Tata Motors Shares Surge as Company Achieves Net Debt-Free Status in FY24

Tata Motors Limited, India’s largest automaker, witnessed a significant 2% surge in its share price today following the company’s announcement that it has become net debt-free in the fiscal year 2023-24 (FY24). This milestone marks a significant financial achievement for the company and has been well-received by investors. Tata Motors’ net debt was reduced by approximately 63% in FY24, primarily driven by improved operating performance and cost optimization efforts. The company’s consolidated revenue for the fiscal year stood at ₹3.26 lakh crore, while its net profit surged by 10% to ₹9,444 crore. The net debt-free status is expected to enhance Tata Motors’ financial flexibility and provide it with greater capacity for future investments and expansion. The company plans to utilize the freed-up financial resources to focus on its core business, invest in electric vehicles and new technologies, and strengthen its global presence. Tata Motors has been consistently implementing a strategic roadmap to improve its financial performance and reduce its debt burden. The company has taken several measures in recent years, including optimizing its operations, divesting non-core assets, and raising capital through equity offerings. “This is a proud moment for Tata Motors,” said N Chandrasekaran, Chairman, Tata Motors. “Becoming net debt-free is a testament to the resilience and determination of our team. It will unlock new opportunities for us and enable us to pursue our long-term vision.” Analysts believe that Tata Motors’ net debt-free status is a positive development that will enhance the company’s investment attractiveness and support its growth trajectory in the coming years. The company is well-positioned to benefit from the growing demand for automobiles both in India and globally. In conclusion, Tata Motors’ achievement of becoming net debt-free in FY24 is a significant milestone that has driven a positive response from investors. The company’s financial flexibility and potential for future growth are expected to support its continued success in the automotive industry.Tata Motors Shares Zoom as Company Turns Net Debt-Free in FY24

Tata Motors Shares Zoom as Company Turns Net Debt-Free in FY24

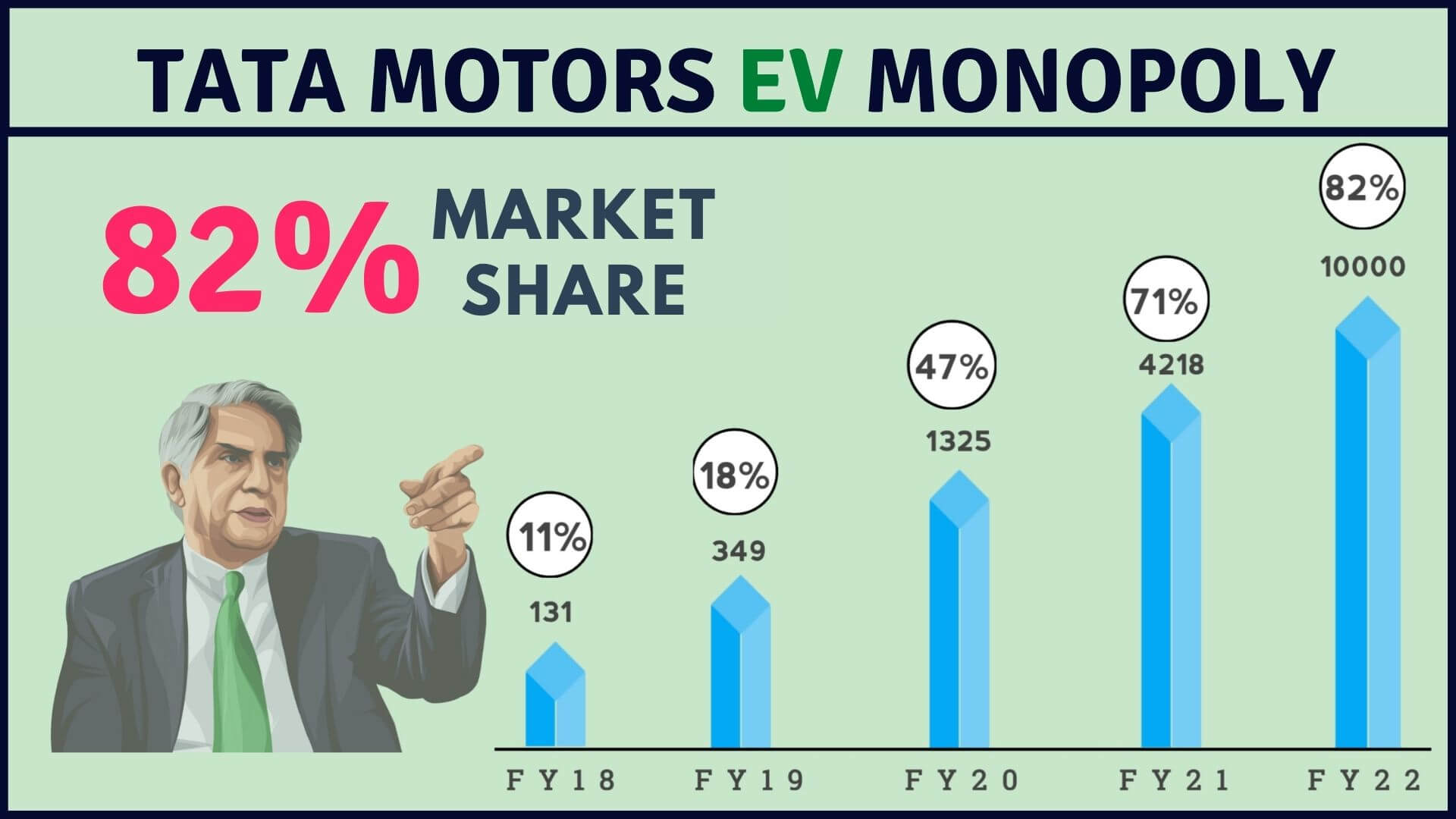

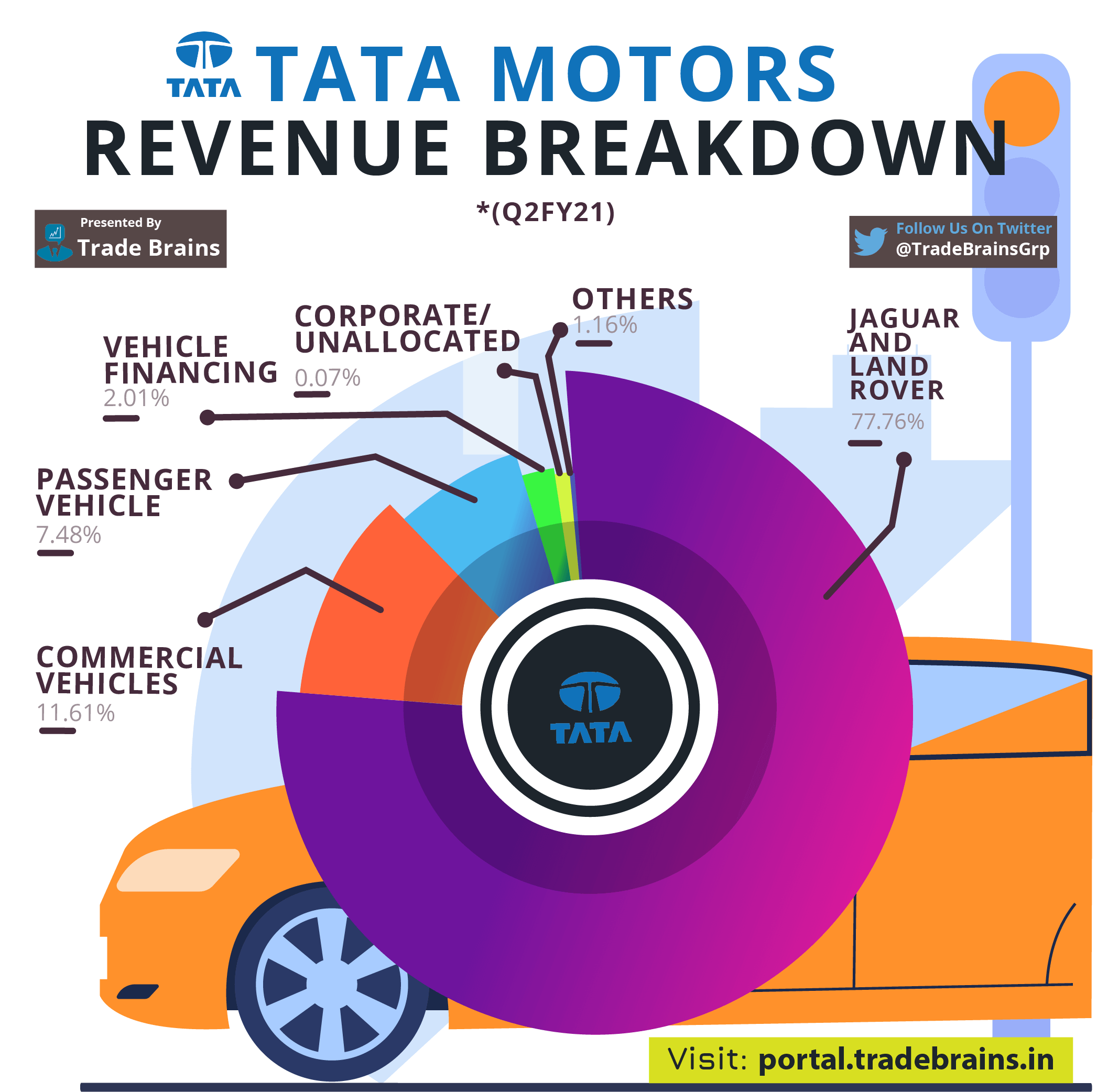

Shares of Tata Motors Limited were trading 2 percent higher at Rs 991 apiece in morning trade on June 11 after management gave a positive outlook for the coming quarters. * Jaguar Land Rover (JLR), the UK arm of Tata Motors, reported a 430 basis points year-on-year improvement in Ebitda margins in its FY24 annual report, driven by a richer product mix and operating leverage benefits. Kotak Institutional Equities said there was also an improvement in the Chinese joint venture’s performance despite lower volumes, driven by cost control measures. The auto giant remains well capitalized, with a good spread of debt securities; and the pension plan is still overfunded. * The country’s largest EV player is confident it will achieve financial stability by achieving net debt-free status by fiscal year 2025. Moreover, the Nexon maker has set a target of achieving a market share of more than 25 percent in various segments. * Looking ahead, Tata Motors is focusing on electric vehicle (EV) development, with plans to achieve breakeven on EV Ebitda by fiscal 2026. Additionally, the company targets consolidated Ebitda of 10 percent for its passenger vehicle (PV) and EV business per fiscal year, the year 2030, emphasizing a long-term commitment to profitability and sustainability. Ebitda is the profit before interest tax, depreciation and amortization. * On the other hand, sales of British subsidiary Jaguar Land Rover (JLR) rose 29 percent year-on-year in May, reaching 6,093 units, compared to 4,732 units sold in May last year. * In the fiscal fourth quarter, the Defender maker continued its strong financial performance. JLR’s revenue for the quarter was 7.9 billion pounds, up 11 percent from Q4FY23 and up 6 percent from Q3FY24. In addition, JLR’s FY24 revenues reached £29 billion, up 27 percent compared to the previous year. * India’s largest manufacturer of four-wheeled electric vehicles posted a staggering 222 percent growth in its consolidated net profit at Rs 17,407.18 crore in Q4’24. The company’s profit after tax (PAT) for the same period last year stood at Rs 5,407.79 crore.

May Car Sales

* In May 2024, Tata Motors recorded total sales of 76,766 units, a slight increase from 74,973 units in May 2023. * In particular, domestic sales of passenger cars, including electric cars, increased 2 percent, reaching 46,697 units. * While international business saw remarkable growth, with an increase of 257 percent, selling 378 passenger cars, sales of electric vehicles fell by 4 percent to 5,558 units. * Domestic sales of medium and heavy commercial vehicles, including trucks and buses, stood at 12,987 units, compared to 11,776 units in May 2023. * Combined total sales for this category, including both domestic and international operations, increased to 13,532 units from 12,292 units in the same period last year.

Tata Motors: Check Target Price

* Kotak said it expects Tata Motors’ performance to remain healthy in FY 2025-26, led by steady business performance from JLR, driven by improvement in mix and cost control measures, market share gains in PV and CV segments and a net cash balance of Financial Year 2025E. * “Tata Motors continued to focus on improving its product mix in the SUV segment, with Range Rover and Defender contributing 79 percent of total sales in FY2024 (up from 76 percent in FY2023). Furthermore, JLR is repositioning itself with a house of brand strategy by creating four separate brands: Range Rover, Defender, Discovery and Jaguar. The company plans to launch more premium ICE and electric SUVs under the new strategy to further enhance the SUV product portfolio,” the company said.

Tata Motors Shares Surge as Company Achieves Net Debt-Free Status

Tata Motors shares witnessed a significant increase of 2% on Thursday, following the company’s announcement that it had become net debt-free in the financial year 2024. This milestone represents a significant financial achievement for Tata Motors, which had been carrying a substantial debt burden in recent years. The company’s total debt stood at over Rs 33,000 crore as of March 2023. The improvement in Tata Motors’ financial health is attributed to several factors, including strong sales performance, cost-cutting measures, and a focus on improving operational efficiency. The company has also benefited from the recent recovery in the automotive sector, which has boosted demand for vehicles. Analysts believe that the net debt-free status will provide Tata Motors with greater financial flexibility and allow it to pursue growth opportunities. The company is expected to invest in new product development, technology upgrades, and capacity expansion. The news has been well received by investors, who see it as a positive sign for the company’s long-term prospects. Tata Motors shares are currently trading at around Rs 435 on the Bombay Stock Exchange.