Unlocking AI’s Transformative Power in Insurance: Embracing an Exponential IT Mindset

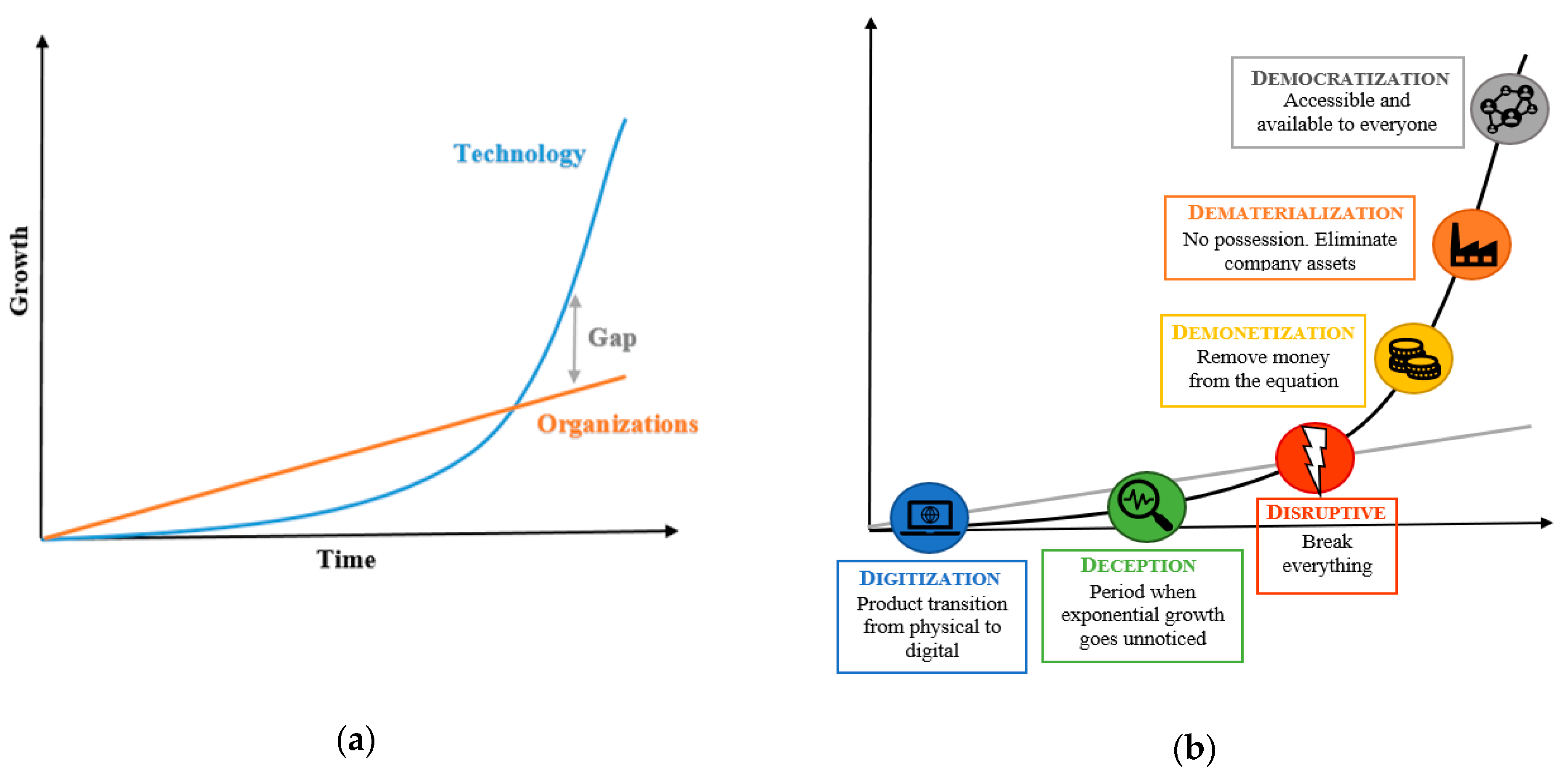

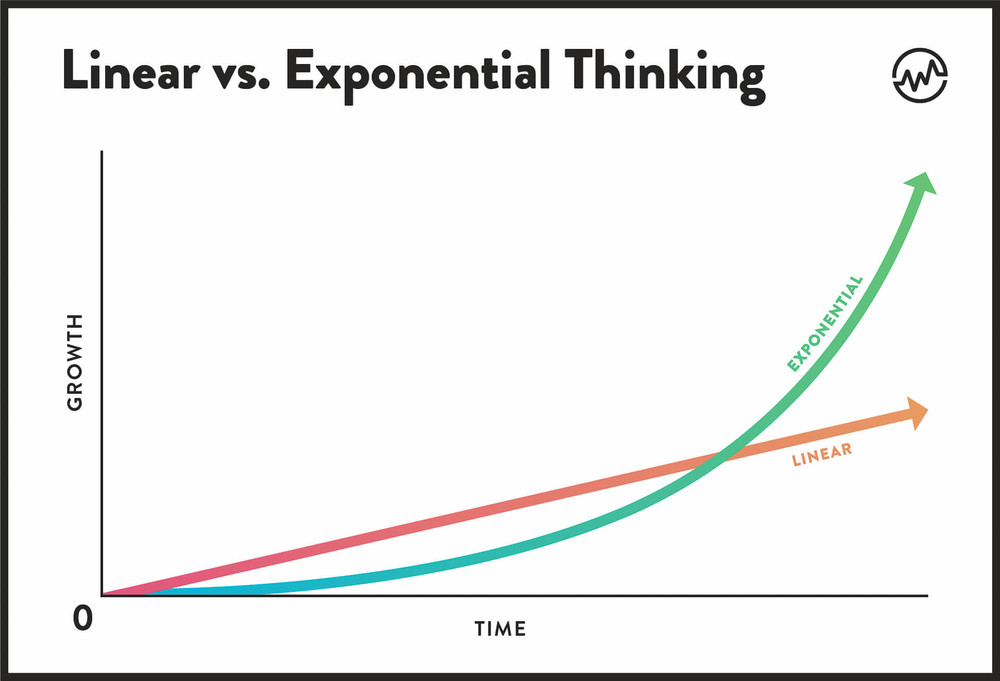

The insurance industry is poised for a profound transformation driven by the advent of Artificial Intelligence (AI). However, to fully harness its potential, a shift towards an exponential IT mindset is imperative, according to industry analysts at Info-Tech Research Group.

Exponential IT Mindset: Adapting to the Rapid Pace of Innovation

An exponential mindset embraces the idea that technology advancements occur at an accelerating rate, leading to a continuous cycle of innovation and disruption. Insurance companies that adopt this mindset will be better equipped to navigate the rapidly changing technological landscape.

Harnessing AI’s Capabilities

AI offers a wide range of capabilities that can enhance insurance operations: *

Automating Processes:

AI-powered systems can automate repetitive and time-consuming tasks, freeing up human staff for more strategic initiatives. *

Improving Underwriting:

AI can analyze large datasets to identify patterns and risks, enabling more accurate and personalized underwriting decisions. *

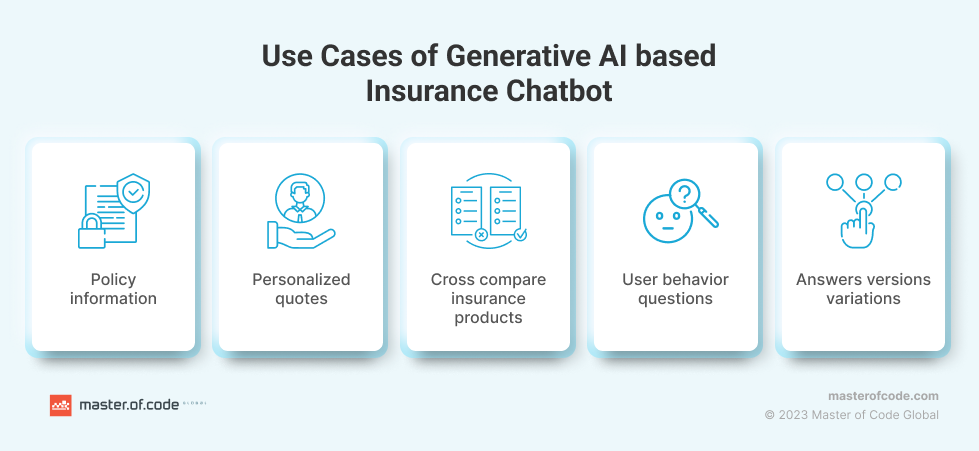

Enhancing Customer Experience:

AI-enabled chatbots and virtual assistants can provide 24/7 support, resolving customer queries and improving the overall experience. *

Fraud Detection:

AI algorithms can detect anomalies and suspicious patterns, reducing the risk of fraudulent claims.

Challenges and Considerations

While AI holds immense promise, it also presents challenges for the insurance industry: *

Data Privacy and Security:

AI systems require access to sensitive customer data, raising concerns about privacy and security. *

Legacy Systems Integration:

Integrating AI with existing legacy systems can be complex and costly. *

Data Interpretation:

AI algorithms can generate large amounts of data, but extracting meaningful insights requires expertise and human judgment.

Embrace the Exponential Mindset

To overcome these challenges and fully leverage AI’s capabilities, insurance companies must embrace an exponential IT mindset that enables them to: *

Invest in Agile Development:

Rapid iteration and experimentation are crucial for keeping pace with constantly evolving technology. *

Foster a Data-Driven Culture:

Collect, analyze, and interpret data to drive decision-making and innovation. *

Develop a Talent Pipeline:

Attract and retain skilled professionals with expertise in AI, data science, and related fields. *

Collaborate with InsurTechs:

Partner with startups and technology providers to access cutting-edge AI solutions.

Conclusion

By embracing an exponential IT mindset, insurance companies can unlock the transformative power of AI. This shift will enable them to automate processes, improve underwriting accuracy, enhance customer experience, and mitigate fraud risks. As the insurance landscape continues to evolve, those who adopt an AI-first mindset will be best positioned to drive success and innovation in the industry.#### Priorities for Adopting an Exponential IT Mindset in the Insurance Industry#### Priorities for Adopting an Exponential IT Mindset in the Insurance Industry

1. Embed Data (Data and Analytics)

Modern insurance organizations rely on data to generate insights across several domains, including customer experience, product development, risk and fraud management, and regulatory compliance. Establishing a data-centric culture with a growing emphasis on integrating internal data with external sources is imperative to providing comprehensive, data-driven insights needed for informed decision-making and strategic planning.

2. Let AI Take Over the Core Activities

Integrating AI into core operations is essential for improving system efficiency, accelerating incident detection, and increasing the productivity of automation processes. Insurance customers now expect immediate service and personalized products, making process automation critical. By using AI and machine learning models, insurers can support autonomous decision-making and deliver fast, high-quality services that meet customer expectations.

3. Focus on Delivering Customer Value

Shifting the focus from delivering services to delivering value is critical in the insurance industry, where products and services often have a long lifespan. Insurers must reevaluate their growth strategies through the lens of value creation, ensuring that every interaction and offering delivers tangible benefits to customers. This value-oriented approach is critical to building lasting customer relationships and maintaining competitive advantage.

4. Exponential Value Creation of the Fund:

Diverting funds from keep the lights on (KTLO) activities to innovative technologies, such as generative AI, is essential to driving exponential value creation. The insurance industry faces significant technology debt, making it imperative for IT departments to address shortcomings in existing systems while investing in forward-looking innovations. Strategically allocating resources to innovation can help insurers overcome existing challenges and position themselves for long-term success.

Harnessing AI’s Power in Insurance Requires Exponential IT Mindset

Leveraging Artificial Intelligence (AI) within the insurance industry mandates an exponential IT mindset, according to the Info-Tech Research Group. This mindset emphasizes constant learning, adaptability, and innovation to unlock the full potential of AI. “The insurance industry is at an inflection point where AI has the power to transform the way we do business,” said Info-Tech Principal Research Analyst, Daniel Power. “But to truly capitalize on its benefits, we need to shift our thinking and embrace an exponential IT approach.”

Key Elements of an Exponential IT Mindset

*

Continuous Learning:

Embracing a learning mindset involves actively seeking knowledge, experimenting with new technologies, and staying abreast of industry trends. *

Agility:

Cultivating agility enables the rapid adaptation of AI solutions to changing market demands and technological advancements. *

Innovation:

Fostering a culture of innovation promotes the development of novel AI applications that drive value and differentiation.

Benefits of an Exponential IT Mindset

An exponential IT mindset enables insurance companies to: * Improve risk assessment and pricing accuracy * Automate repetitive processes and streamline operations * Enhance customer service and engagement * Develop personalized products and services * Innovate at a faster pace “By adopting an exponential IT mindset, we can accelerate our journey towards becoming truly AI-driven insurers,” added Power. “This mindset will help us unlock the full potential of AI and deliver unparalleled value to our customers.”