Missed the Nvidia Surge? Consider These AI Stocks Instead

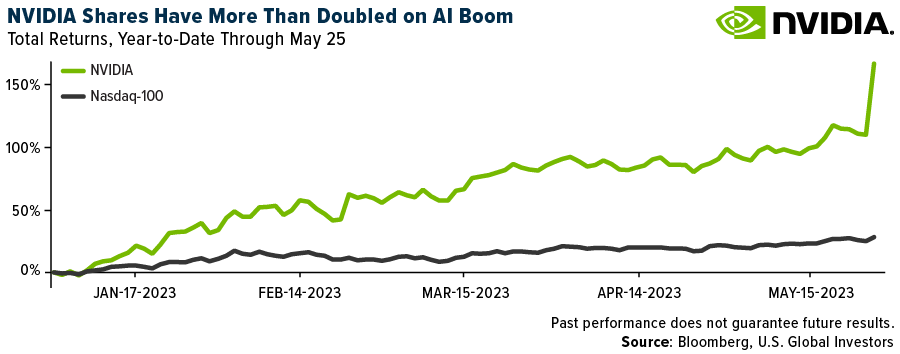

While Nvidia (NVDA) has surged in recent years, gaining over 1,000%, there are still opportunities in the rapidly growing artificial intelligence (AI) space. Here are two stocks worth considering:

1. Microsoft (MSFT)

*

AI Strength:

Microsoft has a deep portfolio of AI technologies, including Azure AI, Cortana, and GitHub Copilot. *

Market Share:

Microsoft is one of the largest cloud computing companies worldwide, providing an extensive platform for AI development and deployment. *

Growth Potential:

The company’s cloud business continues to grow rapidly, driving demand for its AI services. Additionally, its investments in AI-powered healthcare, gaming, and edge computing hold great promise.

2. C3.ai (AI)

*

Focused AI Suite:

C3.ai provides a comprehensive suite of AI applications tailored specifically to industry verticals such as healthcare, energy, and manufacturing. *

Expertise:

The company has a team of leading AI experts who have worked on cutting-edge projects for Fortune 500 companies. *

Partnerships:

C3.ai has strong partnerships with major technology providers like Microsoft and Google, extending its reach and credibility.

Advantages over Nvidia:

*

Diversification:

Both Microsoft and C3.ai offer more diversification than Nvidia, which is primarily a hardware company. *

Growth Opportunity:

Microsoft’s vast ecosystem and C3.ai’s industry-specific focus provide significant growth potential. *

Value:

Compared to Nvidia’s premium valuation, these stocks offer better value for investors seeking AI exposure.

Recommendation:

If you missed out on the Nvidia rally but are still interested in investing in AI, Microsoft and C3.ai are compelling stocks to consider. Their strong AI foundations, growth prospects, and value propositions make them worthy additions to any diversified portfolio.Missed Nvidia Shares? 2 Remarkable Artificial Intelligence Stocks to Buy Instead

Missed Nvidia Shares? 2 Remarkable Artificial Intelligence Stocks to Buy Instead

Parkev Tatevosian, CFA

, a Motley Fool contributor, highlights two artificial intelligence stocks that investors can consider if they find Nvidia (NASDAQ: NVDA) too expensive at current valuations.

1. C3.ai (AI)

*

Market Cap:

$5.2 billion *

Business:

Enterprise AI software and services C3.ai provides AI-powered software and services to businesses in various industries, including energy, manufacturing, and healthcare. The company’s platform enables customers to develop and deploy AI applications without the need for extensive technical expertise.

2. BigBear.ai (BBAI)

*

Market Cap:

$2.2 billion *

Business:

AI-powered cybersecurity and national security solutions BigBear.ai focuses on developing AI-driven solutions for cybersecurity and national security applications. The company’s technology is used by government agencies and commercial organizations to detect and mitigate threats, analyze data, and enhance decision-making.

Why Buy These Stocks Instead of Nvidia?

Tatevosian believes that C3.ai and BigBear.ai are more attractive investments than Nvidia for the following reasons: *

Valuation:

Both companies trade at significantly lower valuations than Nvidia, making them more affordable for investors with limited capital. *

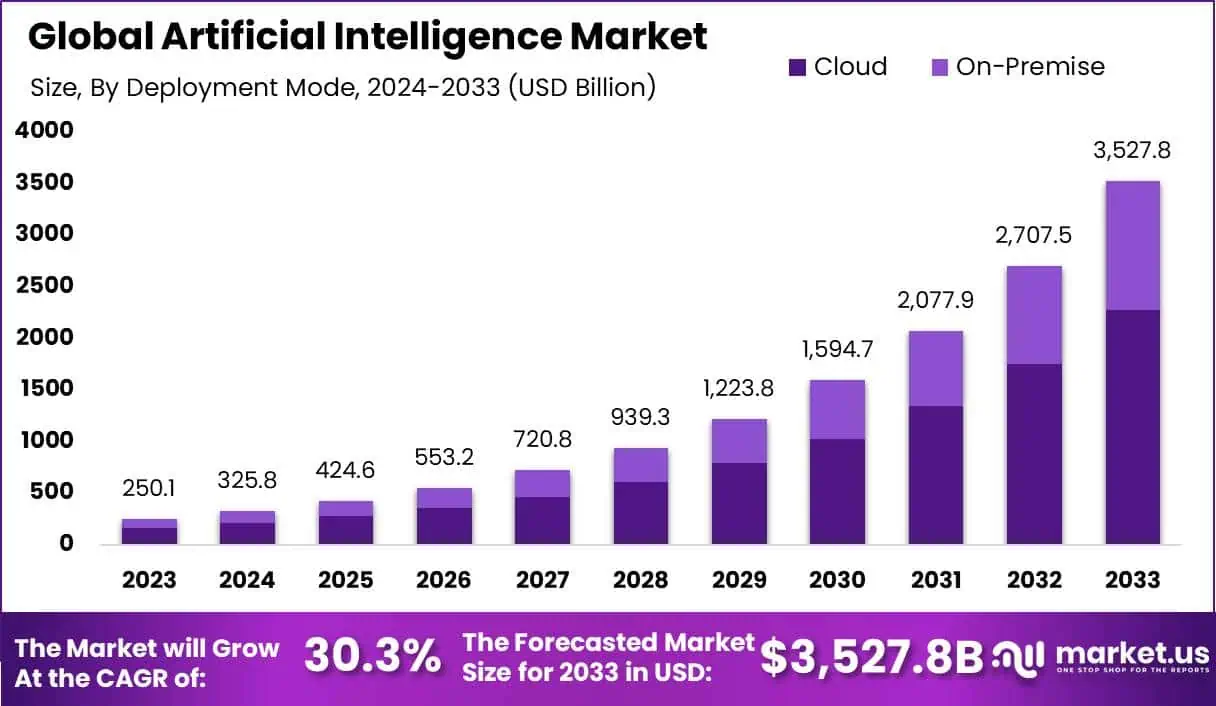

Growth Potential:

The AI market is expected to grow rapidly in the coming years, providing ample growth opportunities for these companies. *

Diverse Applications:

C3.ai and BigBear.ai offer specialized solutions for specific industries, reducing their direct competition with Nvidia’s broad product portfolio.

Investor Takeaway

If you missed out on Nvidia shares or find them too expensive, C3.ai and BigBear.ai are two promising artificial intelligence stocks to consider. Their lower valuations, growth potential, and diverse applications make them attractive investments for those seeking exposure to the rapidly growing AI market.

Disclosure:

* The Motley Fool has positions in and recommends Nvidia, C3.ai, and BigBear.ai. * Parkev Tatevosian is an affiliate of The Motley Fool and may receive compensation for promoting its services.

Artificial Intelligence Stocks on the Rise

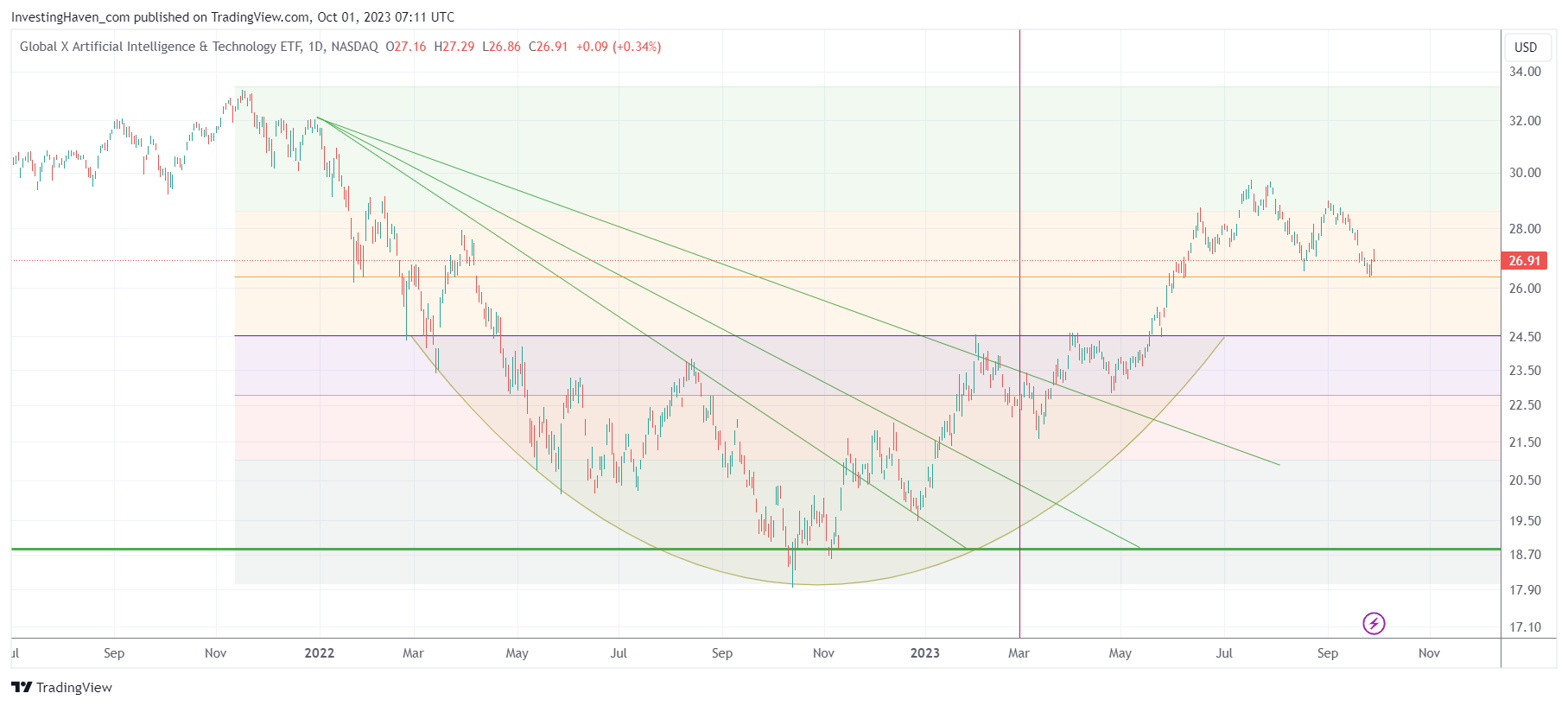

Nvidia’s recent stock surge has highlighted the growing potential of artificial intelligence (AI). If you missed out on Nvidia’s gains, here are two other AI stocks that offer promising investment opportunities.

C3.ai (AI)

C3.ai provides enterprise AI software solutions to various industries. The company’s platform helps organizations automate processes, improve decision-making, and gain insights from data. C3.ai has a strong track record of growth, with revenue increasing by 39% in the past year.

Palantir Technologies (PLTR)

Palantir specializes in data analytics software for government and commercial clients. The company’s platform helps organizations make sense of complex data and find patterns and insights. Palantir has a strong reputation for delivering innovative solutions, and it has recently expanded into new markets.

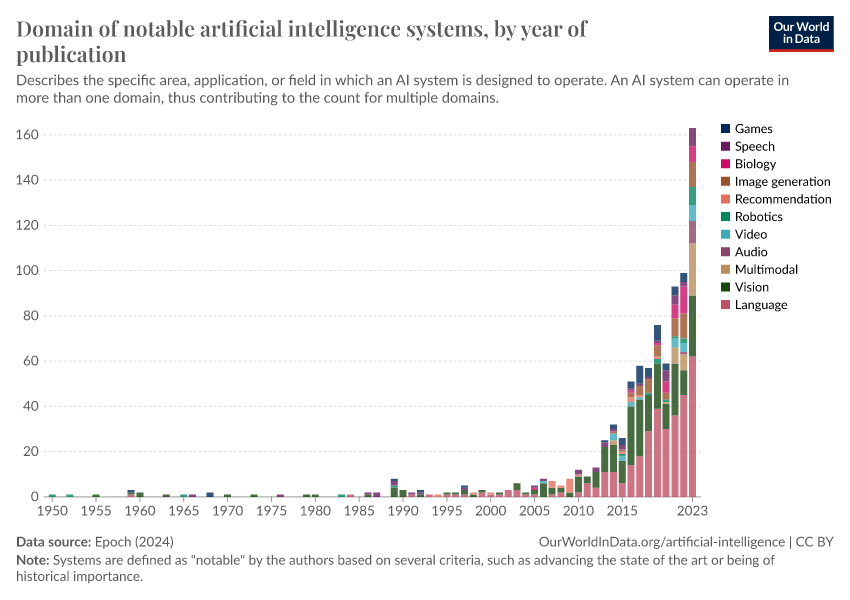

Growth Potential and Future Outlook

Both C3.ai and Palantir are well-positioned to benefit from the growing demand for AI solutions. These companies have strong technology platforms, experienced management teams, and a large market opportunity. They are expected to continue to drive innovation and growth in the AI space.

Invest with Caution

While AI stocks offer significant potential, it’s important to invest with caution. The AI industry is still evolving, and there is always the risk of competition and technological disruptions. Before investing, conduct thorough research and consider your risk appetite.