Debt and Collection Investigations: Major Institutions Under Scrutiny

Recent investigations have uncovered widespread issues with debt collection practices at some of the nation’s largest financial institutions. These investigations have focused on allegations of deceptive or illegal tactics, including:

Premier Bank:

* Falsely claiming to be government agencies or attorneys * Harassing debtors with threatening phone calls and letters * Demanding payments without providing necessary documentation

Credit One:

* Charging hidden fees and interest rates that exceed state limits * Using misleading language to trick customers into signing up for high-cost loans * Withholding payments made by customers

American Express:

* Providing inaccurate credit reports to credit bureaus * Ignoring requests for debt validation * Charging inflated fees for dispute resolution

Wells Fargo:

* Unlawfully seizing customers’ property without notice * Opening unauthorized accounts and overcharging for services * Failing to provide clear explanations of debt collection fees

Discover:

* Collection calls made at excessive frequencies and times * Using aggressive and intimidating language towards debtors * Pursuing legal action even when debts are disputed

Comenity:

* Misrepresenting the terms of debts and collection policies * Failing to respond to customer inquiries * Refusing to provide debt validation documentation

Navient:

* Misleading borrowers about their repayment options * Overcharging for student loans * Failing to properly manage student loan accounts These investigations have resulted in lawsuits, fines, and settlements. The Consumer Financial Protection Bureau (CFPB) has also taken action against some of these institutions, ordering them to cease and desist from deceptive or abusive practices.

Impact on Consumers:

These collection practices have had a significant impact on consumers, often leading to: * Financial distress and bankruptcy * Damage to credit scores * Harassment and intimidation * Inaccurate debt reporting

Steps for Consumers:

If you are being subjected to deceptive or illegal debt collection practices, you should: * Contact the creditor and dispute the debt * Request written validation of the debt * Keep records of all communications * Contact the CFPB or your state’s consumer protection agency * Seek legal assistance if necessary It is important for consumers to be aware of their rights and to hold financial institutions accountable for unfair or illegal practices. By working together, we can ensure that debt collection is conducted in a fair and ethical manner.

Collection Calls: Who’s Affected by Them?

Collection Calls: Who’s Affected by Them?

(Photo credit: ShotPrime Studio/Shutterstock)

(Photo credit: ShotPrime Studio/Shutterstock)

Are you receiving troublesome collection calls from Premier Bank, Credit One, American Express, Wells Fargo, Discover, Comenity, student loan servicer Navient or other financial institutions? If you live in California, Connecticut, Florida, Georgia, Massachusetts, Michigan, Pennsylvania, South Carolina or Texas, you may be entitled to compensation.

If you’re being tormented by relentless calls from these financial institutions, help may be at hand. Residents of California, Connecticut, Florida, Georgia, Massachusetts, Michigan, Pennsylvania, South Carolina, and Texas are fighting the barrage to force institutions to follow federal and state debt collection laws!

Even if the debt collection conversations are not intended for you, you can seek legal help. How many times do you have to tell them that the person they’re looking for doesn’t live here? Or how long will it take before they believe you?

Are you eligible?

You may be eligible for legal action if you receive excessive collection calls. For more information about legal action you can take in California, Connecticut, Florida, Georgia, Massachusetts, Michigan, Pennsylvania, South Carolina and Texas.

For more information, complete the form on this page.

Who called you?

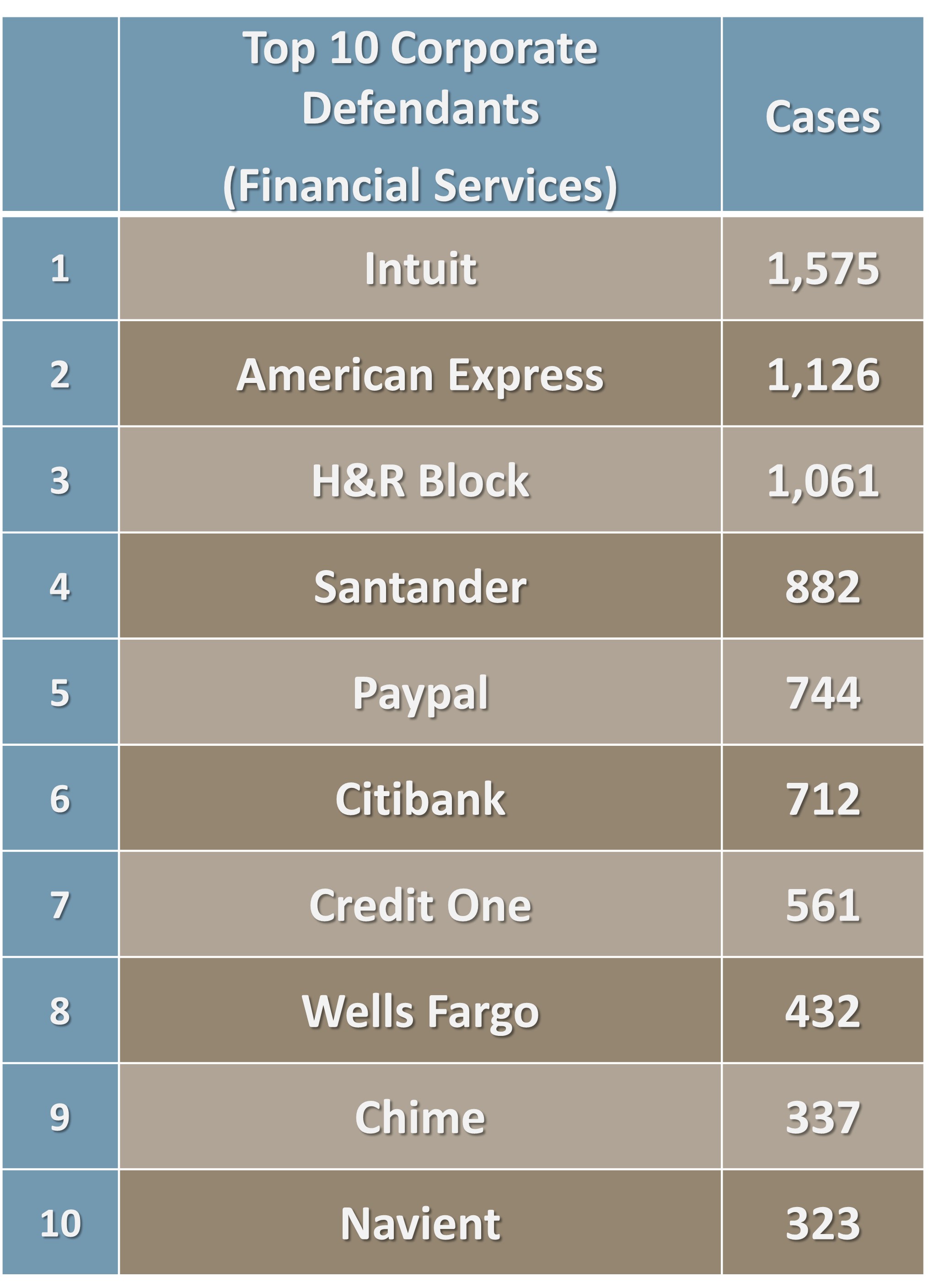

Consumers who have received unlawful collection calls from the following institutions may be eligible to participate in a collection lawsuit:

- Premier Bank

- Credit one

- American Express

- Wells Fargo

- To discover

- Ease

- Navient (student loans)

Debt Collection Laws by State

Debt collection laws vary by state, but by federal law does not allow collection agencies to contact you immediately “if a collection agency knows that an attorney is representing you on the debt… (and) knows or can easily obtain your attorney’s name and contact information.”

California

California debt collection laws are strict collection regulations which prohibit deceptive conduct, including calls that harass or abuse consumers to collect a debt, or calls that make false or misleading statements to collect a debt. In California, calls must be made between 8 a.m. and 9 p.m., and debt collectors are not allowed to contact family, neighbors or others about a debt without meeting specific qualifications.

Connecticut

Connecticut Debt Collection Laws Protecting residents against unlawful debt collection practices. Creditors and debt collectors are prohibited from claiming to be government representatives, saying you have committed a crime, and using the telephone to annoy or harass you.

Florida

Florida Debt Collection Laws protect consumers by prohibiting misleading or harassing behavior, including calling at a frequency that would “reasonably be considered” harassment. Calling a debtor’s work when he knows the employer will not approve it, continuing to contact a consumer after being told to stop calling, and calling after being told the consumer cannot pay the debt in question owed are all violations.

Georgia

Debt Collection Laws in Georgia have debt collectors contact other people to find out where you live or work. They should not call you at unreasonable places or times, or contact you at work if they know that your employer disapproves of private calls. They are not allowed to lie to you in any way.

Massachusetts+

Massachusetts Debt Collection Laws prohibit a number of harassing or deceptive debt collection practices, including calling a personal number more than twice in a seven-day period or more than twice in a thirty-day period to a non-home number, such as a workplace. Massachusetts also bans calls outside of normal hours and requires callers to identify themselves.

Michigan

Michigan Debt Collection Laws prohibit debt collectors from calling before 8 a.m. or after 9 p.m. unless you give permission. Calling your workplace is also prohibited if you have indicated verbally or in writing not to do so. To stop such calls, it is recommended to notify the collectors by telephone and then confirm in writing via registered mail. Keep the receipt; report any violations immediately for resolution.

Pennsylvania

Pennsylvania’s Fair Credit Extension Uniformity Act prohibits unfair and deceptive actions by creditors and debt collectors, including calling a consumer in unusual places, calling a consumer at work, calling more than once a week about each specific debt, or calling before 8 a.m. or after 8 p.m.

South Carolina

below+South Carolina Debt Collection Law debt collectors may contact other people when trying to locate you. However, they cannot disclose what you owe and are generally not allowed to contact third parties more than once. If you hire an attorney, collection agencies may only contact your attorney and not anyone else. If you do not have a lawyer and you write a letter to the collection agency telling them not to contact you anymore, they are not allowed

Banks and Financial Institutions Face Investigations over Debt Collection Practices

Multiple financial institutions, including Premier Bank, Credit One, American Express, Wells Fargo, Discover, Comenity, and Navient, are under investigation for alleged improper debt collection practices. The investigations, launched by various state and federal agencies, focus on allegations that these institutions have violated consumer protection laws by: * Using aggressive and harassing collection tactics, such as repeated phone calls and letters * Misrepresenting the amount of debt owed * Adding unauthorized fees and charges * Threatening to take legal action without proper notice * Failing to respond to consumer complaints and requests for validation “These allegations are extremely concerning and represent a violation of consumers’ rights,” said a spokesperson for the Consumer Financial Protection Bureau (CFPB). “We are committed to holding banks and financial institutions accountable for any wrongdoing.” The investigations come amid a rise in consumer complaints about debt collection practices. According to the CFPB, over 150,000 complaints were filed against debt collectors in 2021. “These companies are supposed to help people manage their finances, but they’re often doing just the opposite,” said a victims’ rights advocate. “They’re using predatory tactics to intimidate and harass consumers into paying debts they don’t even owe.” The institutions involved in the investigations have denied any wrongdoing. However, if found liable, they could face significant fines, penalties, and corrective actions ordered by the agencies conducting the probes. The investigations are ongoing, and it is unclear when they will be completed. However, the outcome could have a major impact on the way banks and financial institutions collect debts in the future.

:max_bytes(150000):strip_icc()/credit-one-bank-american-express-card_blue-e33e10e20d394338becd6b4bf782433d.jpg)