(Editor’s Note: While you’re enjoying the sun this beautiful summer, improving your financial literacy should still be a priority. That is why WCI introduces our summer sale which runs until July 3. You can participate with the code SUMMER20 20% discount everything in store, including all our highly rated courses (including our new offering for medical students and residents)! This is one of the best sales we host all year, so make sure you take advantage of it as you transition into the new medical year. Aside from applying sunscreen every day, take advantage of the summer sale could be the best decision you make this year!)

By Dr. Erik Hofmeister, guest writer

By Dr. Erik Hofmeister, guest writer

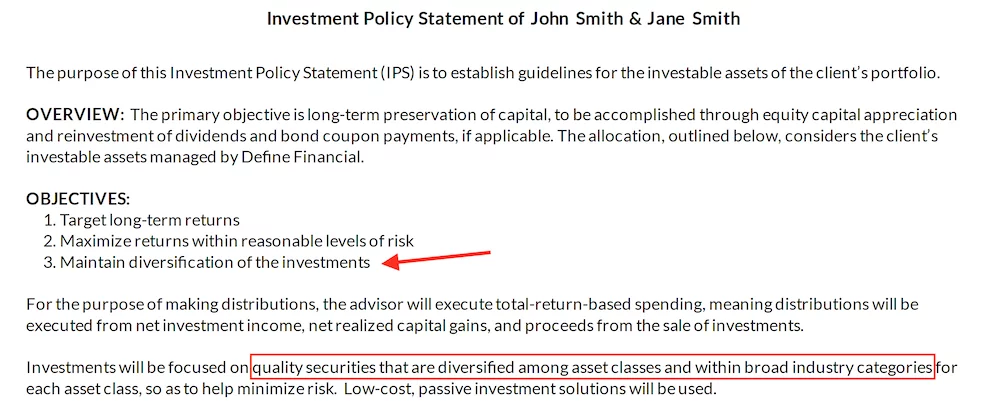

The Investor Policy Statement (IPS) is a critical component of your financial success. It outlines your goals, investment strategy, spending strategy, progress plan, etc. If you don’t have one, WCI’s Fire Your Financial Advisor course can help you get there. Once you have one, however, it’s not set in stone. It’s a living document that can change as your life circumstances change. One of my favorite parts of Dr. Jim Dahle’s IPS is the three-month wait between wanting to make a change to the IPS and actually doing it.

So why, when and how do you change your IPS?

Why change the investor policy statement

We wrote our Investor Policy Statement in 2019 and achieved financial independence in 2022. We are now considering retiring relatively soon. When we reached FI, I thought of the quote, “Once you win the game, stop playing.” It occurred to me that we may need to change the IPS, and we certainly will need to change it once we retire. Here are some reasons why you might want to change your IPS.

Living conditions

Maybe you are divorced, maybe you have a chronic illness and can’t work, maybe you have unexpectedly had a child. There are a whole range of events that can happen in your life that can affect your finances, and vice versa. When your life changes, your IPS may need to change too.

Economic circumstances

Towards the end of 2021, I Bonds became the hot new investment. 7% return on a safe investment? Sign me up! Now that savings accounts yield a decent amount, do you still want to have that much in bonds? Jim recently reviewed Avantis’s funds and concluded that one of them might be a better tax-loss harvesting partner than his current fund. People in the economy are constantly innovating and the economy changes regularly. If this is the case, you may want to reevaluate your IPS.

However, be careful not to chase performance. Just because an investment has performed well recently doesn’t mean it will continue to do so. You don’t have to jump on every seemingly great new thing, either. We decided not to buy I-bonds because dealing with TreasuryDirect seemed like a hassle, and we didn’t really need them to achieve our goals (the amount we could invest wouldn’t make much of a difference to us). Just because you’re considering changing your IPS doesn’t mean you should.

Education

Some people are experienced investors by the time they write their IPS, but most of us are not. The IPS is a document we created relatively early in our personal finance education. Recently Dr. said Rikki Racela that his IPS did not include Backdoor Roth IRAs, but he made the change when he learned more about finances. You may discover that you can harvest tax losses, or you may come to believe that a small factor tilt will be helpful. These are concepts that the newer investor is unlikely to include in their IPS. Consider the diagnostic approach between a fourth-year medical student and an undergraduate student: their behavior changes with their level of experience. As you learn more, you may need to change the plan you made as a beginner.

More information here:

My financial plan calls me. . . Being hung by my fingernails????

Get a financial plan in order

When should you change the investor policy statement?

Below are some milestones when you may want to change your IPS.

- When your emergency fund and insurance are fully arranged. Your basic financial ducks are all in a row, and now you can start thinking about where to send the incoming money: paying off debt, investing, or both.

- When to max out your retirement accounts. Now you’re saving enough that you should consider a taxable account. You may need to consider asset location and allocation.

- When you pay off your student debt. Now all your income can go towards investments, so you may be considering how aggressive you want to be.

- When you reach FI. You’ve “won the game,” so you may want to reduce the risk a little.

- When you are about to retire (