Appian and Swiss Re Expand Partnership for Connected Underwriting in Life Insurance

Appian, a leading low-code automation platform provider, and Swiss Re, a global reinsurance and insurance company, have announced the expansion of their partnership to introduce Connected Underwriting for life insurance in Asia Pacific and EMEA. Connected Underwriting is an industry-leading digital solution powered by Appian’s low-code platform. It automates and streamlines the underwriting process, enabling insurers to make faster and more accurate decisions. “We’re excited to expand our partnership with Swiss Re and bring the transformative benefits of Connected Underwriting to life insurers in Asia Pacific and EMEA,” said Mike Lawrie, CEO of Appian. “Our technology will empower insurers to enhance their customer experience by providing faster turnaround times and more personalized underwriting.” By leveraging Appian’s platform, Swiss Re can rapidly develop and deploy Connected Underwriting for its customers in the Asia Pacific and EMEA regions. The solution integrates with existing systems and data sources, providing a seamless and efficient underwriting process. “Connected Underwriting is a game-changer for life insurance underwriting,” said Praveen Gupta, CEO Reinsurance Asia at Swiss Re. “It enables insurers to automate complex tasks, reduce errors, and improve efficiency significantly. We’re confident that our partnership with Appian will allow us to deliver this transformative solution to our customers across the globe.” Key benefits of Connected Underwriting include: *

Accelerated underwriting decisions:

Automation reduces turnaround time and frees up underwriters for more complex tasks. *

Improved accuracy:

Automated data validation and consistency checks minimize errors and improve risk assessment. *

Enhanced customer experience:

Faster underwriting processes and personalized communication lead to a better customer experience. *

Increased operational efficiency:

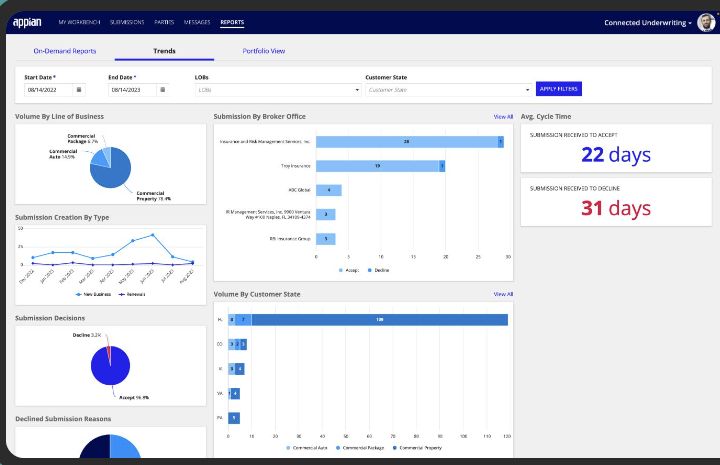

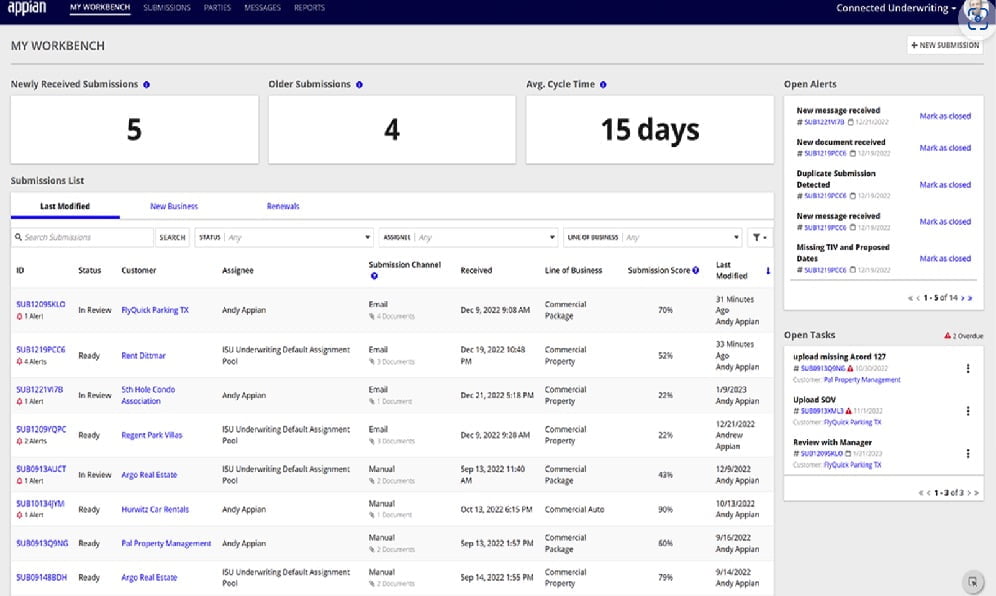

Automation eliminates manual processes and streamlines workflows, freeing up resources for other activities. The expansion of Appian and Swiss Re’s partnership underscores the growing demand for digital solutions in the insurance industry. By leveraging low-code automation, insurers can transform their operations, improve customer service, and gain a competitive edge in the digital age.Improving Underwriting Efficiency with Appian Connected Underwriting Life Workbench

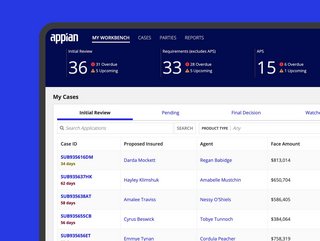

Improving Underwriting Efficiency with Appian Connected Underwriting Life Workbench

Challenges in Life Insurance Underwriting

Life insurance companies often face challenges with scattered information, outdated systems, and lengthy documents, which can slow down risk assessment and policy issuance.

Solution: Appian Connected Underwriting Life Workbench

Appian and Swiss Re have developed the Connected Underwriting Life Workbench to address these challenges. It provides a single, integrated system that: *

Enables intelligent case and workload management:

Automates workload allocation and provides comprehensive case data from multiple sources. *

Automates underwriting processes:

Accelerates policy issuance with intelligent automation, rules, and integrated third-party data. *

Improves customer and insurer experience:

Defer policies faster, minimizes wait times, and simplifies communication. *

Minimizes risks and improves profitability:

Connects data for a 360-degree analysis of policies and portfolios, identifies policy effectiveness with AI, and meets SLAs.

Key Benefits:

* Increased workforce productivity * Minimized wait time * Improved user and customer experience * Measurable business results

About Appian

Appian is a software company that automates business processes, providing tools to design, automate, and optimize workflows. Innovative organizations rely on Appian to enhance growth and customer experiences.

About Swiss Re

Swiss Re is a leading provider of reinsurance, insurance, and other risk transfer solutions. It works to make the world more resilient by managing risks from natural disasters to cybercrime.

Appian and Swiss Re Expand Partnership to Enhance Underwriting in Asia Pacific and EMEA

Appian and Swiss Re have announced the expansion of their partnership to introduce Connected Underwriting for life insurance in Asia Pacific and EMEA. The collaboration aims to enhance the underwriting process, making it more efficient, data-driven, and personalized. Connected Underwriting leverages Appian’s low-code automation platform and Swiss Re’s deep insurance expertise to streamline underwriting operations. It provides insurers with a comprehensive view of applicants’ health, financial, and lifestyle information, allowing for more accurate and timely risk assessments. The solution integrates with existing core systems and external data sources, enabling insurers to access a wide range of data points that may not have been previously considered. This data is analyzed using advanced analytics and machine learning techniques, providing underwriters with insights and recommendations to support their decisions. “Appian’s low-code platform allows us to rapidly develop and deploy solutions that meet the unique needs of the insurance industry,” said Michael Heffernan, Vice President of Insurance at Appian. “Connected Underwriting empowers insurers to make more informed decisions, reduce underwriting times, and improve customer satisfaction.” “Swiss Re is committed to driving innovation in the insurance space,” said Paul Murray, Head of Life and Health Solutions at Swiss Re. “Connected Underwriting is a game-changer that will enable insurers to deliver a more personalized and efficient underwriting experience.” The expanded partnership between Appian and Swiss Re is expected to benefit life insurers across Asia Pacific and EMEA, enabling them to adapt to evolving market trends and meet the growing demands of customers.

![]()

:max_bytes(150000):strip_icc()/insurance-underwriter.asp-final-0e106b06a1c2405d9add3a36946690fd.png)