Cement Stocks to BUYCement Stocks to BUY Ambuja Cement * Target price: Rs 775 * Upgrade from Equal-weight to Overweight UltraTech Cement * Target price: Rs 13,620 * Maintained Overweight ACC Cement * Target price: Rs 2,930 * Maintained Equal-weight Grasim Industries * Target price: Rs 2,990 * Maintained Equal-weight Dalmia Bharat * Target price: Rs 1,990 * Downgraded from Overweight to Equal-weight Shree Cement * Target price: Rs 27,000 * Downgraded from Overweight to Underweight Bull Case for UltraTech and Ambuja * Strong market position * Growth potential Disclaimer This information is for informational purposes only and should not be considered as investment advice. Consult with a financial advisor before making any financial decisions.

Updated on Jul 14, 2024 10:32 PM IST

Cement Stocks to BUY: The securities firm notes that the picture for the cement sector may remain sideways in the near term due to a lack of significant positive catalysts.

Stock market firm Morgan Stanley has announced price targets for the cement sector. (Image: Shutterstock/ET NOW News)

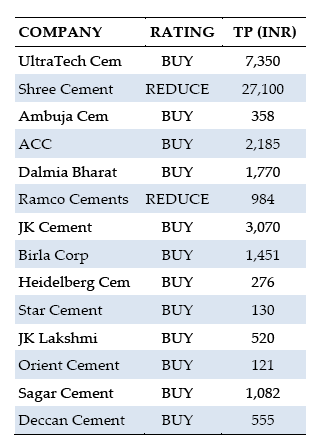

Cement Stocks to BUY: Brokerage firm Morgan Stanley has released its latest ratings and price targets for the cement sector. The brokerage firm notes that the short-term picture for the cement sector may remain sideways due to a lack of significant positive catalysts. However, the medium-term picture is still strong due to the demand-driven story of margin expansion. Stocks with capacity share expansion and cost improvement potential are expected to do well. Here is an in-depth analysis of the updates:

Ambuja Cement target price 2024

Shares of Ambuja Cement closed at Rs 676.30 on BSE with a slight gain of 0.42 per cent. The company’s stock was trading at a 52-week high of Rs 706.85 and low of Rs 404, on July 12, 2024. The stock has risen nearly 60 per cent in a year.

Read the full article

The brokerage house has upgraded its rating to Overweight from Equal-weight on the Adani-backed stock. The firm has also raised the target price to Rs 775 from Rs 665.

UltraTech Cement target price 2024

Shares of UltraTech Cement closed at Rs 11600.95 on BSE with a slight gain of 0.33 per cent. The stock of Aditya Birla Group Company was trading at a 52-week high of Rs 12,078.15 and low of Rs 7,940.55, on July 12, 2024. The stock has risen nearly 41.11 per cent in a year.

The brokerage house, maintained Overweight on the stock price of Aditya Birla Group cement company. The company has raised the target price to Rs 13,620 from Rs 11,600.

ACC Cement Share Price Target 2024

Shares of ACC Cement closed at Rs 2,685.80 on BSE with a slight gain of 0.33 per cent. The stock of cement manufacturing company was trading at a 52-week high of Rs 2,843 and low of Rs 1,763.25, on July 12, 2024. The stock has risen nearly 50.10 per cent in a year.

The brokerage house has maintained the Adani Group-backed cement company at Equal-weight. The brokerage house has also raised its Target to Rs 2,930 from Rs 2,700.

Grasim Industries Stock Price Target 2024

Shares of Grasim Industries closed at Rs 2,843.10 on BSE, registering a slight gain of 1.44 per cent. The stock of cement manufacturing company was trading at a 52-week high of Rs 2,849.50 and low of Rs 1,737.22, on July 12, 2024. The stock has risen nearly 60.94 per cent in a year.

Morgan Stanley has maintained Equal-weight rating on Grasim Industries stock. The brokerage has raised the target Price to Rs 2,990 from Rs 2,570.

Dalmia Bharat target price 2024

Shares of Dalmia Bharat closed at Rs 2,843.10 on BSE, registering a gain of 3.78 per cent. The cement manufacturing company’s stock was trading at a 52-week high of Rs 2,428.85 and low of Rs 1,664.20, on July 12, 2024. The stock has given a negative return of -6.39 per cent in a year.

Brokerage house downgraded the company’s shares to Equal-weight from Overweight. The firm also lowered the target price of the cement company to Rs 1,990 from Rs 2,200.

Shree Cement Share Price Target 2024

Shares of Shree Cement closed at Rs 27650.80 on BSE with a slight decline of 0.48 per cent. The stock of cement manufacturing company was trading at a 52-week high of Rs 30,710.15 and low of Rs 23,023.05, on July 12, 2024. The stock has gained 13.92 per cent in a year.

Brokerage firm has downgraded cement company shares to Underweight from Overweight. The firm has lowered its target price to Rs 27,000 from Rs 30,000.

Bull Case for UltraTech and Ambuja

Morgan Stanley believes UltraTech and Ambuja are optimistic given their strong market position and growth potential.

(Disclaimer: The above article is for informational purposes only and should not be considered as investment advice. ET NOW DIGITAL advises its readers/audience to consult their financial advisor before taking any financial decisions.)