Tesla’s Comeback: Buoyed by Expectations of Recurring GrowthTesla’s Comeback: Buoyed by Expectations of Recurring Growth Tesla (TSLA) has experienced a remarkable recovery, erasing 40% of its decline since April 2024. This surge is attributed to several factors, primarily investors’ heightened optimism for recurring growth. Delivery Numbers and AI Expectations Tesla’s better-than-expected delivery numbers have fueled the recent rebound. Despite a 4.8% year-over-year decline, investors were buoyed by the fact that this exceeded consensus estimates. Optimism about artificial intelligence (AI) is also driving sentiment, with Tesla’s advancements in humanoid robots and AI-powered assistants capturing attention. Musk’s Influence and Ambitious Promises Elon Musk’s public statements and bold promises have bolstered confidence in Tesla’s prospects. He has targeted short sellers and expressed confidence in the company’s ability to solve autonomy and mass-produce Optimus, its humanoid robot. Cautionary Tales However, some analysts raise concerns about Tesla’s aging fleet and lack of innovation in its best-selling models. Competition from Chinese electric carmakers, such as BYD, is also intensifying, posing a threat to Tesla’s market share. Investors’ Confidence Despite these concerns, investors remain bullish on Tesla’s stock price. They anticipate that the company’s recurring growth potential and ongoing investments in AI will continue to drive profitability.

EV King has been rallied for the past few months, hoping for recurring growth, while recurring growth is nowhere to be seen. But does it matter? Let’s find out.

Tesla erases 40% drop in thrilling rally

Tesla (ticker: TSLA) shares are on a roll. A powerful comeback has silenced the haters as the electric carmaker has surged about 80% from its 2024 lows in April. In other words, more than $350 billion has been added to Tesla’s market cap in the space of a few months.

What’s driving the electrifying charge at the hottest automaker, perhaps the hottest? It’s a number of factors. But more than anything, it’s investors’ high expectations for recurring growth after the automaker’s stock begged to be snapped up by bargain hunters.

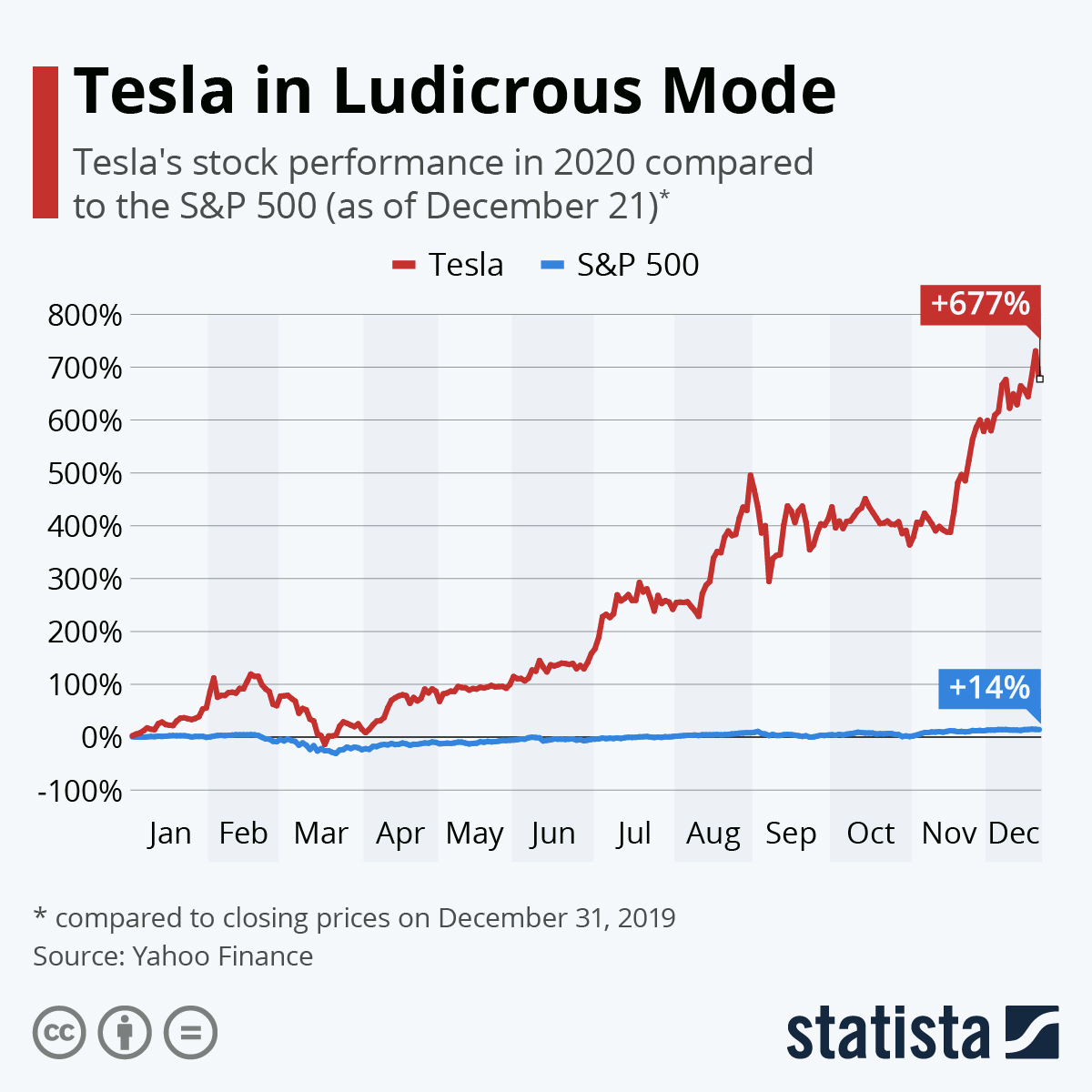

Tesla shares were down about 40% through late April, while other big tech giants were busy setting records and getting AI-drunk. Take Microsoft (ticker: MSFT) or Nvidia (ticker: NVDA). Or any of the Magnificent Seven. All have been feted for the prospects of AI-driven profits.

The apparent gulf between Tesla and the rest of the Mag 7 crew is gone. After an eight-day winning streak through Friday, Tesla shares managed to claw back from their deep 2024 losses and move about 1% in the green.

Deliveries fuel investors’ long-term bets

Better-than-expected delivery numbers helped fuel the recent rebound. The Elon Musk-led company delivered 443,956 vehicles globally in the three months through June, down 4.8% from the same quarter last year. And while the second straight decline suggested that delivery activity wasn’t growing, investors were excited by the numbers, which beat consensus. Analysts had expected 439,302 units delivered. It also beat the first-quarter delivery figure of 386,810.

Optimism about artificial intelligence is also a major factor driving the stock price higher. It is worth noting that Tesla, which recently started turning a profit, has been reducing its production rate, producing about 411,000 vehicles in the last quarter. Lower production means lower inventory, lower costs and less pressure to cut prices to get rid of cars collecting dust in factories.

That means the company can spend money on other projects in the pipeline and on refreshing existing projects.

Elon Musk + AI + Promises = Profit???

The advancement of robots and AI-powered assistants is one of Elon Musk’s top priorities. Tesla’s second-generation humanoid robot Optimus made its debut last week at the 2024 World AI Conference in Shanghai. First released in 2021, Optimus was designed as an everyday AI assistant to help with tasks like carrying, cleaning up and cooking. Before it goes to market, Tesla plans to test it in its factories starting in early 2025.

Elon Musk had only one thing to do: tackle the short sellers and send them to “destruction.”

“Once Tesla fully solves autonomy and gets Optimus into mass production,” Musk wrote on X, “anyone still holding a short position will be wiped out.” He went even further to take aim at one specific Tesla permabear: Bill Gates.

Buyer beware!

Now for some troubling reality checks that will make you think twice before sinking your hard-earned cash into the EV maker. Tesla’s fleet is getting old fast. The Model Y is about to set off the confetti for its fifth birthday. A lack of innovation in Tesla’s best-selling models could erode some of the company’s brand recognition for sleek, cutting-edge EVs.

Tesla is also facing stiff competition from the East. China’s largest electric carmaker, BYD (ticker: 1211), sold a record number of electric and hybrid cars in the latest quarter. And it’s threatening to overtake Tesla as the world’s top EV maker.

In June, Tesla’s market share in China fell by a worrying 24% from a year ago, even as broader sales rose thanks to the rollout of cheaper EV alternatives. BYD sales rose 24% in the second quarter to 426,039 EVs.

We want to hear from you

Can Tesla continue its run and keep profits flowing to fund its risky bets on AI? Judging by the rise in its stock price, investors seem to think so. What do you think?

Let us know in the comments below.