Weekly Crude Oil Production Rises to Offset Gasoline Consumption

According to Investing.com, the latest data shows that weekly crude oil production has increased to offset rising gasoline consumption.

Key Findings:

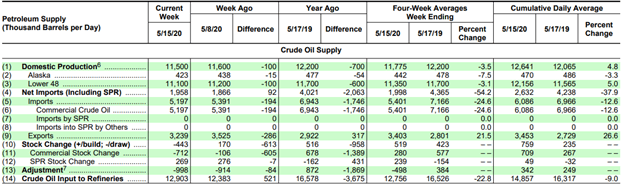

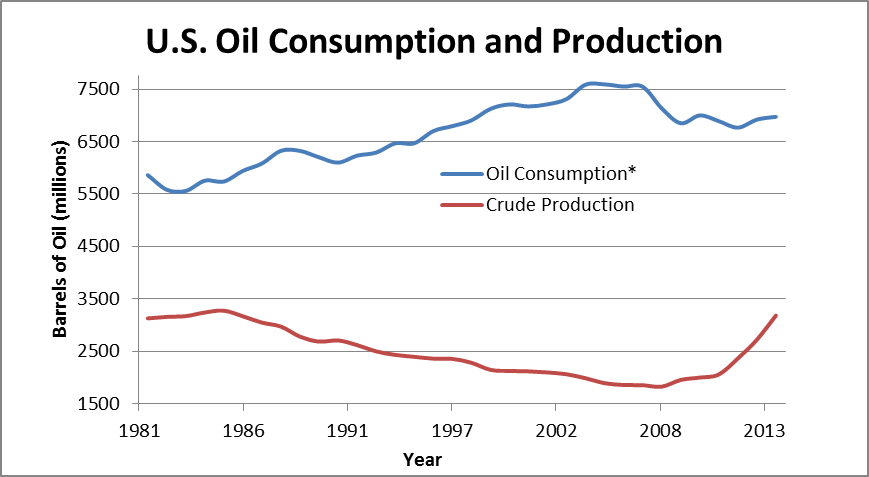

* Crude oil production in the United States increased by 100,000 barrels per day (bpd) to 12.1 million bpd, the highest level since April 2020. * This increase in production comes as gasoline consumption has surged due to increased travel and economic activity. * Gasoline demand has reached 9.3 million bpd, the highest level since August 2019, prior to the pandemic. * The rise in crude oil production is primarily driven by increased output from shale oil producers in the Permian Basin of Texas and New Mexico. * Despite the increase in production, gasoline prices remain elevated due to the ongoing war in Ukraine and global supply chain disruptions.

Implications:

* The increase in crude oil production provides some relief to gasoline consumers, as it helps to stabilize prices. * However, the high level of gasoline consumption suggests that further increases in production may be necessary to prevent a supply shortage. * The surge in gasoline demand reflects the rebound in economic activity post-pandemic but also poses challenges for refiners, who are facing increased pressure to produce more fuel. * The ongoing geopolitical tensions and supply chain disruptions continue to influence global oil markets and are likely to impact crude oil production and gasoline prices in the coming months.

Conclusion:

The increase in weekly crude oil production is a positive step towards addressing rising gasoline consumption. However, ongoing supply chain disruptions and geopolitical uncertainty remain factors that may affect oil markets and gasoline prices in the long term.US Crude Inventories Expected to Rise Modestly

US Crude Inventories Expected to Rise Modestly

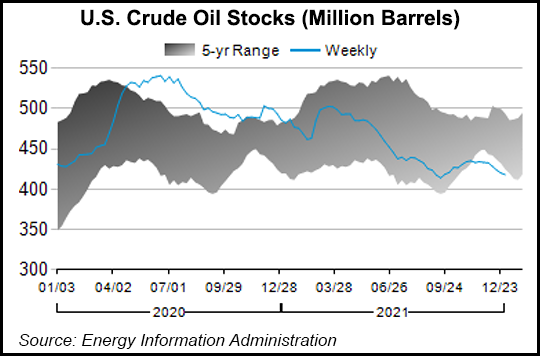

Commodity strategists at Macquarie Bank anticipate a slight increase in U.S. crude inventories for the week ending June 7, with a projected rise of 2.2 million barrels (MM BBL). This forecast contrasts with the 1.2 MM BBL increase reported for the week ending May 31, indicating a potential loosening in the overall U.S. crude balance. The analysts predict a marginally lower rate of crude oil refining for the current week, with a decline of 0.2 million barrels per day (MBD) to approximately 17.0 MBD. Regarding net imports, they anticipate a substantial nominal rise, with a decrease in exports (-1.2 MBD) and imports (-0.3 MBD) on a nominal basis. Implied domestic supply, which incorporates production, adjustments, and transfers, is expected to witness a significant decrease (-1.0 MBD) this week, following a strong performance the previous week. Additionally, the strategists project a smaller increase in Strategic Petroleum Reserve (SPR) stock (+0.7 MM BBL) for the week under consideration.

Crude Oil Production to Offset Gasoline Consumption

Global crude oil production is expected to increase significantly in the coming years, outpacing gasoline consumption growth, according to Investing.com. This increase in production is driven by a combination of factors, including: * Rising demand from emerging economies, particularly in Asia * Technological advancements in extraction techniques * Government incentives for oil exploration and development The growth in crude oil production will help to offset the increasing demand for gasoline, which is expected to slow in the coming years due to: * Increased fuel efficiency in vehicles * Adoption of electric and hybrid vehicles * Shift towards renewable energy sources As a result of these contrasting trends, the global crude oil market is expected to become more balanced in the future. This could lead to lower oil prices, which would benefit consumers and businesses. However, the geopolitical landscape and global economic conditions can impact oil prices in unpredictable ways. It is important to monitor these factors closely to assess their potential impact on the market.