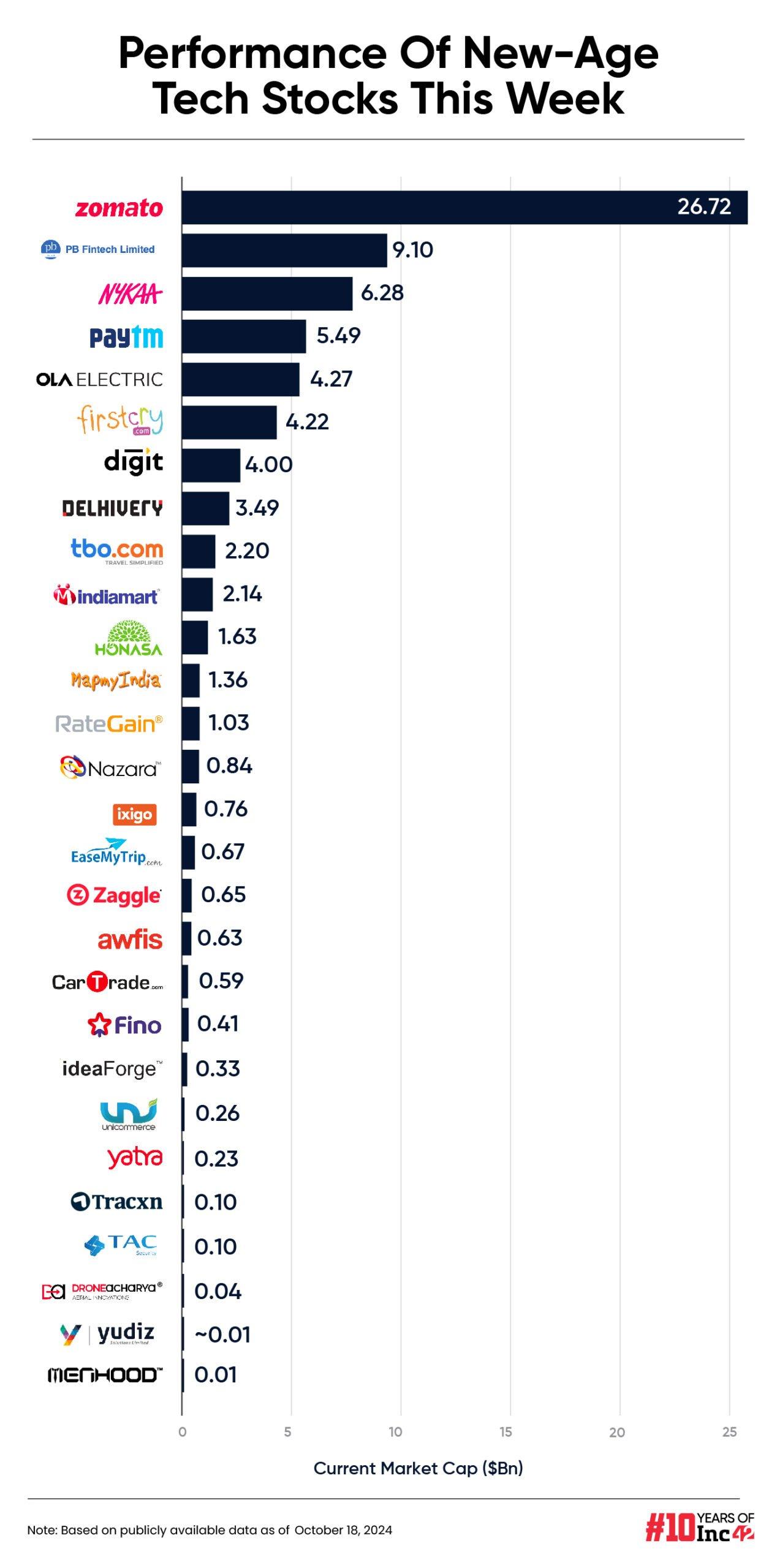

Of the 28 stocks covered by Inc42, 14 gained between 0.1% and 16% on the week.

The biggest gainer this week was TAC Infosec, whose shares rose almost 16%, while Zomato fell over 7%.

Amid geopolitical uncertainty and lack of strong domestic cues, benchmark indices Sensex and Nifty fell 0.19% and 0.44% this week

India’s new-age technology stocks had a mixed week at the bourses amid volatility in the broader domestic equity market.

Of the 28 companies covered in Inc42’s report, 14 gained between 0.1% and 16% during the week. Continuing your rally, NSE Emerge-listed TAC Infosec was the biggest gainer this week.

TAC shares jumped almost 16% in a week after the announcement a new partnership with Google to help developers and organizations meet the tech giant’s mobile app security standards.

CarTrade was the second-biggest gainer this week, with its shares rising 10.9% on the BSE. This was followed by Awfis, which gained almost 7%, and ixigo, which increased by approximately 6.8%.

Zaggle, Yudiz, PB Fintech and DroneAcharya also gained this week.

Meanwhile, shares of 14 companies fell during the week, with Zomato being the biggest loser. Zomato shares fell over 7% and EasyMyTrip fell 6.4%. ideaForge fell 5.1% on the BSE.

Nykaa, Ola Electric, Delhivery, Yatra, Menhood, Mamaearth, Tracxn, TBO Tek, Go Digit, RateGain, ideaForge and FirstCry are the other losers this week, with declines ranging from 0.1% to 4%.

Amid geopolitical uncertainty and lack of strong signals from the country, benchmark indices Sensex and Nifty fell 0.19% and 0.44% this week. However, both the indices ended the last session of the week in green with the Sensex closing at 81,224.75 and Nifty at 24,863.4.

IT indices were negatively impacted after Infosys gave a dim earnings outlook for the second quarter.

Vinod Nair, Head of Research, Geojit Financial Services, said, “Sustained selling pressure from FPIs, subdued expectations for Q2 earnings and elevated valuations weighed negatively on the market. Weak demand and input price volatility are headwinds to earnings this quarter.”

However, he said that the long-term prospects for the domestic market remain solid due to strong economic growth forecasts and an expected increase in investment spending. “We expect the market to be range-bound with a mixed bias in the short term, while investors should look more towards specific sectors and stocks at such a time,” Nair added.

Prashanth Tapse, senior vice-president (research) at Mehta Equities, also said that geopolitical tensions coupled with continued FII outflows from domestic markets are leading to caution in the market.

According to Siddhartha Khemka, head of research and wealth management at Motilal Oswal, consolidation is expected to continue due to mixed global signals and lack of domestic factors.

Stock action is expected during Q2 earnings season.

Now let’s take a closer look at the performance of some new technology companies this week.

The 28 tech stocks covered by Inc42 ended the week with a combined market capitalization of $77.56 billion, up from $81.48 billion last week.

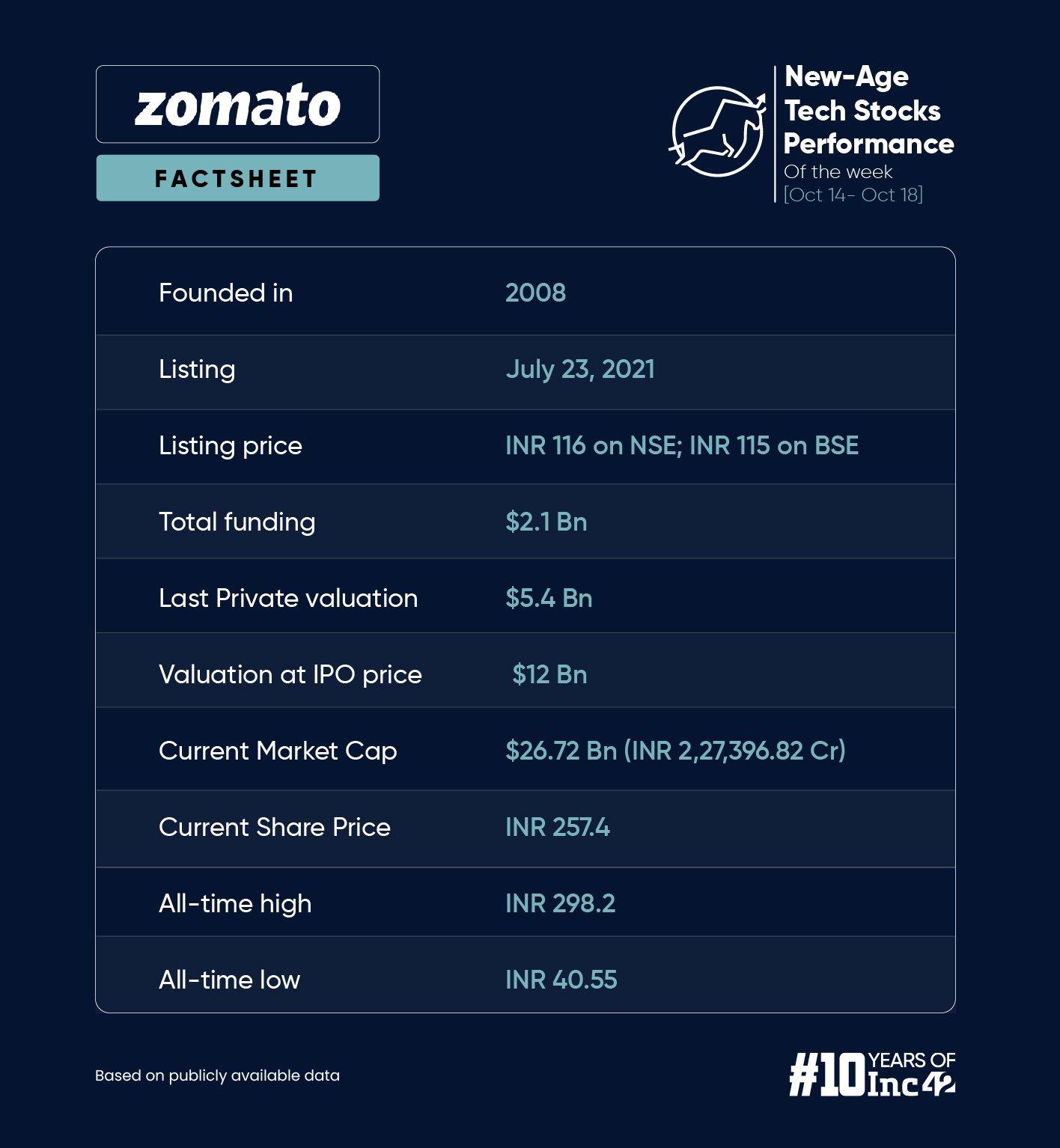

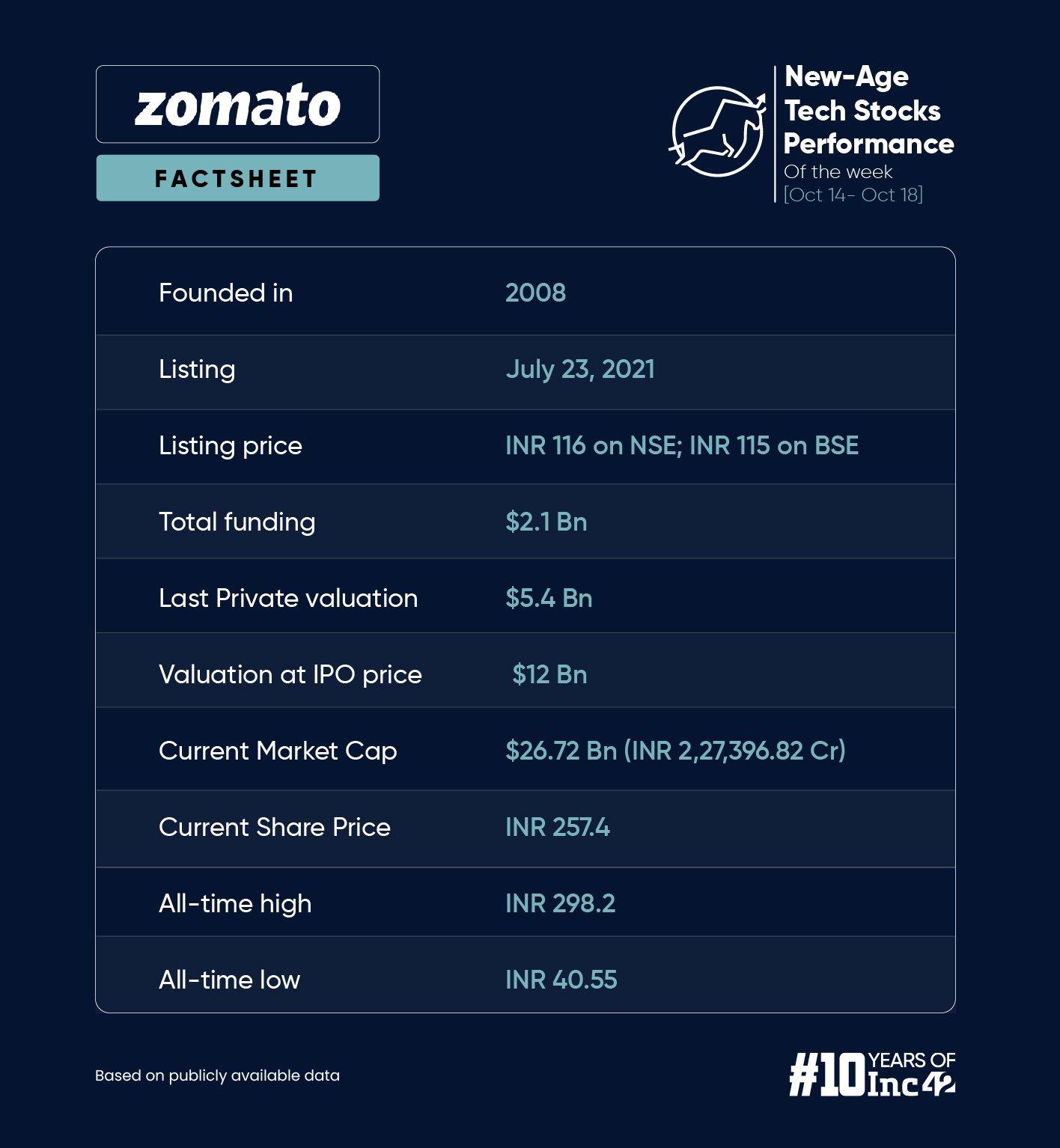

Zomato falls on fundraising plans

Shares of Zomato, a major food and beverage company, fell a significant 7.2% to end the week at INR 257.4 on the BSE.

The decline occurred after the company’s announcement fundraising plans through qualified institutional practice (QIP).

In the news for:

- According to media reports, Zomato plans to raise INR 8,500 Cr (approximately $1 billion) through QIP. The startup did not disclose the fundraising amount in its stock exchange filing. Its board will meet on October 22 to consider and approve the proposal.

- Besides, an independent director of Zomato Gunjan Soni resigned from the company’s management last week, citing “increased professional commitments.”

- According to media reports, Zomato is also considering revamping and relaunching its ‘Xtreme’ logistics business after it was suspended earlier this year due to weak demand.

While Zomato shares gained ground in the first session this week, it saw a sharp decline in the next four consecutive sessions.

Since the beginning of the year, its shares have increased by 108%.

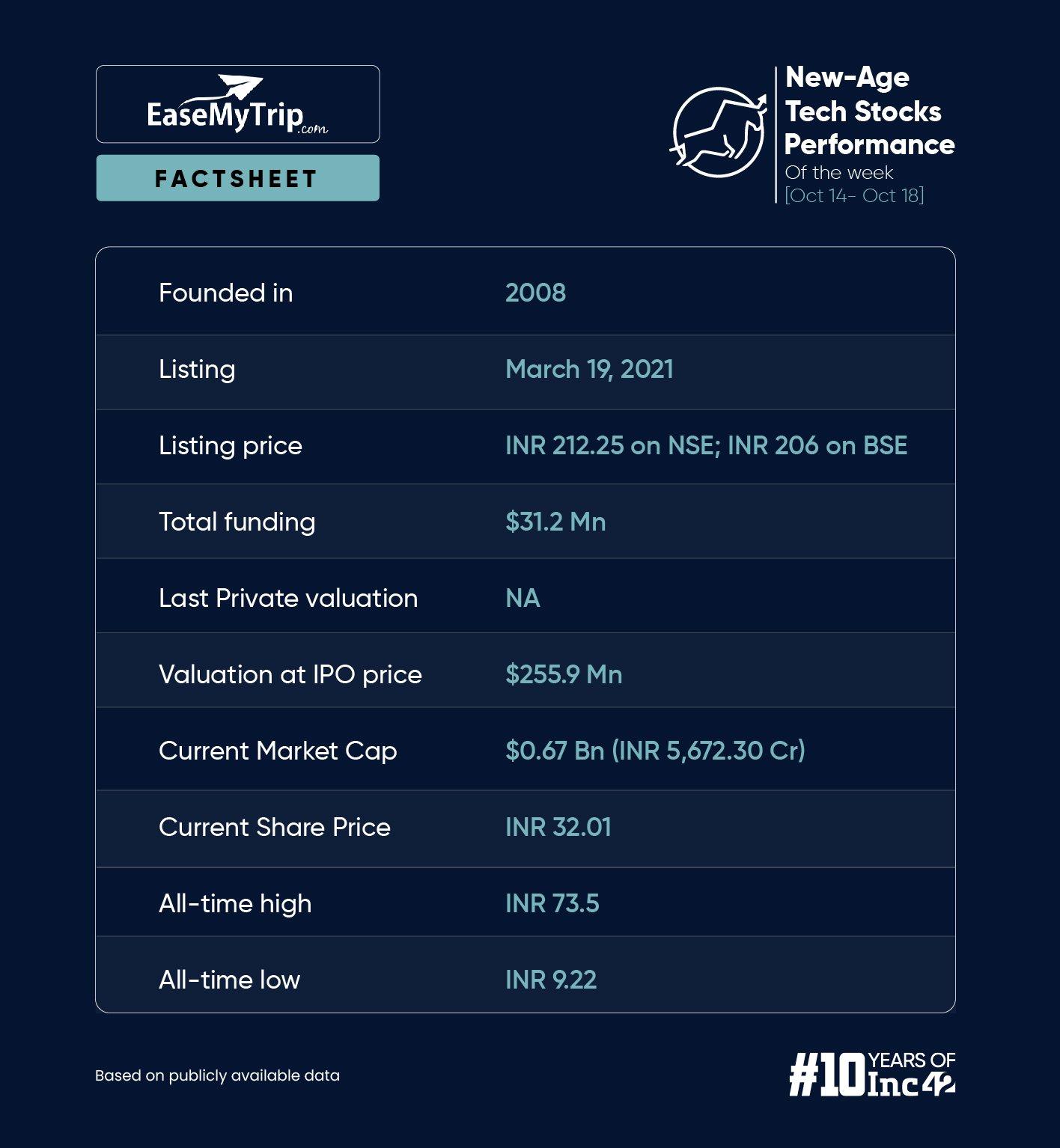

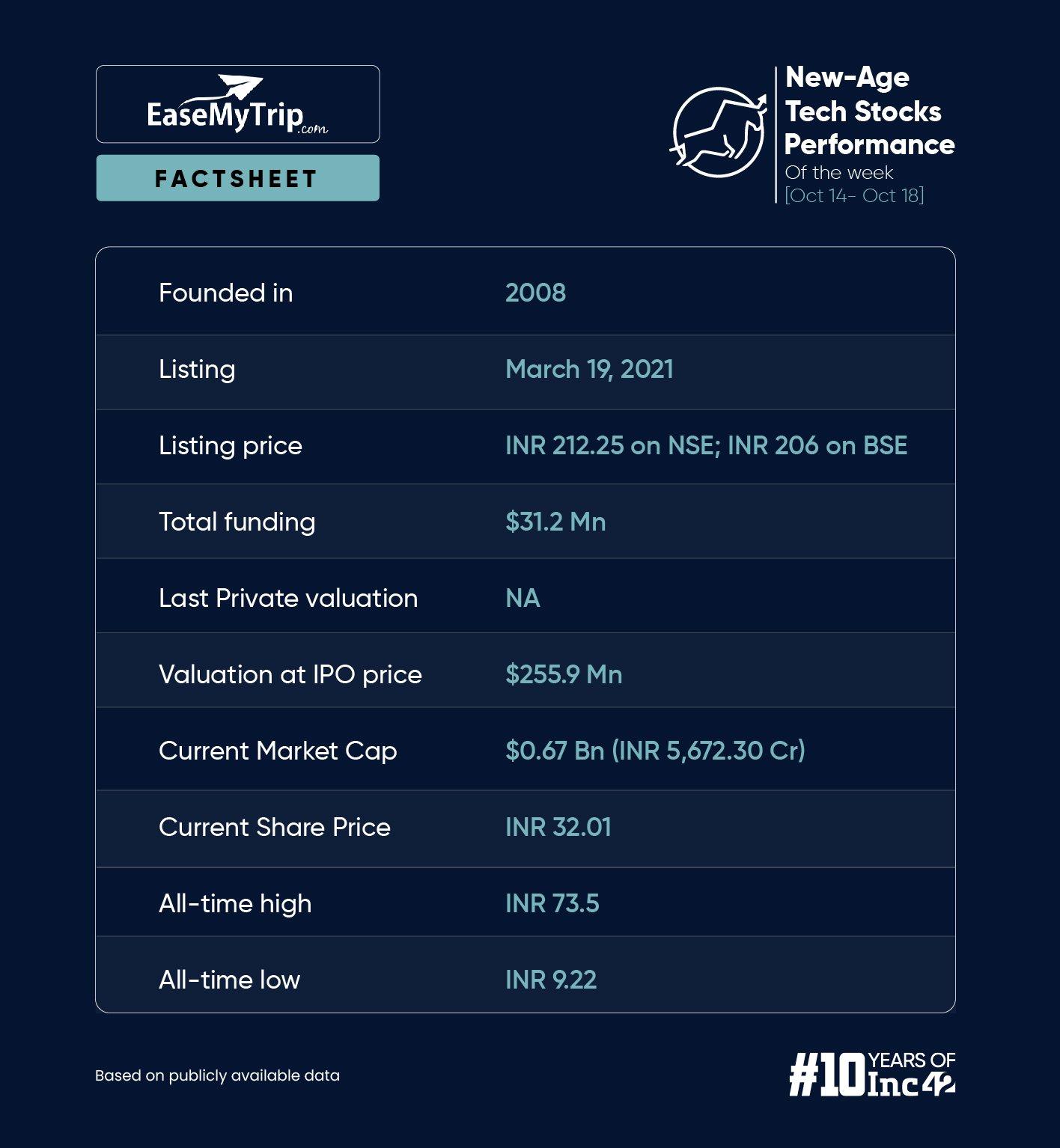

EaseMyTrip lowest in almost three years

After its share price plummeted late last month, EaseMyTrip is trying to get back on track. Shares fell in all five sessions this week.

EaseMyTrip shares fell 6.4% to end the week at INR 32.01 on the BSE. The stock last traded at this level in December 2021.

While the company’s stock had been under pressure almost throughout the year, it fell sharply after co-founder and CEO Nishant Pitti sold off 24.65 Cr shares of the company. Among them, major traveltech approved the issue of bonus shares in a 1:1 ratio this week.

The company said it will issue 177.2 Cr shares with a face value of INR 1 each. The issue of bonus shares would require an amount of INR 177.2 Cr.

The company’s shares are down 20.6% since the beginning of the year.

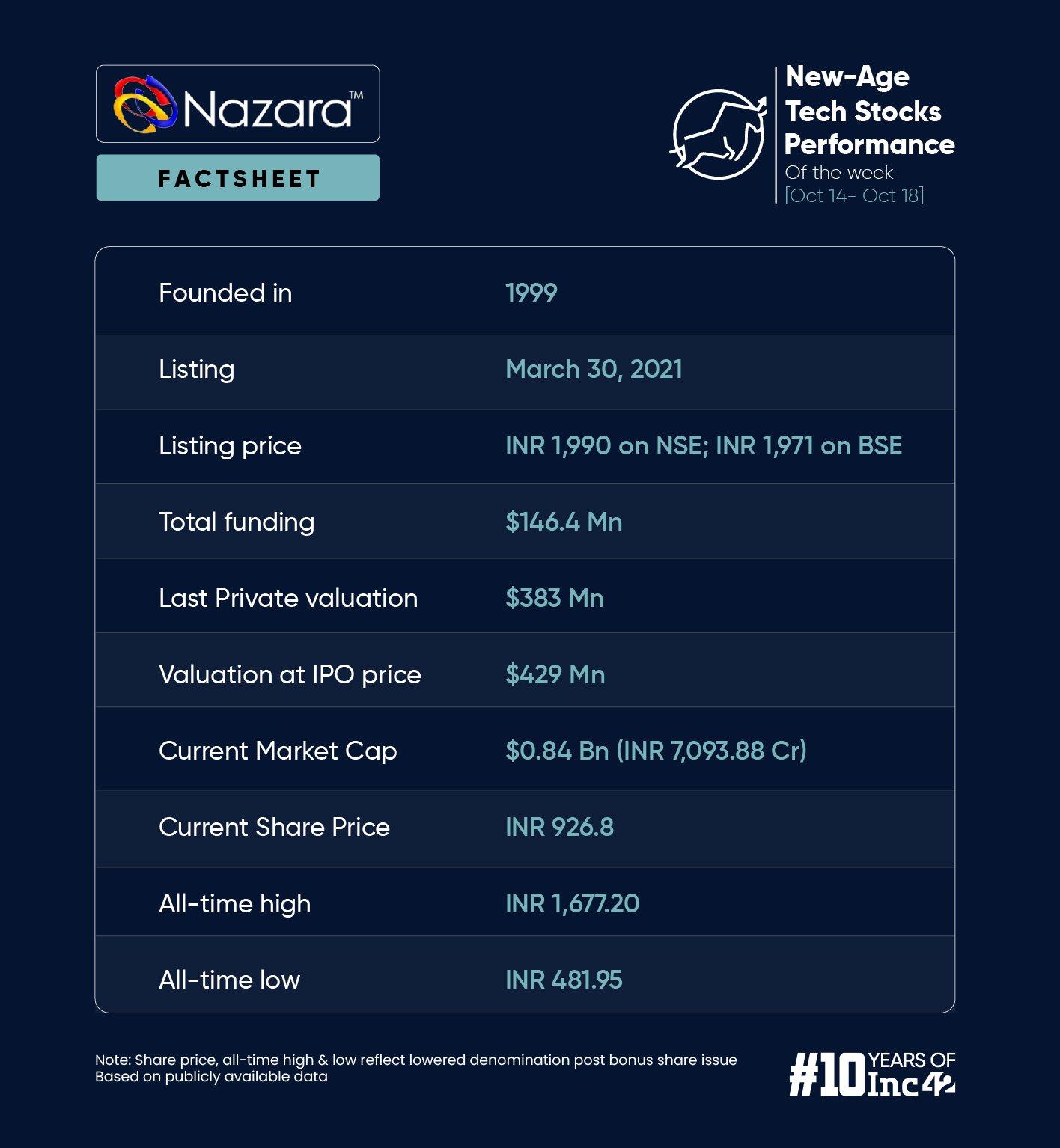

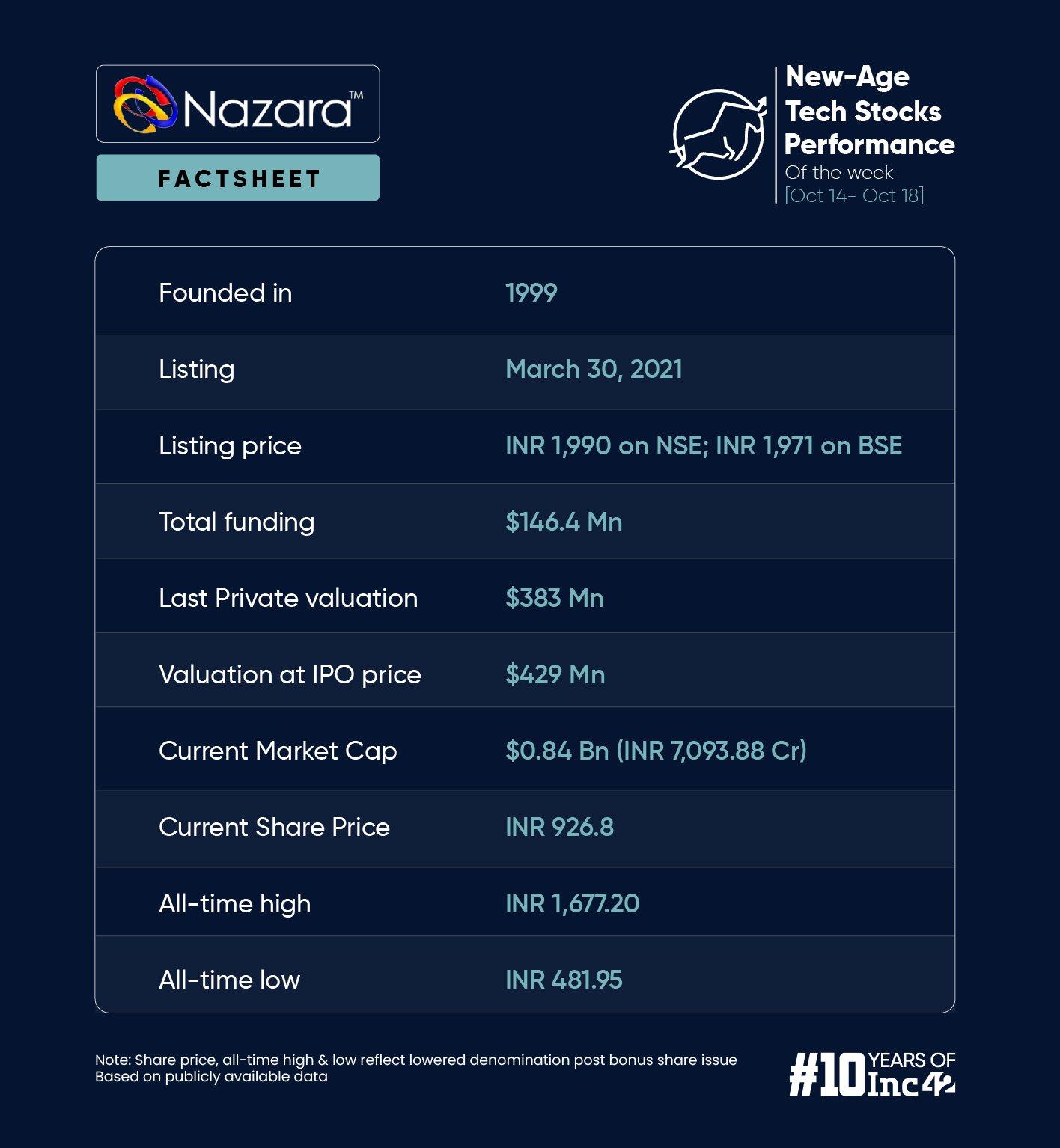

Nazara’s new acquisition

Nazara obtained obtaining shareholder approval this week to acquire significant shares in Moonshine Technologyparent company of the online poker platform Pokerbaazi.

As part of the ongoing acquisition spree of a major gaming player, Nazara last month entered into a definitive agreement to acquire 47.7% stake in Moonshine Technology for INR 831.5 crore through an add-on transaction.

The company said it received shareholder approval for the transaction at an extraordinary general meeting held on October 12.

Nazara shares fell mid-week but later rebounded and ended the week in the green. Overall, Nazara gained 0.33% to end at INR 926.8 on BSE.

Currently, its shares are trading over 8% higher than a year earlier.