Direct Store Delivery (DSD) Service Software Industry Value Chain Analysis

OVERVIEW

Direct Store Delivery (DSD) service software is a critical component of the DSD industry, enabling distributors to optimize their operations, reduce costs, and enhance customer service. The industry’s value chain involves various stakeholders that contribute to software development, implementation, and deployment.

KEY INDUSTRY STAKEHOLDERS

1. Software Providers:

* AFS Technologies, Deacom, StayinFront * Responsible for designing, developing, and maintaining software solutions.

2. Distributors:

* Utilize DSD software to manage orders, deliveries, and inventory. * Integrate software with their ERP systems.

3. Retailers/Customers:

* Receive deliveries of goods from distributors and use software to track and manage inventory. * Interact with distributors through software for order placement and tracking.

4. Third-Party Service Providers:

* Offer complementary services such as barcode scanning, route optimization, and mobile workforce management. * Integrate their services with DSD software.

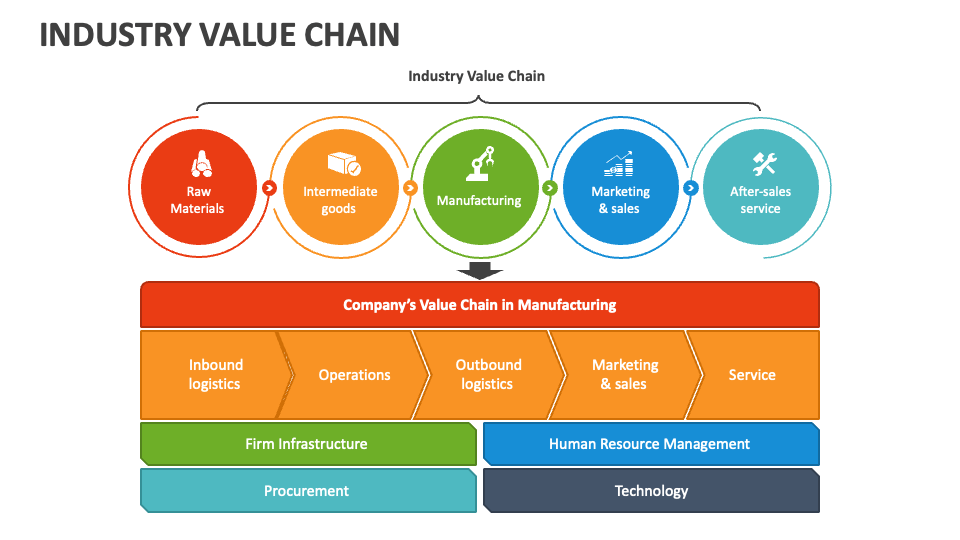

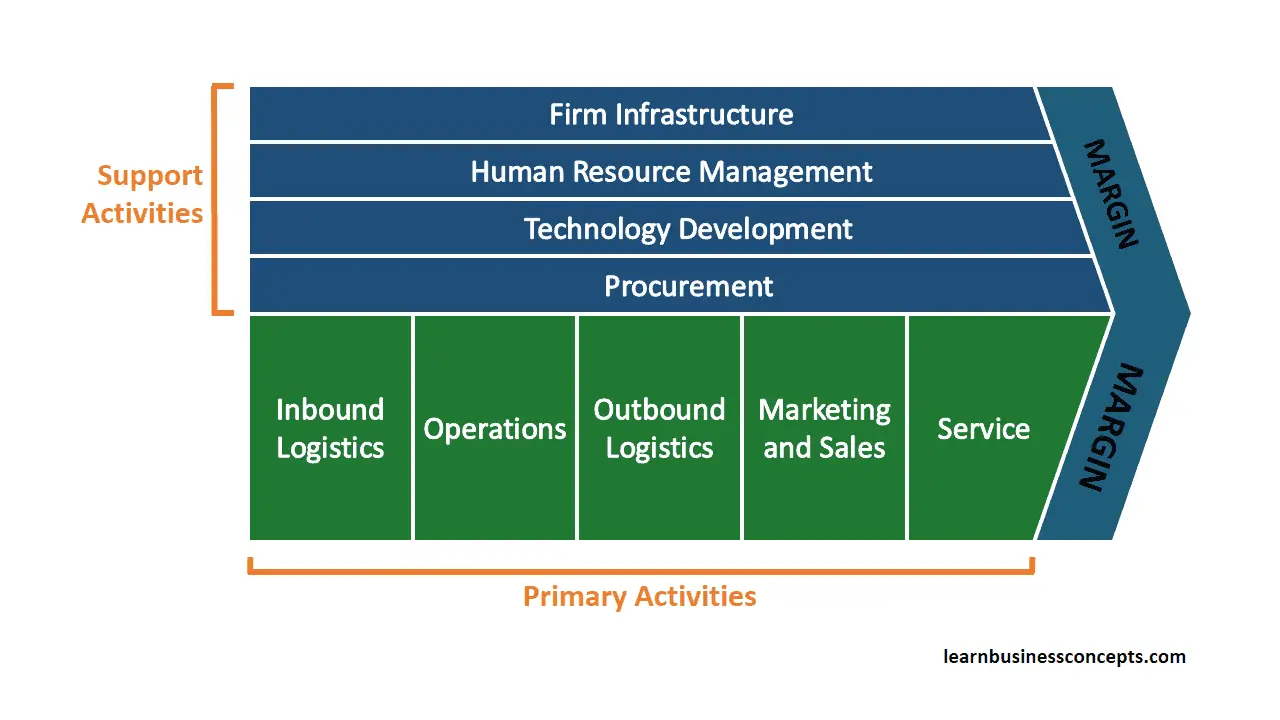

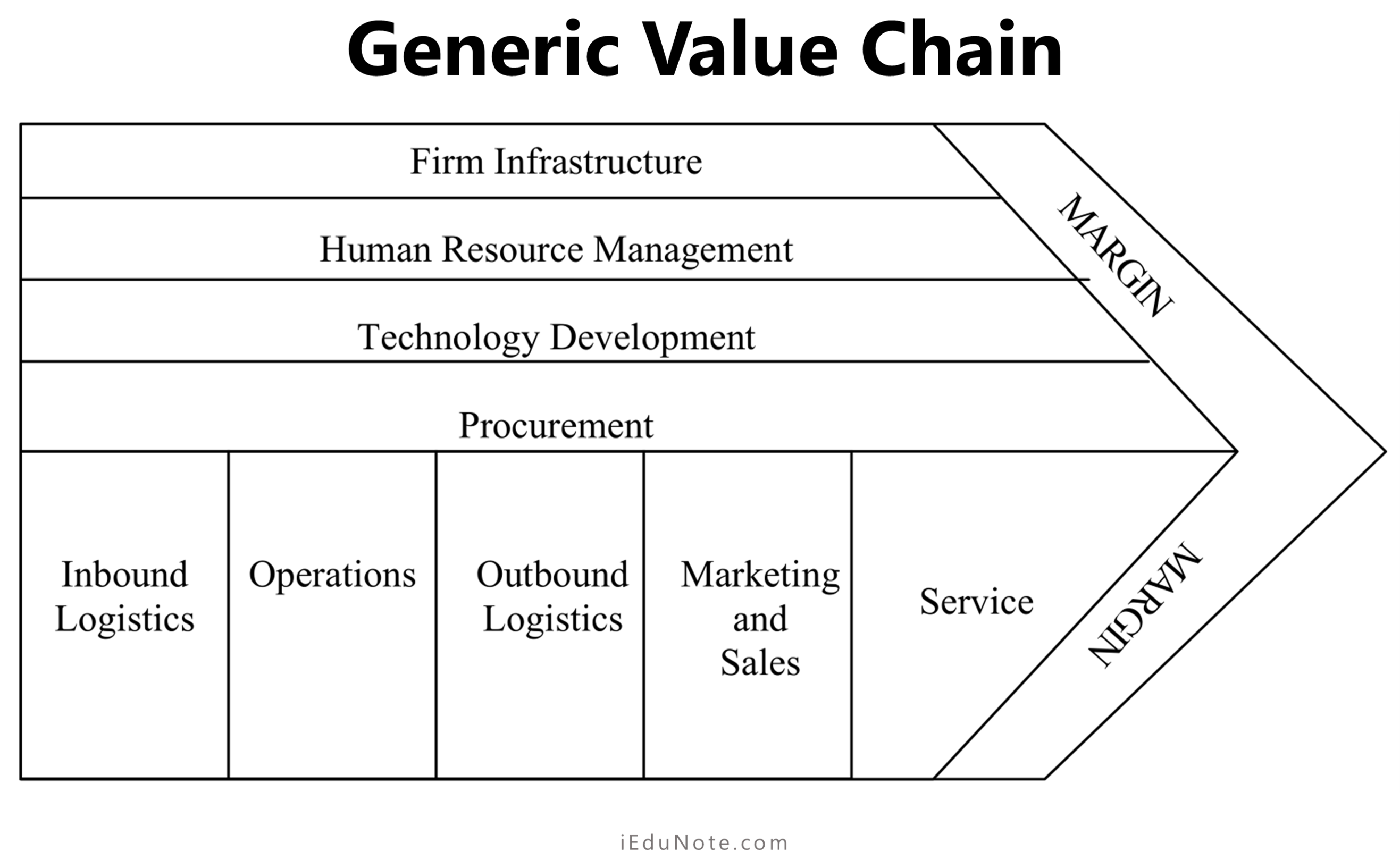

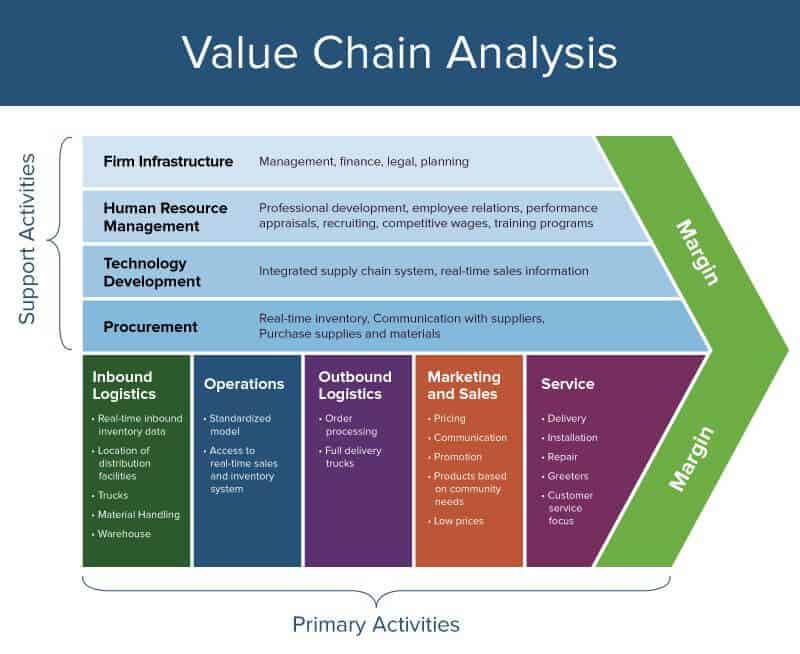

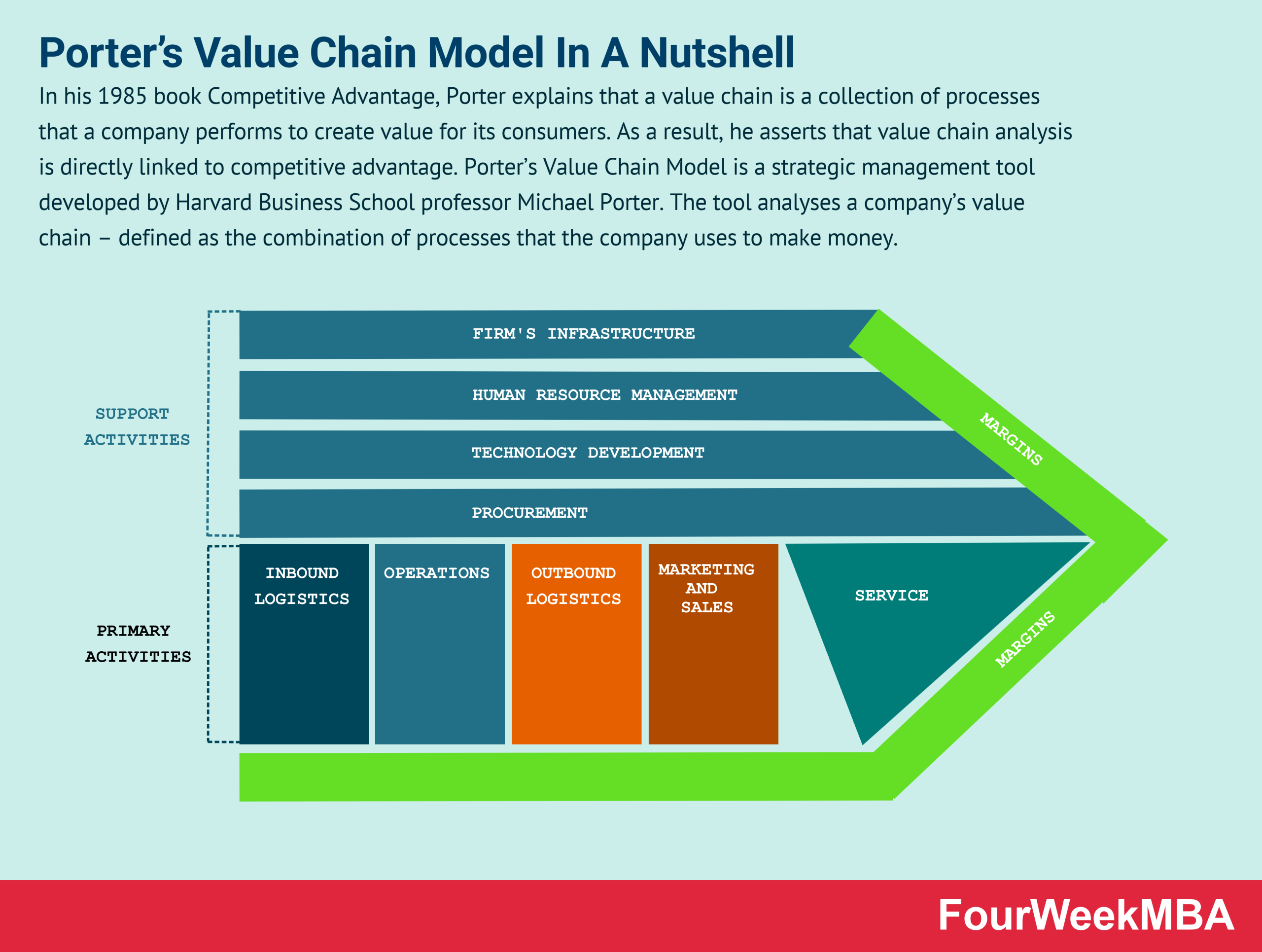

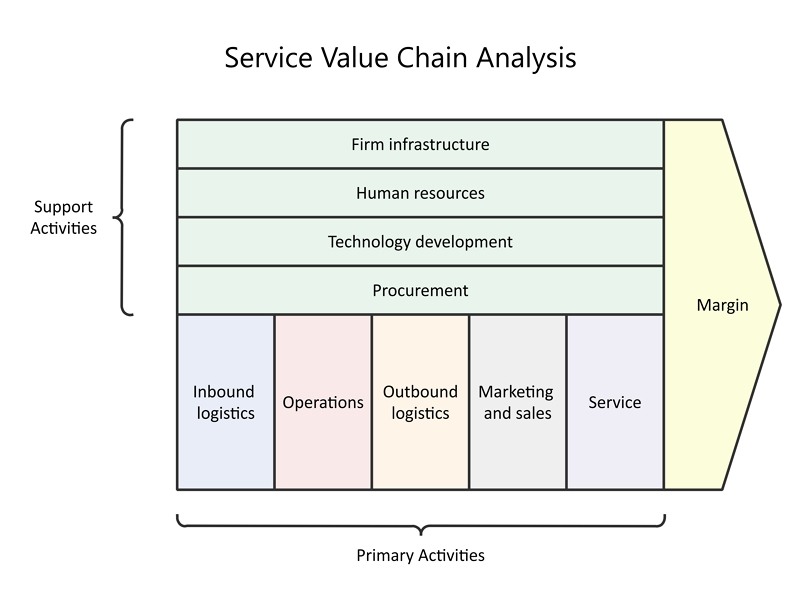

INDUSTRY VALUE CHAIN

1. Software Development:

* Software providers engage in research and development to create innovative solutions that meet industry needs.

2. Implementation:

* Distributors partner with software providers to implement and customize software according to their specific requirements.

3. Deployment:

* Software is deployed on mobile devices and desktop computers used by field sales representatives, delivery drivers, and warehouse personnel.

4. Order Processing:

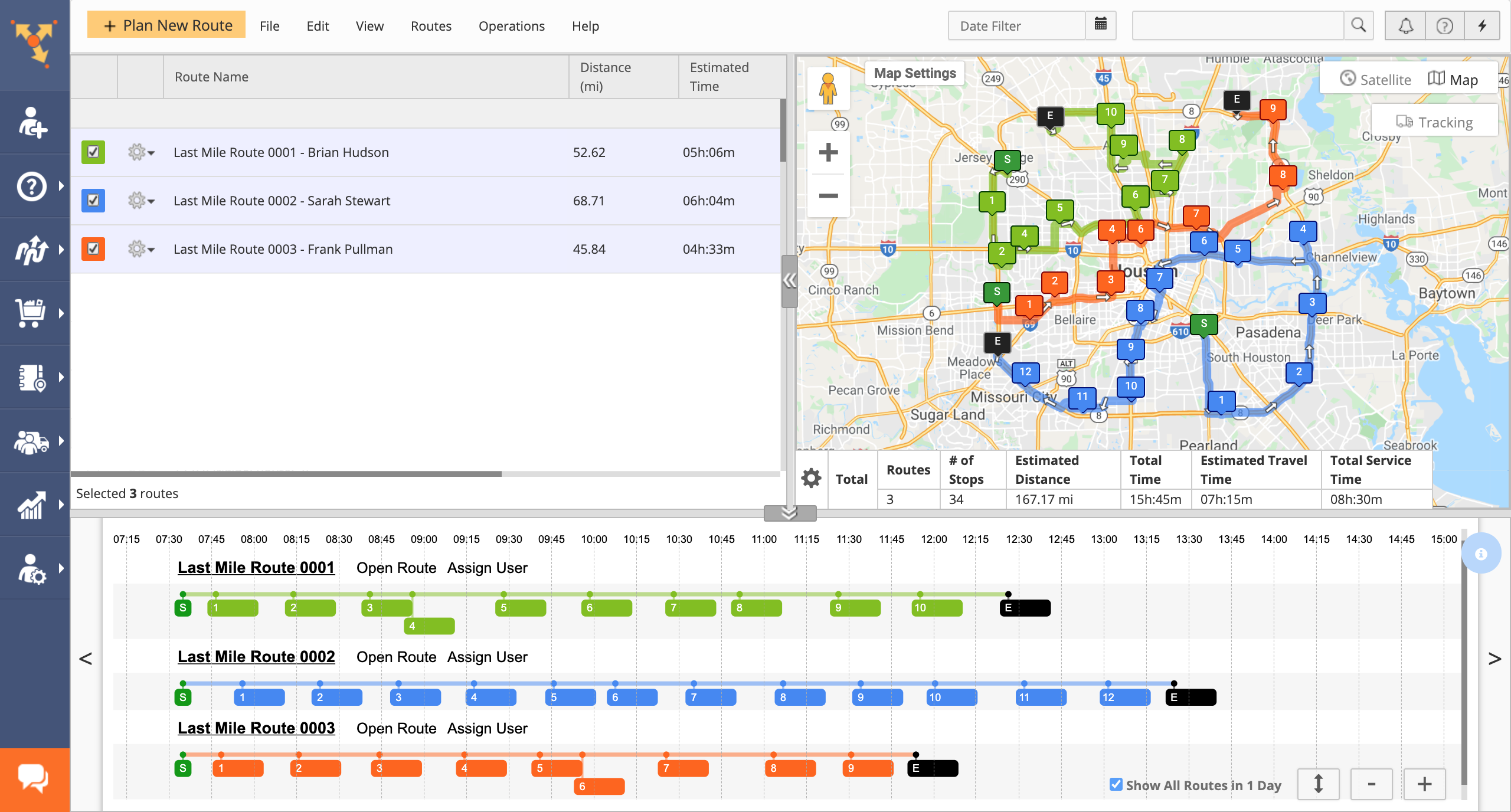

* Software facilitates order placement, routing, and scheduling. * Distributors use software to generate invoices and manage collections.

5. Delivery Management:

* Software provides real-time tracking of deliveries, optimizes routes, and monitors driver performance.

6. Inventory Control:

* Distributors use software to manage inventory levels in warehouses and retail stores. * Software tracks deliveries, adjustments, and stock replenishment.

7. Customer Relationship Management (CRM):

* Software helps distributors build and maintain relationships with retailers and customers. * It provides tools for communication, order management, and complaint tracking.

8. Analytics and Reporting:

* Software generates reports and analytics that provide insights into sales performance, delivery efficiency, and inventory levels.

9. Support and Maintenance:

* Software providers offer ongoing support and maintenance services to ensure software functionality and address any issues.

INDUSTRY TRENDS AND OPPORTUNITIES

*

Cloud-Based Deployment:

Cloud-based software solutions offer flexibility, scalability, and reduced infrastructure costs. *

Mobile Optimization:

Increasingly, software is optimized for mobile devices to empower field representatives and delivery drivers. *

Artificial Intelligence (AI):

AI is used to improve inventory forecasting, route optimization, and customer service responsiveness. *

Integration with RFID Technology:

Software can be integrated with RFID devices to enhance inventory tracking and product traceability. *

Focus on Customer Experience:

Software solutions prioritize improving customer satisfaction through ease of use and real-time visibility.

CONCLUSION

The DSD service software industry value chain is a complex ecosystem that involves a range of stakeholders and processes. Software providers, distributors, retailers, and third-party service providers collaborate to deliver efficient and effective DSD solutions. By understanding the industry’s value chain, businesses can identify opportunities for optimization, innovation, and enhanced customer service.Direct Store Delivery Service Software Market Report

Direct Store Delivery Service Software Market Report

Industry Overview

The Direct Store Delivery (DSD) Service Software Market report provides an in-depth analysis of the market, including market size, key drivers, challenges, and opportunities. The report also segments the market by type, application, and region to provide a comprehensive overview of the market landscape.

Key Findings

* The global DSD service software market is expected to grow at a CAGR of 8.5% during the forecast period (2023-2027). * The cloud-based segment is expected to dominate the market throughout the forecast period. * The large enterprises segment is expected to hold a larger market share over the forecast period. * North America is expected to remain the largest market for DSD service software during the forecast period.

Key Market Drivers

* The rising demand for efficient and cost-effective delivery solutions * The increasing adoption of cloud-based software * The growth of the retail and e-commerce sectors

Competitive Landscape

The key players in the DSD service software market include: * AFS Technologies * Diacom * Stay at the Front * FwdMbl Solutions * Harvest Food Solutions * HighJump * GizMobile Northwest * LaceUp Solutions * Invasystems * Extensive Data * Pepperi * Westrom Software * Technologies Include * Spring Global * Vinkel * Xguy * Zetes

About Orbis Research

Orbis Research is a leading provider of market research reports and consulting services. We have a database of over 100,000 reports from leading publishers and authors around the world. Our team of experts can help you find the perfect report for your needs.

Contact Us

For more information, please contact: Hector Costello Senior Manager – Customer Engagement Orbis Research 4144N Central Highway, Suite 600, Dallas, Texas – 75204, USA

Direct-to-Store Delivery Service Software Industry Value Chain Analysis

Overview

The direct-to-store (DTS) delivery service software market has experienced significant growth in recent years due to the increasing demand for efficient and accurate delivery operations. This software streamlines the process of managing delivery schedules, routes, and drivers, providing businesses with greater visibility and control over their logistics.

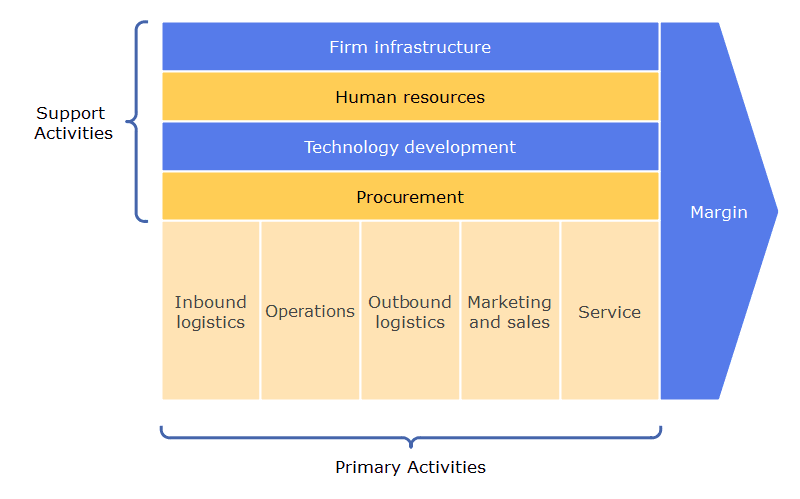

Value Chain

The DTS delivery service software industry value chain comprises several key players, including: *

Software Vendors:

Companies that develop and sell DTS delivery service software solutions. *

System Integrators:

Providers that implement and configure software solutions for businesses. *

Consultants:

Companies that offer advisory and consulting services to assist businesses in optimizing their DTS operations. *

Training Providers:

Organizations that provide training materials and courses on DTS software usage. *

Customers:

Businesses that purchase and use DTS delivery service software to manage their logistics operations.

Key Industry Participants

Leading software vendors in the DTS delivery service industry include: * AFS Technologies * Deacom * StayinFront

Market Trends

*

Increased Adoption of Cloud-Based Solutions:

Businesses are increasingly adopting cloud-based DTS delivery service software due to its scalability, flexibility, and cost-effectiveness. *

Growing Demand for Real-Time Visibility:

Businesses are seeking software solutions that provide real-time visibility into delivery operations, enabling them to respond quickly to changes and improve decision-making. *

Integration with ERP Systems:

DTS delivery service software is being integrated with enterprise resource planning (ERP) systems to streamline data sharing and improve operational efficiency.

Challenges

*

Data Security Concerns:

Cloud-based DTS delivery service software can raise concerns about data security, which businesses must address by implementing robust security measures. *

Complex Implementation:

Implementing DTS delivery service software can be complex and time-consuming, requiring careful planning and coordination. *

Integration Costs:

Integrating DTS delivery service software with other systems, such as ERP, can incur additional costs and require technical expertise.

Conclusion

The DTS delivery service software industry is poised for continued growth as businesses seek to improve their logistics operations. Software vendors, system integrators, and other value chain players are providing innovative solutions and services to meet the evolving needs of businesses. By leveraging DTS delivery service software, businesses can streamline their operations, reduce costs, and improve customer satisfaction.

.png)