European Stocks Start Day with Calmer Mood

European stock markets opened with a sense of calm on Tuesday, as investors digested recent economic data and awaited key events later in the week. After a volatile start to the month, European indices have been trading sideways in recent sessions. Today’s opening was no different, with the STOXX 600 index inching up 0.1% in morning trading. Sentiment was boosted by positive economic news from the region. Germany’s ZEW economic sentiment index rose for the second consecutive month in August, indicating improving business expectations. In France, consumer confidence improved slightly in July, offering hope for a rebound in spending. However, investors remain cautious ahead of Thursday’s European Central Bank (ECB) meeting. The ECB is expected to raise interest rates for the second time this year, amid concerns over rising inflation. Investors will be monitoring the bank’s forward guidance and any signals about the pace of future rate hikes. Other key events on the horizon include the release of U.S. inflation data on Friday. A hot inflation reading could reignite concerns over aggressive monetary tightening by the Federal Reserve, adding pressure to European markets. Sector-wise, technology stocks were among the top performers in early trading, led by gains in semiconductor and software companies. Energy stocks also rose, tracking higher oil prices. However, healthcare and real estate stocks were under pressure. Overall, European stocks are starting the day with a calmer mood. However, investors remain cautious ahead of key events later in the week that could shape the market outlook for the coming days.European Market Update

European Market Update

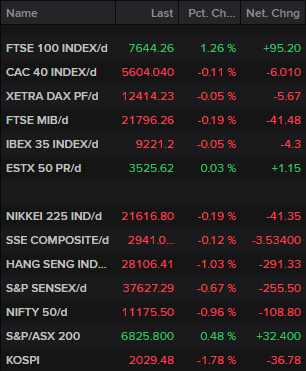

European markets opened slightly higher on Monday, with most major indices posting modest gains. * Eurostoxx: +0.3% * Germany (DAX): +0.2% * France (CAC 40): +0.3% * UK (FTSE): +0.3% * Spain (IBEX): -0.1% * Italy (FTSE MIB): +0.2%

Market Sentiment

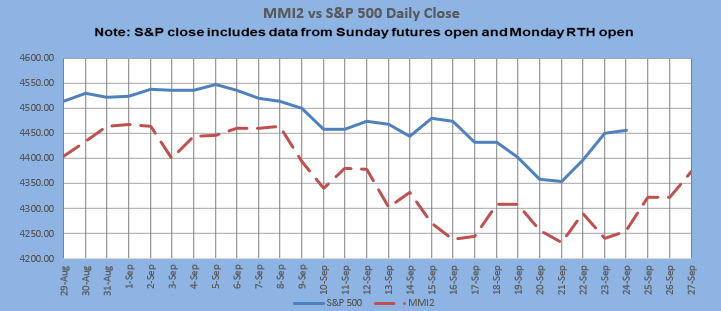

Market sentiment remains subdued as investors await key risk events scheduled for Tuesday. While the CAC 40 has recovered from yesterday’s low, it opened closer to 7,800 points and is still up only 1.4%. S&P 500 futures are currently flat.

Key Events

*

Tuesday:

Key risk events include the release of U.S. inflation data, Federal Reserve meeting minutes, and the European Central Bank’s policy meeting.

Video

The provided code appears to be for embedding a video using an AMP video iframe. However, the specific video content is not available in the provided code.European stocks opened higher on Monday, as investors took a more cautious approach after last week’s sell-off, with a focus on earnings and economic data. The pan-European STOXX 600 index was up 0.2%, with most sectors trading in positive territory. Miners and utilities were among the top performers, while technology and retail stocks lagged. French carmaker Renault jumped 4.1% after it confirmed it was in talks with Chinese automaker Geely for a partnership on electric vehicles. Danish pharmaceutical company Novo Nordisk gained 2.3% after raising its full-year sales forecast. On the downside, British online retailer ASOS fell 5.5% after warning that it expects sales to decline in the fourth quarter. German sportswear company Puma dropped 2.6% after reporting a decline in quarterly sales. Investors are also keeping an eye on earnings and economic data this week. German inflation data is due on Wednesday, while the European Central Bank is set to announce its latest policy decision on Thursday. Overall, the mood in European markets is calmer at the start of the day, with investors taking a more cautious approach after last week’s volatility.