Latest update on the start date of the $300 child tax credit

The Child Tax Credit is a crucial program designed by the U.S. government to help households manage the financial demands of raising children. This initiative aims to alleviate economic pressure on families and ensure they have the resources necessary for the well-being of their children.

The initial payment of child benefit is expected to be paid out in mid-July. While the exact payment date may vary, reliable sources suggest that the payout will be around July 15.

Incentive payment child tax credit monthly amount 2024

From July 15, 2024The monthly Child Tax Credit stimulus payment provides substantial financial support to qualifying families. Here’s what you need to know:

- Families with children younger than six years will receive one Monthly payment of $300which comes down to $3,600 per year.

- Households with children aged six to seventeen gets a Monthly payment of $250total $3,000 per year.

Stay informed and ensure you receive your payments on time by monitoring updates from official channels. This financial boost can make a significant difference in your household budget, allowing you to better care for your children.

The Child Tax Credit (CTC) offers qualifying families the opportunity to significantly reduce their federal income tax liability for each qualifying child under age seventeen.

When will you receive $300 CTC payments?

Starting in 2024, families will benefit from a new structure for monthly CTC payments. Instead of receiving a lump sum as part of a tax refund, families will receive consistent support throughout the year. The CTC payments is paid on the 15th of each month. Mark your calendar for July 15, August 15, September 15, etc. If the 15th falls on a national holiday, the payment will be moved to the next business day.

CTC reduces income tax liability for families

Originally implemented in 1997, Child tax credit has undergone several expansions to better support families. Starting in 2024, the credit amount will increase to $300 per month for children under the age of six at the end of June. This change is intended to provide families with young children with more substantial financial assistance.

Want to check the status of your CTC payments? Read below for a step-by-step guide.

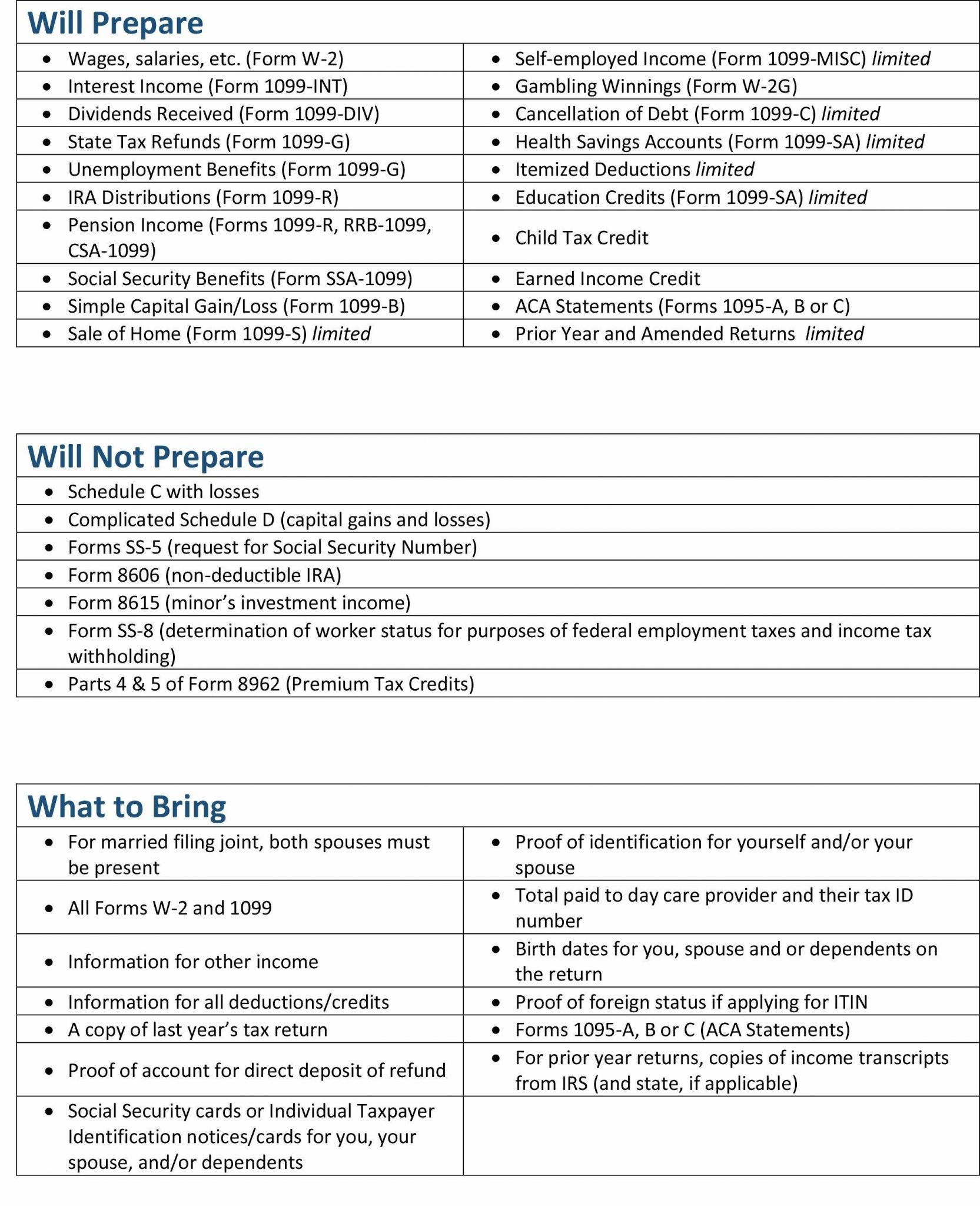

(Figure 1)

Are you wondering who will receive the CTC amount of $300Let’s take a closer look at the criteria and qualifications for this important benefit.

Eligibility for child benefit (CTC)

To qualify for the CTC advantagecertain conditions must be met. These are the main requirements:

- Have a dependent child who meets specific criteria

- The child must be younger than 17 years old at the end of the tax year

- The child must have a qualifying relationship to the applicant, such as a direct descendant, niece, grandchild, stepchild, nephew, foster child, or sibling.

- Meet residency, income and wealth standards

Who are considered dependent children?

Dependent children include a variety of relationships, including:

- Direct descendants such as sons and daughters

- Nieces and nephews

- Grandchildren

- Stepchildren

- foster children

- Brothers or sisters

Automatic payment process

Households that fall into one of the following categories will automatically receive the $300 CTC payments:

- Filed a 2023 federal income tax return

- Enrolled in the 2023 Economic Impact Payment Program

- Used the IRS enrollment tool for non-filers to register for the Advanced Child Tax Credit

The tax authorities will generally use the 2023 tax return to determine the payment amount. However, if the 2023 tax information is not available, the IRS will refer to the 2022 tax information.

Understanding these eligibility criteria and processes will ensure that you are well prepared to receive the CTC benefit if you are eligible. Be sure to keep your tax information up to date to avoid problems with automatic payments.

Are you eagerly awaiting your $300 Child Tax Credit and wondering how to check the status? We’ve got you covered. In this guide, we’ll walk you through the steps to track your payment and what to do if you experience delays.

Keeping track of your child tax credit payment

Recipients can easily track their payment status online using the IRS websiteHowever, if you find it difficult to navigate the website, there is an alternative option: the IRS2Go mobile applicationThis app simplifies the process, allowing you to check your payment status on the go.

What you need to check your status

- Your Citizen service number or IT IN

- Your archiving status

- The exact amount payable

Once you have this information, you can quickly check the status of your payment. Typically, the IRS takes about 21 days to issue payments for tax returns. However, if you filed a paper return, you may experience a delay in receiving your money.

What to do if your status has not been updated

Don’t panic if the portal doesn’t show any results while checking the status. It may take a while for the system to update, especially during peak tax season. Be patient and check for updates after a few days.

By following these steps and understanding the possible delays, you can stay on top of your $300 child tax credit status and know what to expect. Have fun following!

The tax authorities may not have received your tax return yet.

Who is eligible for child benefit?

This credit is fully applicable to:

- Couples earn up to $150,000

- Heads of families earn up to $112,500

- Other taxpayers earn up to $75,000

Who administers the Child Tax Credit program?

The IRS administers the Child Tax Credit program in the United States. Some key points about the Child Discount and its administration:

- The Child Tax Credit is a federal tax credit available to taxpayers with qualifying children under the age of 17. It was created to help offset the costs of raising children.

- Taxpayers claim the credit when they file their annual federal income tax return with the IRS. The credit reduces the amount of taxes owed.

- The IRS processes tax returns claiming the child tax credit. It provides refunds for the credit to eligible taxpayers.

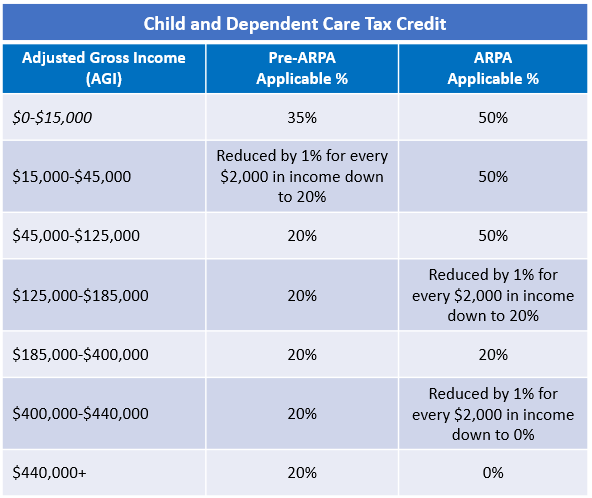

- In 2021, the American Rescue Plan Act expanded the Child Tax Credit. The IRS was required to send monthly payments of the tax credit to most families. Previously, taxpayers had to wait to claim it on their tax returns.

- The U.S. Treasury Department oversees the IRS. The IRS administers the Child Tax Credit program. It does this by processing tax forms and making payments.

In brief, the Internal Revenue Service is the national tax collection agency. It oversees and administers the Child Tax Credit as part of the federal income tax system. The credit is claimed on IRS tax forms, and the IRS processes payments and refunds related to the credit.

:max_bytes(150000):strip_icc()/f2441Pg1-386902f42b8a4e61b03a246af9d9b0e2.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png)