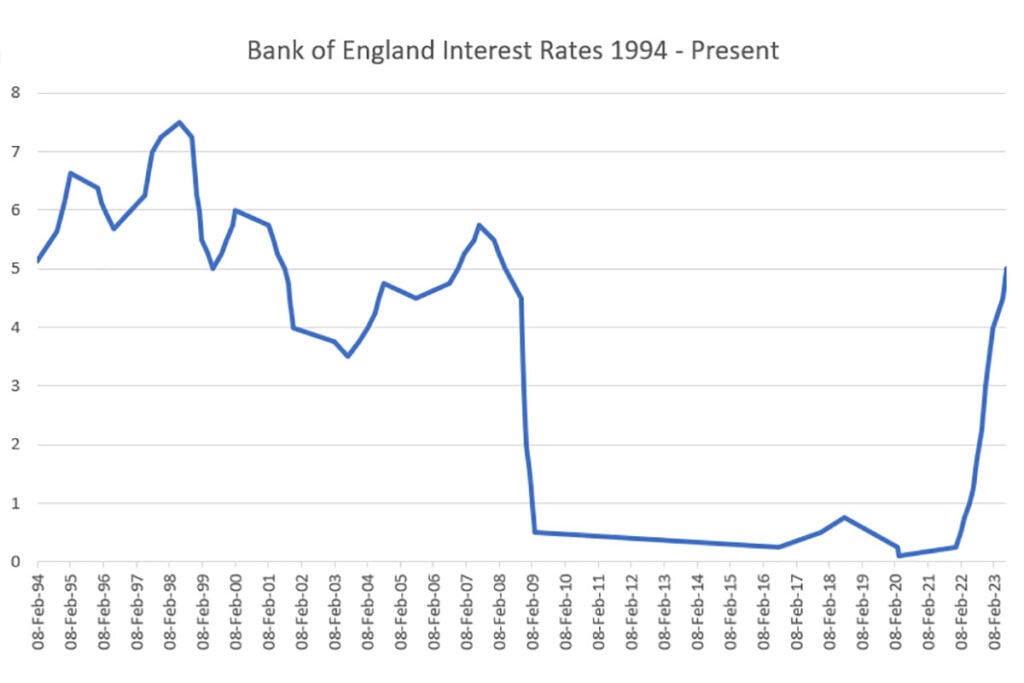

Barclays Raises Rates as Hopes Fade for June Bank Rate Cut

Barclays has become the latest UK bank to raise interest rates on its variable rate mortgages, in a move that reflects the diminishing expectations for an interest rate cut by the Bank of England in June.

Key Findings

* Barclays has increased its standard variable rate (SVR) by 0.15% to 3.89%. * This follows similar rate increases by other major banks, including HSBC and Santander. * The market had anticipated a rate cut in June to stimulate economic growth, but falling inflation and a strengthening labor market have dampened those hopes.

Impact on Mortgages

* The rate increase will add an additional £12.50 per month to the cost of a £150,000 mortgage over 25 years. * It could also impact new mortgage applications, as lenders may now require higher interest rates on new loans.

Reasons for Rate Increase

* The Bank of England has kept its benchmark interest rate unchanged at 0.75% since August 2018. * However, rising inflation and concerns about a potential Brexit-induced economic slowdown have forced banks to re-evaluate their own interest rates. * Barclays cited the “prevailing economic conditions” as the reason for its rate increase.

Market Reaction

* The move by Barclays has sent shockwaves through the financial markets, with investors selling off their shares and the pound weakening. * Analysts believe that other banks are likely to follow suit and raise interest rates on variable rate mortgages.

Conclusion

The rate increase by Barclays is a reminder that the market is no longer expecting an interest rate cut in June. As the Bank of England takes a wait-and-see approach, homeowners and mortgage applicants may face higher borrowing costs in the near future.

Barclays Raises Mortgage Rates as Expectations for June Bank Rate Cut Dwindle

Barclays has announced an increase in its mortgage rates, citing a reduced likelihood of a Bank of England rate cut in June. The move comes as economic data suggests that inflationary pressures remain persistent, making it less likely that the central bank will ease monetary policy in the near term. Previously, markets had anticipated that the Bank of England would cut its benchmark interest rate by 25 basis points to 0.25% at its June policy meeting. However, recent figures showing rising wages and strong consumer spending have tempered these expectations. Barclays’ rate hike reflects this shift in sentiment, with the bank now offering two-year fixed-rate mortgages at 1.39%, up from 1.34% previously. Five-year fixed-rate mortgages have also increased, moving from 1.59% to 1.64%. Experts believe that the probability of a June rate cut has now fallen significantly. “The Bank of England is likely to remain cautious about cutting rates too soon, given the current inflationary environment,” said Myron Jobson, senior personal finance analyst at interactive investor. The increase in mortgage rates by Barclays is likely to have a dampening effect on the housing market, as buyers will face higher monthly payments. However, some analysts believe that the rise in rates is a sign of a stronger economy, and that the housing market will continue to perform well in the long term.