How Miami Residents Can Prepare Their Finances for Hurricane Season

Hurricane season in Miami brings the potential for devastating storms that can leave residents with significant financial losses. To mitigate the impact of a hurricane, it’s crucial to prepare your finances in advance.

Secure Your Insurance Coverage:

*

Homeowners insurance:

Ensure you have adequate coverage for your home, belongings, and any additional structures on your property. *

Flood insurance:

If your home is in a flood-prone area, consider purchasing flood insurance as homeowners insurance typically doesn’t cover flood damage. *

Car insurance:

Make sure your car insurance includes comprehensive coverage, which covers damage caused by storms and falling objects.

Create an Emergency Fund:

* Establish a savings account specifically for hurricane-related expenses, such as evacuation costs, repairs, and replacement items. * Set aside as much money as possible before the season begins.

Review Your Assets and Liabilities:

* Take inventory of your valuable possessions and document their value. This will help you determine the extent of your potential losses. * List your outstanding debts, such as mortgages, credit cards, and student loans. If possible, consider consolidating debt or increasing your payments to reduce your financial burden after a hurricane.

Protect Your Financial Documents:

* Scan and store important financial documents, such as insurance policies, loan agreements, and investment statements, in a secure online location or a watertight container. * Keep a physical backup of essential documents in a waterproof bag at your evacuation destination.

Plan for Evacuation Costs:

* Estimate the expenses associated with evacuation, including transportation, lodging, food, and other necessities. * Set aside funds for these expenses and consider having a credit card available for emergency use.

Monitor Disaster Relief Programs:

* Familiarize yourself with government and non-profit organizations that provide financial assistance to hurricane victims. * Keep track of eligibility requirements and application deadlines for these programs.

Additional Tips:

*

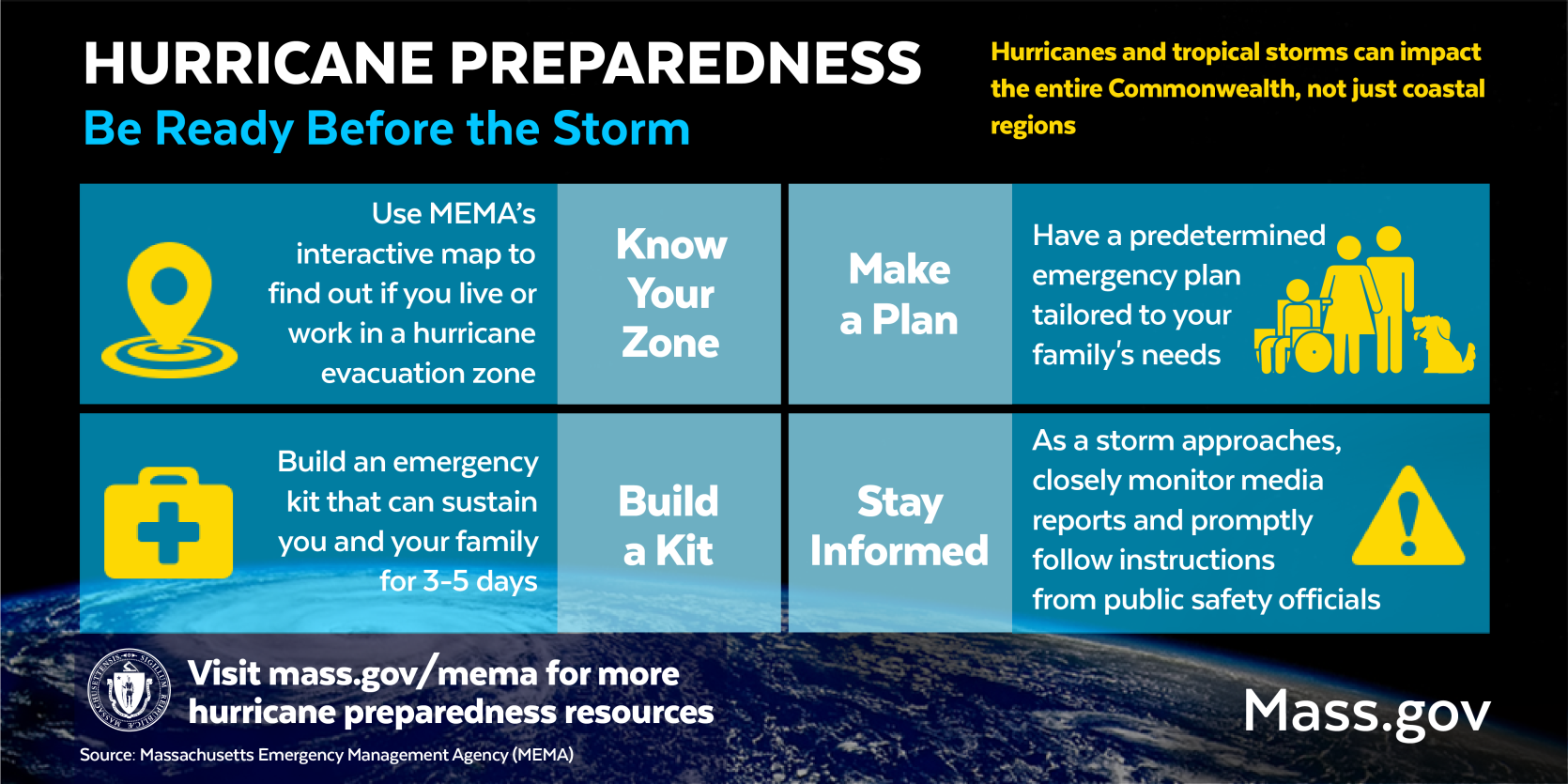

Stay informed:

Monitor weather updates and heed evacuation orders. *

Evacuate early:

Don’t wait until it’s too late. Leave early to avoid traffic congestion and potential hazards. *

Keep receipts:

Save all receipts for hurricane-related expenses. These will be necessary for insurance claims and potential disaster relief assistance. *

Communicate with creditors:

If you are unable to make payments due to a hurricane, contact your creditors immediately. They may be able to offer assistance or defer payments. By following these steps, Miami residents can prepare their finances for hurricane season and mitigate the financial consequences of these powerful storms. Remember, it’s better to be over-prepared than underprepared.This is an HTML article about preparing for hurricane season. This is an HTML article about preparing for hurricane season. The first paragraph tells the reader that many Miami residents have a contingency plan in place but that it’s also important to make sure you’re financially ready. The next five paragraphs are titled tips and provide the reader with the following advice: 1. Create a financial first aid kit. 2. Protect and store important documents. 3. Evaluate your insurance. 4. Have a source of cash. 5. Share information with family members. The article concludes by telling the reader to follow these tips to ensure that you are better prepared financially for the next hurricane. There is also a call to action at the end of the article encouraging the reader to read more about hurricane season.

Prepare Your Finances for Hurricane Season in Miami

As hurricane season approaches, Miami residents should take steps to protect their finances from potential storms. Here are some key actions to consider: *

Review Insurance Policies:

Ensure that your homeowners or renters insurance policies are up-to-date and provide adequate coverage for hurricane damage. Consider purchasing flood insurance if your property is located in a flood zone. *

Create an Emergency Fund:

Establish a dedicated savings account to cover unexpected expenses related to hurricanes, such as repairs, evacuations, and lost income. Aim to build an emergency fund of at least three to six months’ worth of living expenses. *

Secure Important Documents:

Protect important financial documents, such as insurance policies, banking records, and identification cards, by storing them in a waterproof and fireproof safe. Consider creating digital copies and storing them online or with a trusted friend or family member outside the hurricane-prone area. *

Monitor Your Credit Report:

Stay vigilant about monitoring your credit report for any suspicious activity. Fraudulent transactions can occur during or after hurricanes, so it’s crucial to report any irregularities promptly. *

Consider Emergency Assistance Programs:

Familiarize yourself with Federal Emergency Management Agency (FEMA) assistance programs, such as the Individual and Household Program, which provides grants to eligible individuals and families for disaster-related expenses. *

Prepare a Financial Plan:

Develop a financial plan that outlines potential hurricane-related expenses and how you will cover them. This includes estimating the cost of repairs, evacuations, and other emergencies. *

Consider Income Protection:

Explore income protection options, such as disability insurance or lost wages benefits, to safeguard your income in the event of a hurricane-related job loss or injury. *

Communicate with Creditors:

Inform your creditors about your situation if you anticipate difficulty making payments due to hurricane damage or displacement. Many lenders offer payment deferrals or other assistance programs during emergencies. By taking these proactive measures, Miami residents can help ensure their financial stability during hurricane season and minimize the impact of potential storms on their wallets.